Finance and technology leaders at growth-stage companies face a pivotal challenge: navigating expansion while laying the groundwork for a potential IPO or transaction down the road. In this turbulent environment, data and analytics emerge as primary focus areas every company must enhance. Why?

Because intuition-driven decisions don’t suffice when greater financial, operational, and regulatory complexity enters the picture.

Common Data and Analytics Challenges

Transforming data and analytics capabilities often presents growth-stage companies with a unique set of challenges they can no longer postpone or hope to bypass. At the forefront is the issue of data quality. Without high-quality, reliable data, resulting financial reports can be misleading, a risk growth-stage companies can ill-afford, especially if contemplating a transaction.

Challenges often include:

- Data integration from disparate sources. A lack of consistency in data can generate obstacles in financial reporting, potentially leading to inaccuracies.

- Scalable data infrastructure. As companies evolve and expand, reporting and data manipulation in Excel is no longer realistic.

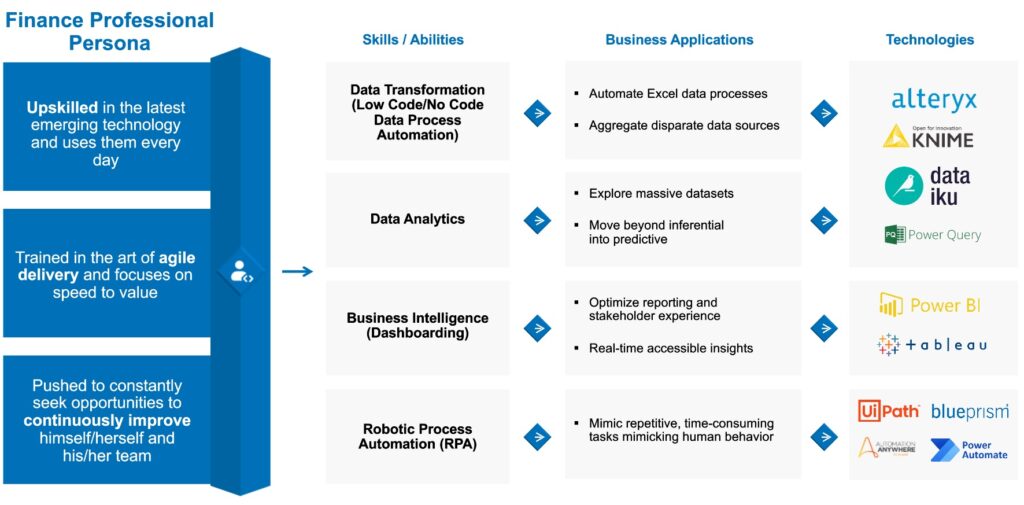

- Skilled, efficient data analysis. Limited expertise conducting analysis or ingesting data using Excel means outcomes are highly variable and may not be actionable.

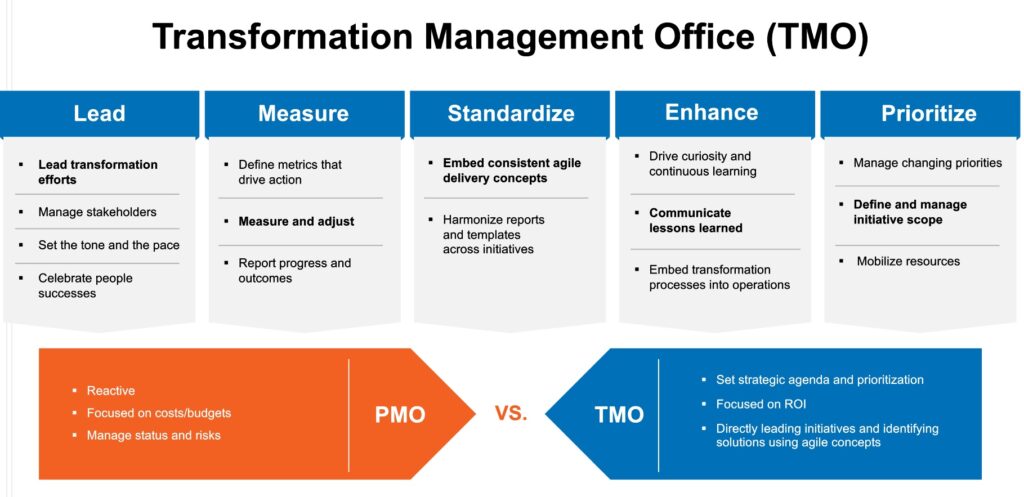

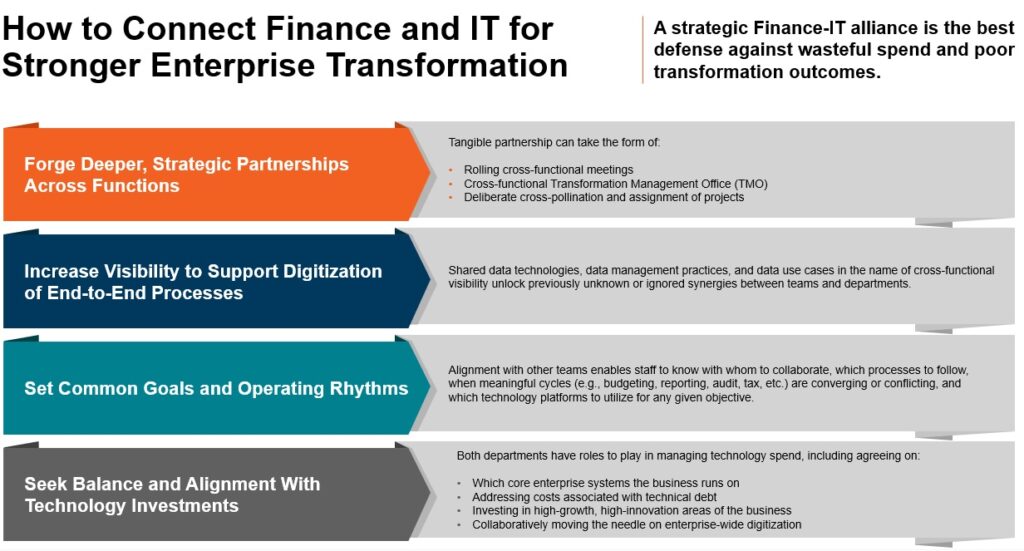

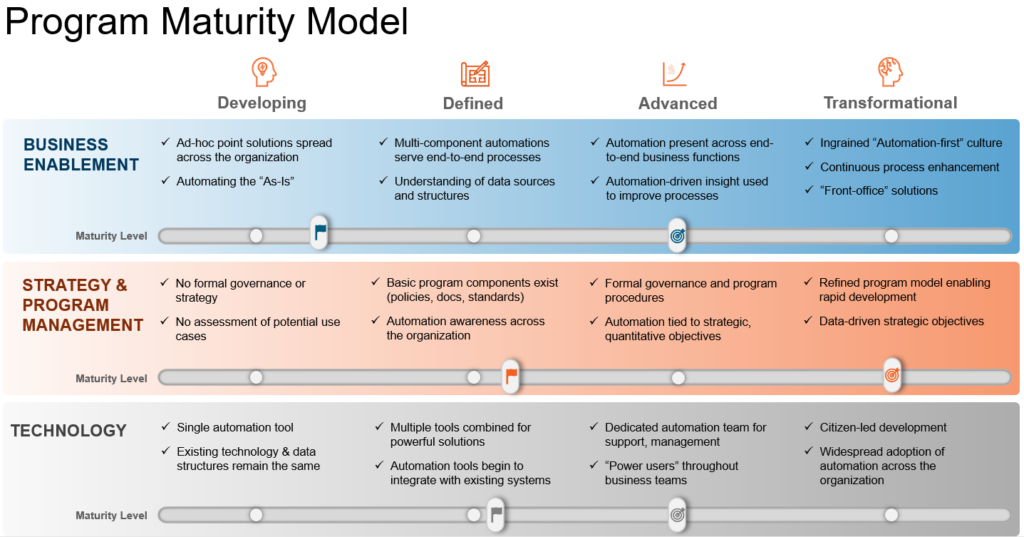

- Technology optimization: Companies currently using or exploring use cases for tools like Alteryx, Tableau, or MS Power Platform Apps often aren’t doing so in a standardized way, such as a Transformation Management Office (TMO) or Center of Excellence (CoE), which creates more IT bloat, technical debt, and process redundancies.

Explore expert Data Transformation & Analytics solutions that solve real-world problems

Accelerate strategic adoption of data, analytics, and artificial intelligence platforms within a scalable systems architecture for efficient reporting, cleaner insights, and greater change readiness.

In conversation with thousands of organizations seeking to address data and analytics gaps, these are some of the pain points that are often expressed:

- “My team spends weeks manually wrangling data in Excel. It takes us so long to pull together data for our reports that we don’t even have time to analyze and act on our findings.”

- “My teams and business are growing so fast. We cannot keep up with the amount of additional work. How can we use data or automation to scale our processes?”

- “I don’t have a complete and accurate view of the key data needed, nor do I know which definitions to use to make decisions.”

- “Individual team members know how to build and develop specific reports, but when they’re out, no one else knows how to create the reports.”

Sound familiar?

A Path Forward: Data and Analytics Solutions for Scale

Fortunately, with the support of transformation advisors and implementation partners, leaders can lay the data foundation for scalable, sustainable success. To get started, focus on these solutions:

- Develop a data strategy and data governance framework. This will guide all future decision-making, systems selections, corporate policy, and more. It will also be immensely helpful to have a fully established and documented approach to data when the time comes for a complex transaction like IPO or M&A.

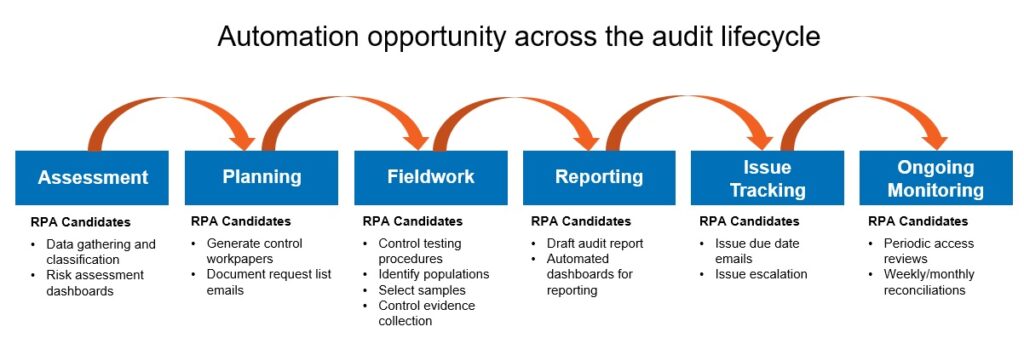

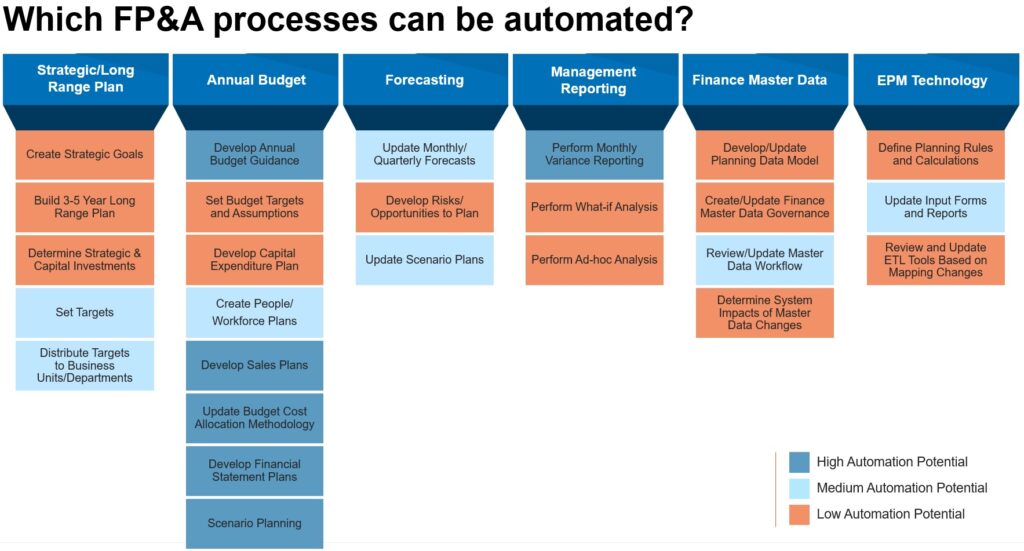

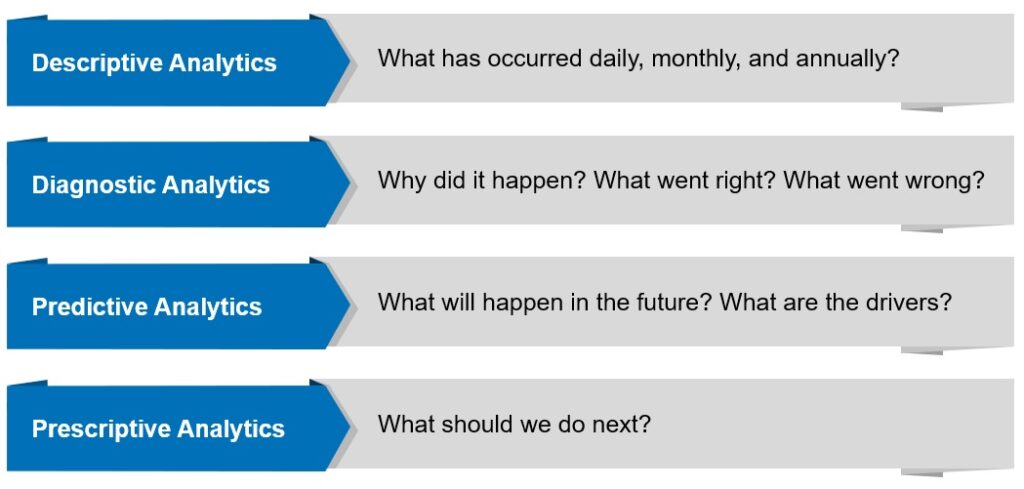

- Review and optimize data processes. Assess which processes in the data and analytics architecture can be automated, streamlined, eliminated, or further invested in. This might mean developing reusable assets for common use cases, reducing the time spent gathering information, and leveraging artificial intelligence (AI) or machine learning (ML) platforms to make analytics more predictive and prescriptive.

- Implement automation software. Manual processes will not scale as the company evolves, and bad processes should never be automated. Instead, create an “ideal” process workflow that requires limited human intervention leveraging stakeholder inputs from a TMO. Then implement an automation tool like Alteryx to bring the new process to reality. By reducing manual effort, organizations can free up time, improve productivity, and generate cost savings.

- Implement data management software. Cloud data warehousing, data lakes, and other data management tools like Snowflake help centralize and rationalize the storage, collection, lineage, and structure of organizational data flows.

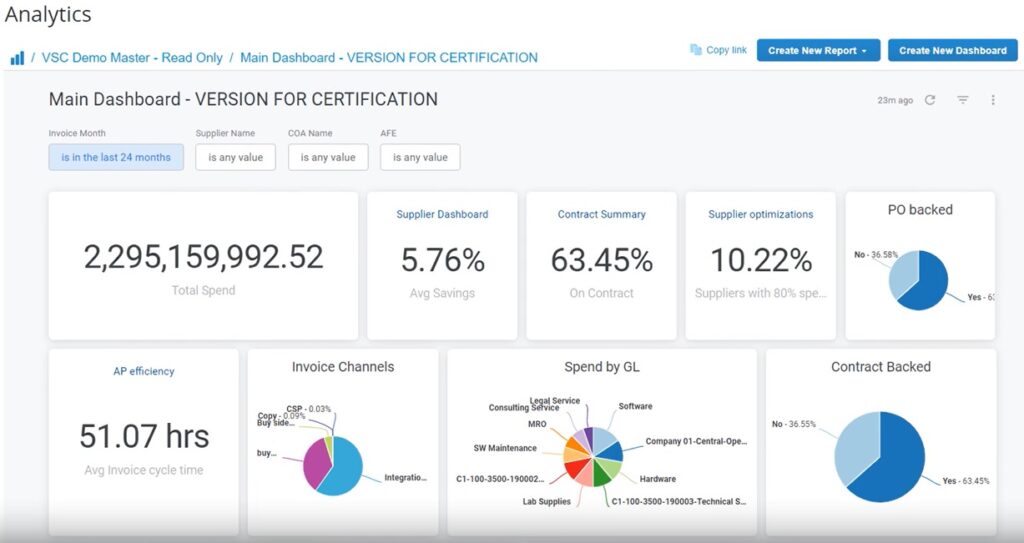

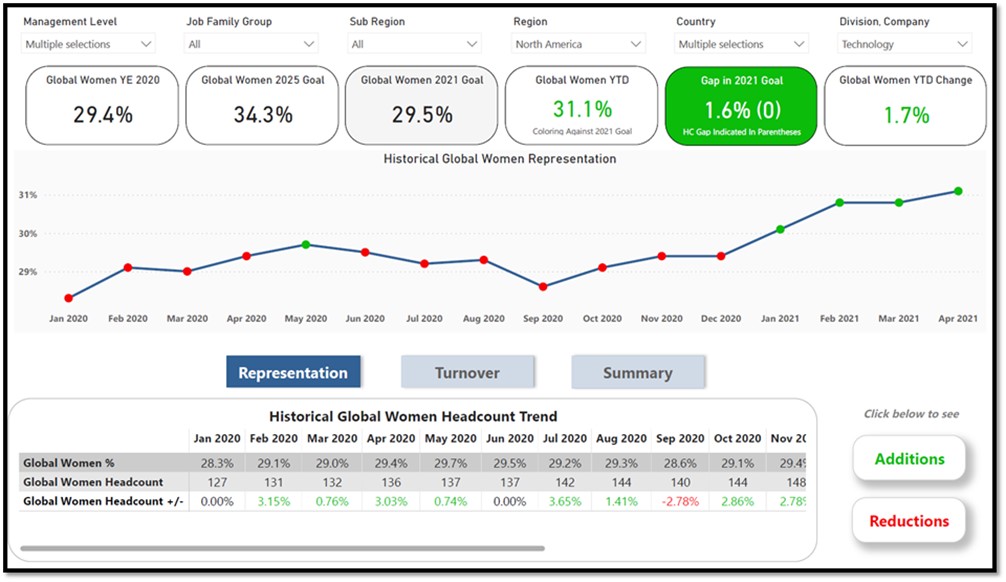

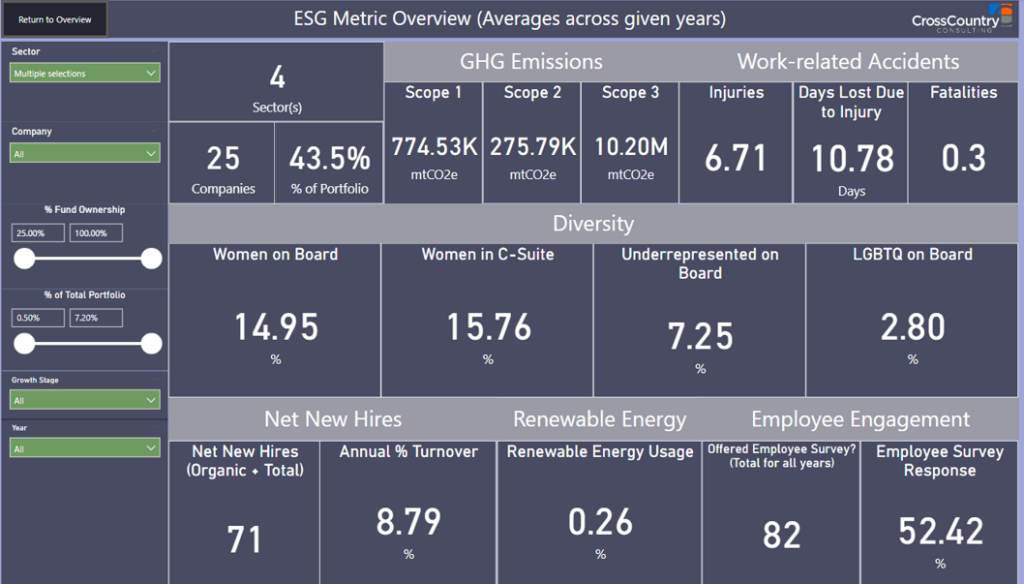

- Standardize reports and dashboards. Employee churn, continual ad-hoc requests, and inflexible reporting tools make visualizing and transmitting key data incredibly difficult and time-consuming. Reports often must be built from scratch each time new data is needed, and not everyone has the skills or tool permissions to make their own reports. Through Power BI and Tableau, reports, dashboards, and other visualizations can be standardized, regularly refreshed, and easily sent to stakeholders as needed. This frees up and converts analysts’ time from simply gathering information and building one-off reports to instead performing more meaningful tasks and finding more actionable insights.

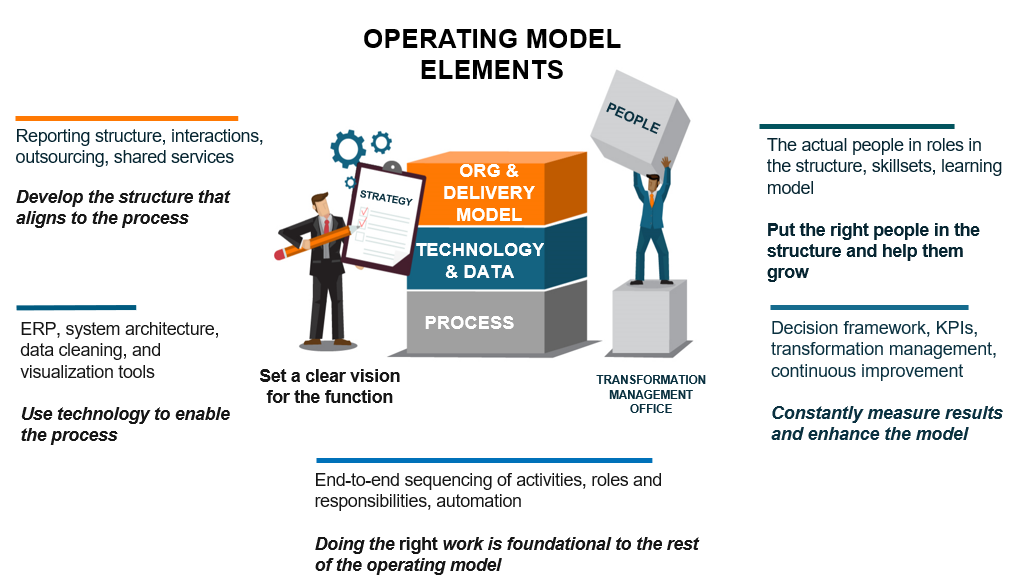

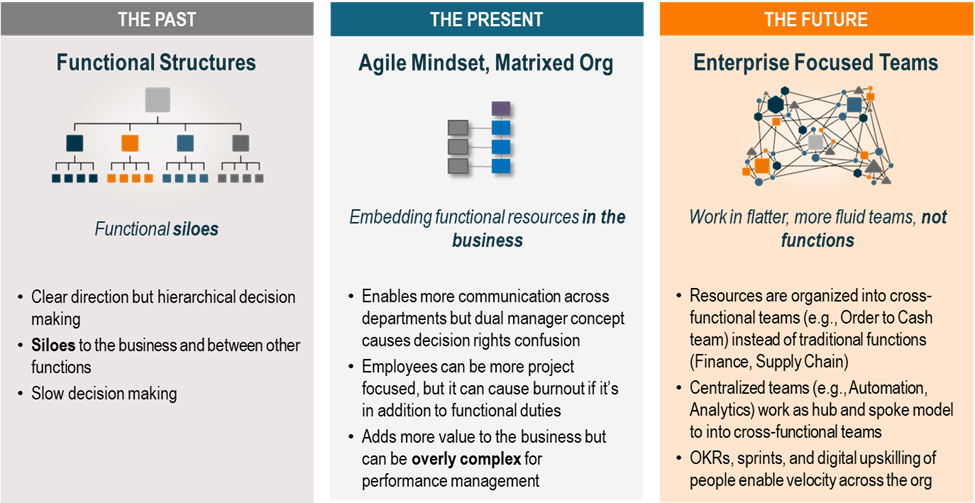

- Define and document roles and responsibilities. In parallel with new technologies, staff must understand roles and responsibilities within their team, department, and organizational structures. Based on the operating model, staff might be working laterally with other functions, in agile sprints, or hierarchically – whatever the case, these rules of engagement must be documented to ensure seamless handoffs, clear lines of communication, and efficient workflows when generating, curating, and delivering key data.

- Establish and strengthen a data-literate corporate culture: It’s imperative to improve every employee’s level of comfort with generating, storing, handling, and disseminating data from the organization’s data ecosystem. Data literacy can enhance risk awareness, remove informational silos, and organically lead to faster delivery in day-to-day workflows.

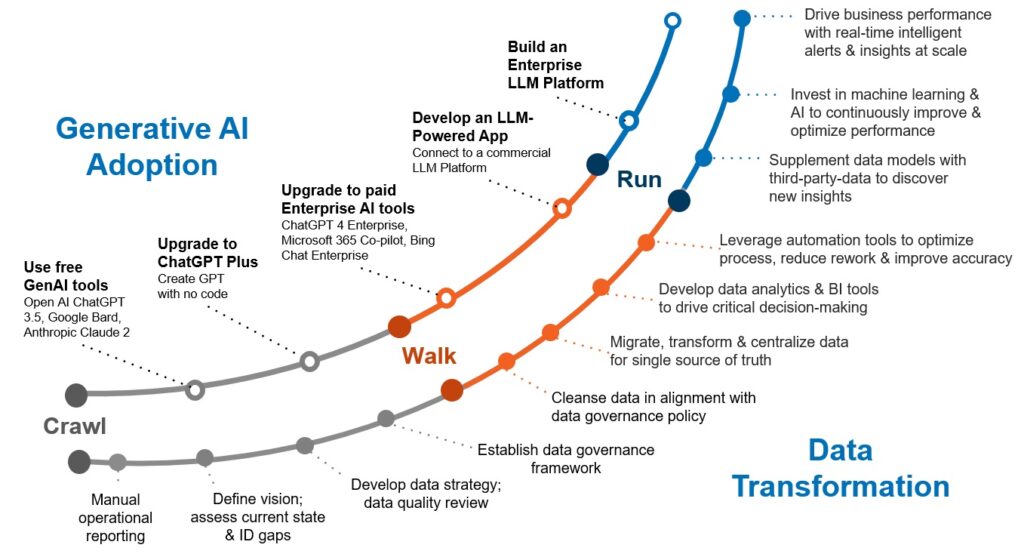

- Create a framework for refining and evolving the strategy for the future: There are several necessary steps required to set a strong data foundation to achieve predictive, real-time insights. A crawl-walk-run framework recommends focusing on establishing a data governance framework before building out a BI and analytics platform. And, if you can’t produce BI, don’t focus on AI.

Featured Insight

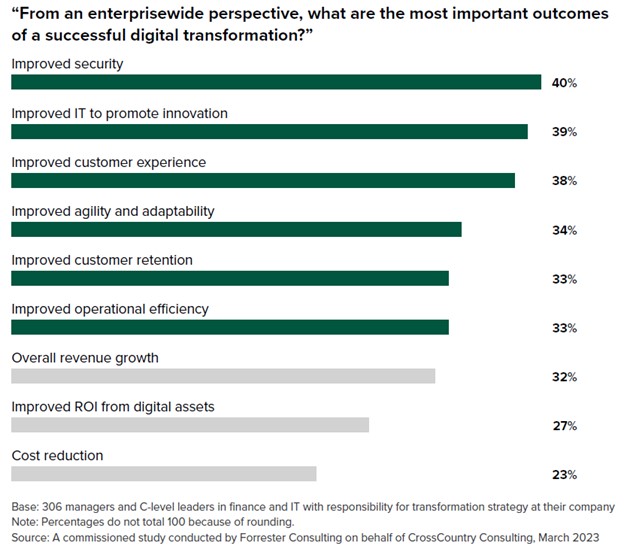

Why Invest Now? The Data-Driven Advantage

By investing in data and analytics capabilities now, companies can optimize the present and prepare for the future. This means:

- Smarter decisions, faster growth: Data-driven insights help optimize growth campaigns, identify customer needs, and improve operational efficiency.

- Scalability and agility: Building a robust data infrastructure now ensures seamless integration of new systems and data sources as companies scale. This agility is crucial for adapting to market changes and seizing new opportunities.

- Exit readiness: Investors demand transparency and data-backed forecasts. By showcasing data and analytics capabilities, leaders demonstrate a commitment to sound decision-making and future growth potential.

- Demonstrated financial maturity: Better forecasting, projections, scenario planning, modeling, and reporting via enhanced data and analytics show investors a clear understanding of financial health and growth opportunities.

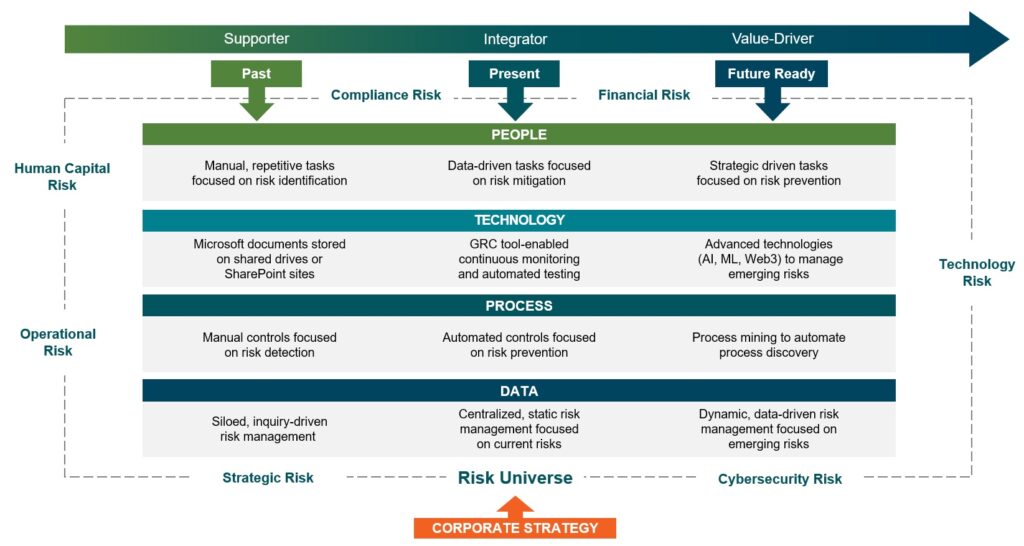

- Reduced risk and enhanced transparency: Data-driven risk management tools provide a deeper understanding of the expanding risk universe and the mitigation strategies to address employee, Board, regulatory, and investor concerns.

- Change readiness: Continuously innovate and adapt to market changes with data-driven decision-making, securing a competitive advantage against key market players.

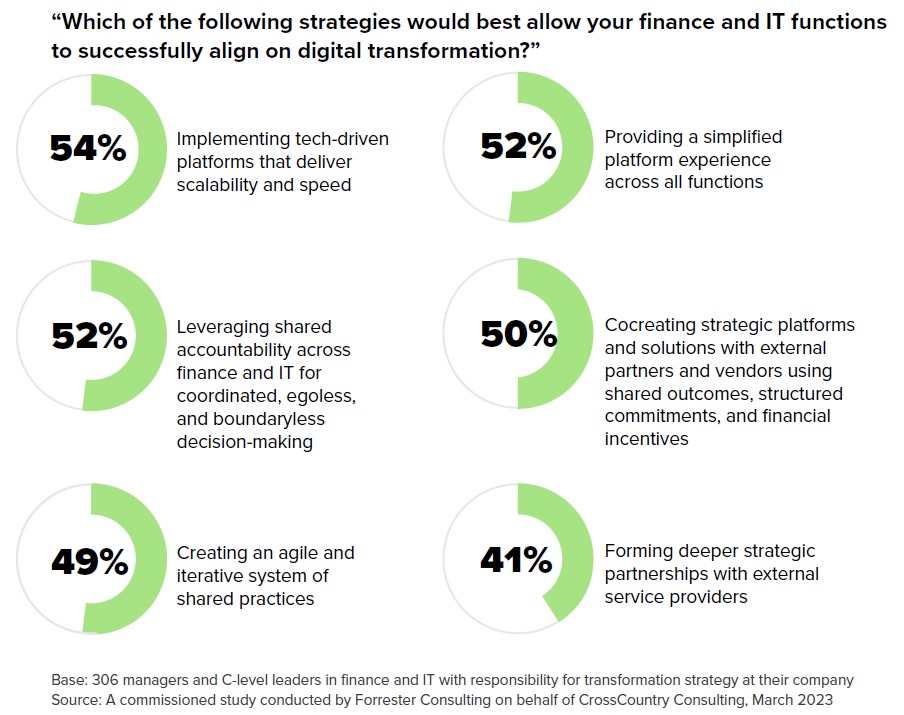

To thrive, leaders need a scalable technology and process architecture capable of meeting current and future finance, operations, and data management needs. With this foundation in place, leaders can successfully solve comprehensive enterprise challenges by converging the efforts and talent from technology and business teams on an actionable transformation roadmap.

Ready to take the next leap forward in your data and analytics journey? Contact CrossCountry Consulting to get started.

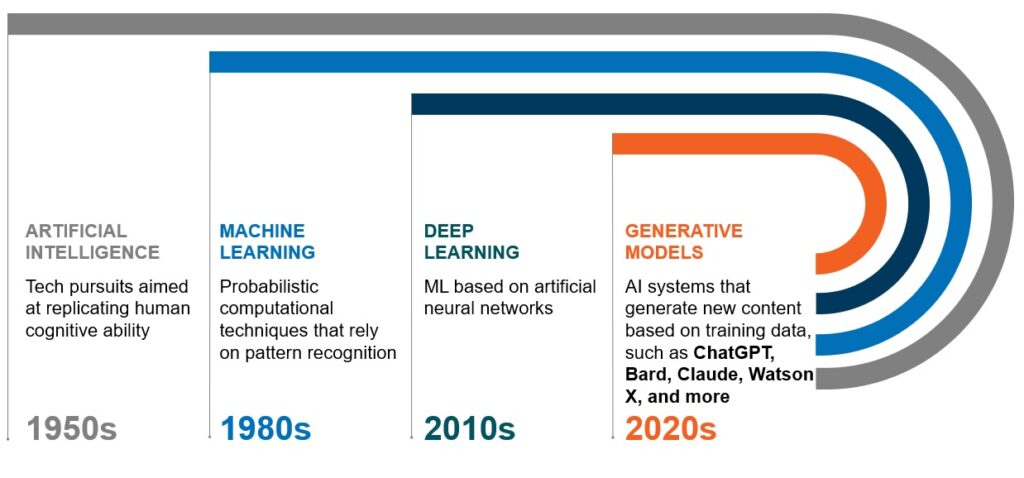

Generative artificial intelligence (GenAI) provides a glimpse of how today’s teams can leverage technology as an enabler of insight and efficiency. As a result, executives are now in the spotlight with their Boards, who are demanding action plans to adopt GenAI strategically across their organizations.

Executives, however, often find themselves planning and presenting GenAI strategy while still trying to figure out exactly how to best apply it. Despite improvements to GenAI user education, corporate discussions are too often rooted in theoretical instead of practical applications.

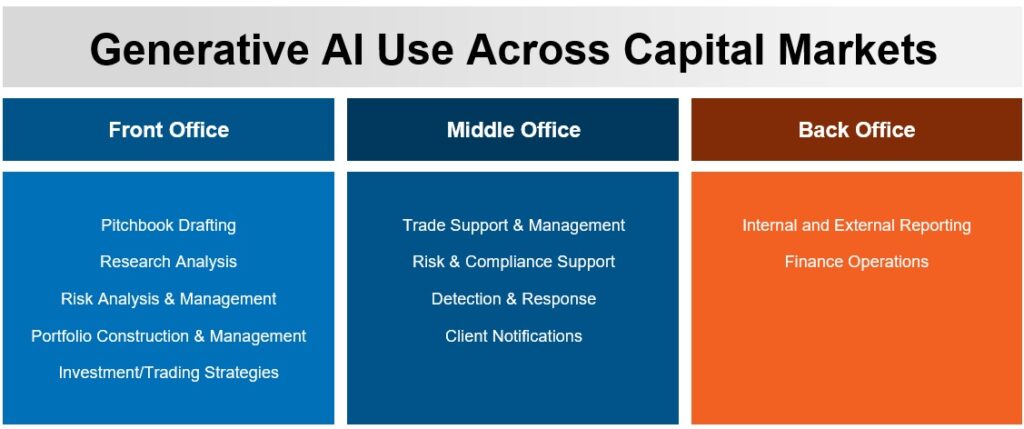

Banks and other financial services institutions are changing that.

With great exposure to the effects of GenAI relative to other industries, banks are capitalizing on this opportunity by quickly developing and deploying pragmatic GenAI-enabled solutions in core areas of the business. Meaningful, measurable use cases are here, and they’re already driving real value. Explore how below.

Current Banking and Capital Markets GenAI Adoption

Research and Analysis

Adoption of GenAI’s processing capability paired with firms’ research libraries have provided wealth managers with more accurate market insights and investment opportunities. Wealth managers can augment these findings with their clients’ investment profiles and generate personalized investment strategies more efficiently for their clients. As Jeff McMillan, Head of Analytics, Data, and Innovation at Morgan Stanley Wealth Management, said in an interview with CNBC referring to GenAI, “We saw a window of opportunity … we didn’t want to get left behind.”

Customer Support

Before GenAI hit the mainstream, banks had leveraged technology to improve customer interactions. Chatbots provide 24/7 customer support through programming pre-set answers to the most common questions banks identified in their customer base. GenAI took it a step further with the development of Customer Support Assistants that can generate real-time responses, which enables more natural interactions with clients, thereby eliminating a fixed set of responses.

Capital One is one such example with Eno, a GenAI assistant that supports customers in their inquiries, alerts them to atypical activity, and even provides services in account management. Eno can monitor customer accounts by looking for unique charges and protect customers’ financial information by creating virtual card numbers for online shopping.

Records Management

Another growing use case CrossCountry Consulting has helped develop is leveraging GenAI technology to support client-facing employees with records management in their client interaction lifecycle. By summarizing large volumes of data collected through emails and integrating this information with a records management tool, the AI enables regular updates to the records tool. This GenAI-enabled process still requires human oversight to review and approve updates made by GenAI to the records, but it has dramatically improved document processing time.

Emerging GenAI Trends in Banking and Capital Markets

Cybersecurity

While GenAI presents ongoing data protection and cybersecurity concerns, it also provides a significant opportunity for banks in their fight against bad actors. Financial services continues to be one of the most targeted industries for cyberattackers, with the number of reported data breaches and attacks growing year over year.

IBM noted that the global average cost of a data breach reached $4.45 million in 2023. But organizations that adopted GenAI and automation experienced a data breach lifecycle that was 108 days shorter than organizations that hadn’t deployed these technologies (214 days versus 322 days). GenAI reduces the data breach lifecycle by more efficiently isolating compromised areas in technology infrastructure and providing a quicker analysis of fraudulent activity.

As cyberattacks evolve, companies are using GenAI in their threat protection exercises, particularly the popular cybersecurity exercise of Red Team vs Blue Team. With GenAI, red team vs blue team exercises have an additional interactive member that can participate in threat protection and security infrastructure testing.

Fraud Detection

GenAI defends against bad actors through anomaly and fraud detection. Banks are continuously analyzing, learning, and adapting to emerging fraud tactics to offer robust protection for customers – even as hackers continue to prey on banks and their customers. With the rise of digital transactions, GenAI-enabled risk management tools and techniques offer real-time solutions aimed at blocking fraudulent transactions or requiring verification before proceeding. Companies such as Mastercard are leveraging internal GenAI’s advanced pattern recognition applications to analyze potentially fraudulent or unusual transactions and banking actions.

AML/KYC

The trend of client bases being exposed to new methods of high-risk transaction approaches has elevated the need for mature Anti-Money Laundering/Know Your Customer (AML/KYC) processes to improve their detection and analysis capabilities. This can be unlocked through GenAI.

GenAI provides an advantage due to its ability to gather, centralize, analyze, and provide insights across multiple data sources. GenAI can expose hidden patterns by tracking the complex relationships and networks that occur in money laundering. For example, banks can leverage these tools to automatically generate a customer risk score based on transactional patterns, network behaviors, and high-risk transactions. This is a step beyond traditional rule-based transaction alerting systems and allows AML/KYC teams to do deeper investigations of their clients and make more informed decisions.

Featured Insight

Unit Testing in Technology Implementation

A critical aspect of the development and implementation of new technology is the testing stage, established toward the end of the development lifecycle. The goal of the testing stage is to ensure that technology performs as expected, meets user expectations, and will not harm the technology infrastructure when deployed to production.

The software testing market is expected to exceed $20 billion by 2032, and now GenAI can act as an independent Quality Assurance engineer to create and execute test cases written by human QA resources. This avoids the potential conflict where a tester creates their unit test cases and executes them themselves. It also addresses the challenges of workforce attrition and finding quality testers at scale across service lines.

GenAI Adoption: Prepare Your Strategy

Banks must continue embracing innovation to stay ahead of competitors and change curves. The applications of GenAI illustrated above are just the tip of the iceberg. Because each bank has its own unique data and technology infrastructure, it’s best to partner with a team of industry experts with demonstrated skills in identifying GenAI use cases that deliver real value in support of the organization’s strategy and vision.

CrossCountry Consulting’s Banking & Capital Markets team advances key initiatives on GenAI and other progressive technologies for leading organizations amid rapid disruption. With new perspectives on how to implement GenAI strategically and key GenAI considerations banks must address to manage risk, our team enables organizations to capitalize on relevant AI opportunities with proven strategies, frameworks, and accelerators. To explore practical GenAI solutions designed for your specific use case, contact CrossCountry Consulting.

This article is part of a series on generative AI technology, implementation strategies, use cases, and more in Banking & Capital Markets.

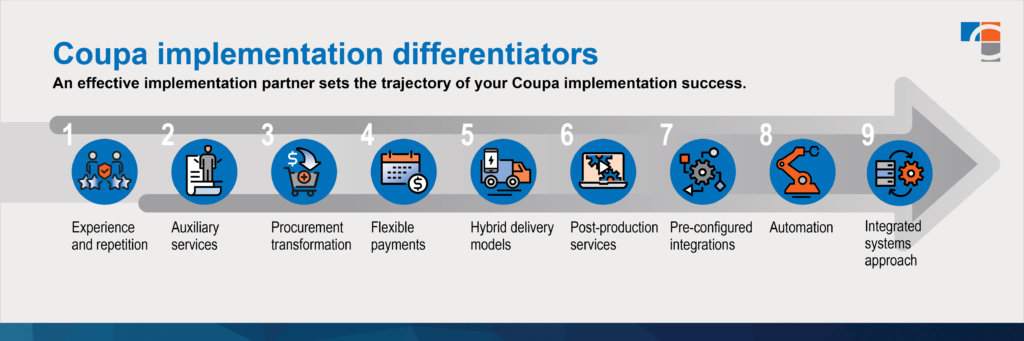

The international invoice compliance landscape continues to evolve in 2024, with new legal and tax implications for companies operating in multiple countries. Most notably, Poland, Romania, and Saudi Arabia will be joining Italy, Mexico, and more in the global move toward pre-clearance invoicing models, which require all vendor invoices to gain government validation before submitting to buyers. In 2025, France will also shift to this model.

Thankfully, leading cloud-based Procure-to-Pay (P2P) platforms like Coupa provide robust support and Compliance-as-a-Service (CaaS) solutions for 52 countries. Coupa is proactively planning for these country-specific changes, and more like them, as pre-clearance invoicing gains momentum worldwide.

Getting Started With International Invoicing Adoption

When procurement teams roll out a P2P system globally, leaders must account for three key components:

- A country’s spend and corresponding benefits.

- The invoicing model of the requisite country/countries.

- How their system of choice does or does not support that particular model.

There’s no singular metric or easy way to capture this information across multiple P2P vendor options and countries. System implementation partners like CrossCountry Consulting can lead the supplier enablement effort, technology selection, and deployment process to ensure all options are properly vetted against the scope, approach, and priority of the implementation project.

Explore expert Coupa solutions that solve real-world problems

Execute efficient Coupa deployments, enhance procurement and supply chain ROI, and minimize risk with Integration-as-a-Service offerings.

On a practical level, countries under consideration can be aggregated into the following four buckets, allowing for cleaner comparisons and categorizations of invoicing models and their Coupa system:

- Non-clearance model countries where Coupa provides a presentation and can legally create invoices.

- Clearance model countries where Coupa is fully integrated/compliant with those countries’ defined databases or partners.

- Non-clearance model countries where Coupa provides limited/partial support but cannot legally create invoices.

- Clearance model countries where Coupa does not fully support.

Procurement teams can prioritize the approach they’d like to take based on, among other things, their ability to realize benefits, resource availability, and geographic considerations. Though Coupa supports many clearance countries (e.g., India, Italy, Mexico, etc.), additional discussion internally and with suppliers is still required to ensure the new process is fully understood and tested by all parties.

Invoice Compliance Considerations Before a Global Rollout

When preparing for significant changes to invoicing processes, leaders must proceed with caution. In addition to the legal, tax, and compliance consequences involved in a new invoicing process in different countries, there are also downstream effects on internal policies, change management, and technology interoperability.

Here are some of the primary points to keep top of mind before, during, and after rollout:

- Even if a country is well-supported by Coupa, additional supplier communication and testing support will be needed, particularly for clearance model countries.

- There may be other non-regulatory complexities that must be considered and accommodated, even if not legally required. Due to rapid currency fluctuations, this is often the case in countries with unique supplier arrangements.

- Different companies (or business units within the company) may currently address country-specific regulations through different methods. There’s rarely a one-size-fits-all approach that suits all parties. A Coupa deployment is a great opportunity to align on a single approach even if certain aspects of the process must remain outside of Coupa.

- Be thoughtful about how the Chart of Accounts in Coupa is configured and how tax registrations are assigned. This will impact suppliers’ experience with the Coupa Supplier Portal (CSP).

- Anticipate country language needs when completing the supplier data design strategy.

- Consider third-party tax validation software to ensure invoice compliance efforts happen in parallel with any other software used to assess tax based on the service, usage location, and entity tax status.

With every new release of Coupa functionality, today’s investment in creating country-specific templates and capabilities within Coupa increases the total return on investment in the future. Given Coupa’s extensive track record of support for the transition of Italy and Poland to a clearance model, it will continue to surpass peer platforms as governments around the world modernize invoicing and tax reporting practices.

To bring more spend under management (SUM) into Coupa and maximize international ROI, contact CrossCountry Consulting.

With the SEC’s recent finalization of pioneering climate-disclosure regulations, the landscape of corporate reporting is set to undergo a significant transformation. These regulations, aimed at ensuring transparency and consistency in climate-related disclosures, require a strategic and proactive approach from corporate executives. As the phase-in period approaches, with large-accelerated filers embarking on disclosures by 2025, understanding and preparing for these changes is critical for staying ahead.

Overview

The SEC’s initiative represents not just a regulatory requirement, but a strategic opportunity for businesses to showcase their commitment to climate-related disclosures and risk management. Under the leadership of SEC Chair Gary Gensler, the rules are designed to provide investors with decision-critical information, thereby requiring that public companies focus on their climate-related risks and the expected mitigation strategies.

Summary of Disclosure Requirements

Regulation S-K: Strategic and Operational Insights

- Risk and Goal Disclosure: Highlight how climate-related risks and objectives could materially affect business operations and financial statements.

- Strategy and Business Model Impact: Describe the actual and potential impact of climate-related risks on the company’s strategy, business model, and outlook.

- Risk Mitigation and Adaptation: Detail actions taken to mitigate or adapt to material climate-related risks.

- Governance of Climate Risks: Outline board and management oversight on climate risks, including the processes for risk identification, assessment, and management.

- Financial Implications of Climate Actions: Report material expenditures and the impact on estimates and assumptions from climate-related mitigation and adaptation activities.

- GHG Emissions Reporting: For relevant filers, disclose Scope 1 and Scope 2 emissions, emphasizing the importance of assurance for material emissions data.

Regulation S-X: Financial Impact and Expenditures

- Weather and Natural Conditions Costs: Disclose costs and expenses from severe weather events and natural conditions, adhering to specified disclosure thresholds.

- Carbon Offsets and Renewable Energy Credits or Certificates (RECs): Report on expenses related to carbon offsets and renewable energy credits, especially if they are significant for achieving climate-related goals.

- Financial Planning Impact: Describe how severe weather and other natural conditions affect financial estimates, disclosed climate-related targets, or transition plans.

A Multi-disciplinary Approach to Implementation

In an era where climate will shape market dynamics, aligning SEC climate disclosure requirements with corporate strategy is not just about compliance; it’s about seizing a leadership position in sustainability. A holistic, multi-disciplinary approach, drawing on expertise from sustainability, finance, operations, legal, HR, and supply chain, is pivotal for embedding climate consciousness into every facet of your business operations.

This 5-step guide will help you outline a phased approach to meet the SEC mandates.

1. Streamline Reporting and Bridge Gaps

Evaluate your existing climate reporting procedures against the SEC’s benchmarks to identify and address discrepancies. This critical first step ensures your reporting infrastructure is robust and fully compliant.

2. Quantify and Manage Emissions with Precision

Establish clear organizational and operational scopes for GHG emissions, utilizing standardized data collection templates and controls. This foundation supports accurate emissions reporting and strategic decision-making for reduction efforts.

3. Elevate Disclosure Quality and Transparency

Collaborate with stakeholders to refine climate-related disclosure practices. Enhance the clarity, depth, and relevance of your disclosures, drawing upon TCFD and GHG Protocol standards to meet and exceed SEC expectations.

4. Governance and Oversight for Climate Integrity

Strengthen your governance model to ensure comprehensive oversight of climate-related risks and strategies. This includes defining clear management roles and improving data collection processes to enhance the reliability and efficiency of your climate reporting.

5. Assurance and Accountability

Ensure your GHG emissions data and climate disclosures are audit-ready. Engage both internal and external auditors for a thorough review of your processes and controls, guaranteeing the integrity and credibility of your disclosures.

As you navigate the complexities of the SEC’s climate disclosure mandates, remember that this is not just a compliance exercise, but a strategic business imperative. CrossCountry Consulting is your partner in aligning these new requirements with your corporate objectives, ensuring not only compliance but also a stronger competitive edge and enhanced investor confidence. Let’s redefine the future of corporate sustainability together.

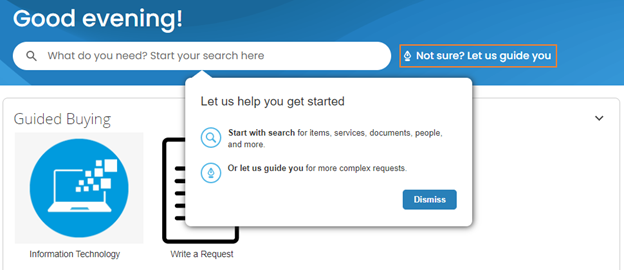

In 2023, when Coupa R35 centralized the procurement intake process with Guided Experience, users were confidently able to answer the persistent question, “Where do I start?” Fast-forward to 2024 and Coupa’s biggest release of the year, R38, delivers major enhancements to Guided Experience to further support users in guiding the request process.

Available to all Coupa customers by February 2024 (depending on release schedule), Guided Request provides new visual cues, is more configurable, and is packed with additional options, making this powerful tool more valuable and user-friendly than ever.

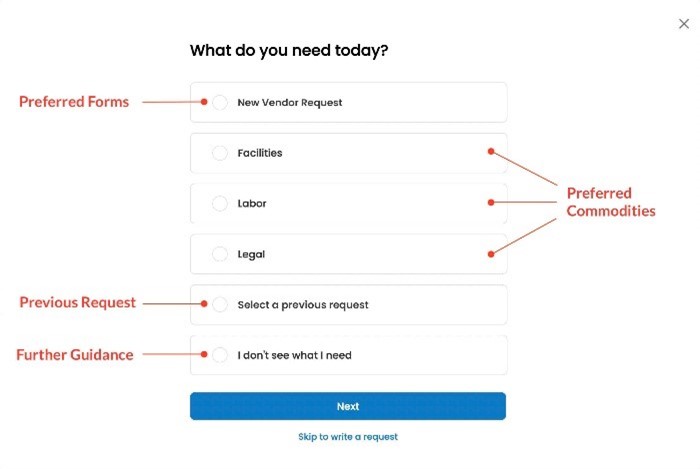

Guided Request Details

Enhancements include:

- Multiple Guided Request pages can be linked by admins for more comprehensive guidance.

- New visual cues for improved user experience.

- Individual users can default to Write a Request as their first option.

- Process Automator enhancements allow the New Supplier Process and Requisition approval process to occur in parallel.

- New policy and process document types added for Guided Requests.

- New data table experience with collapsible views.

These changes are explored in more detail below.

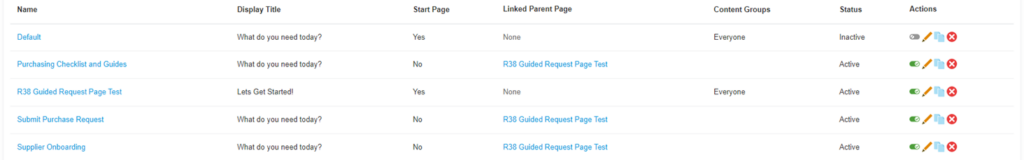

Link Multiple Guided Request Pages

Users can still select individual Guided Requests from a pre-determined list, but to make this starting page even more dynamic, multiple requests can be linked in a parent-child relationship directly from the start page, supporting a more sophisticated guided experience. Admins can manage relationships by accessing Guided Requests and indicating whether the request is linked to a parent page.

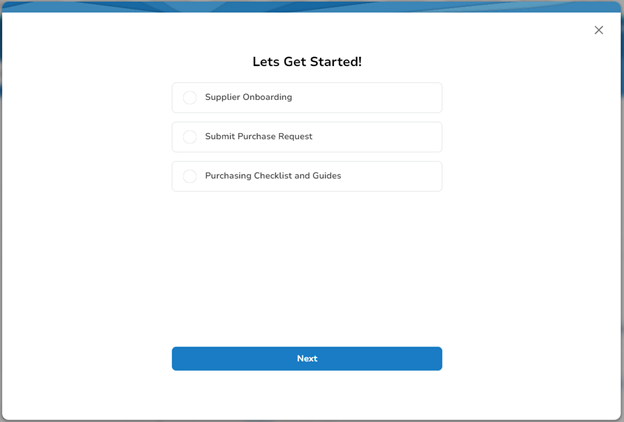

By creating the parent-child relationship, users can access requests related to the parent page from one request form. Shown below, the Parent Page R38 Guided Request Page Test is linked to 3 Guided Requests, displayed to the user under the “Let’s Get Started!” Display Name

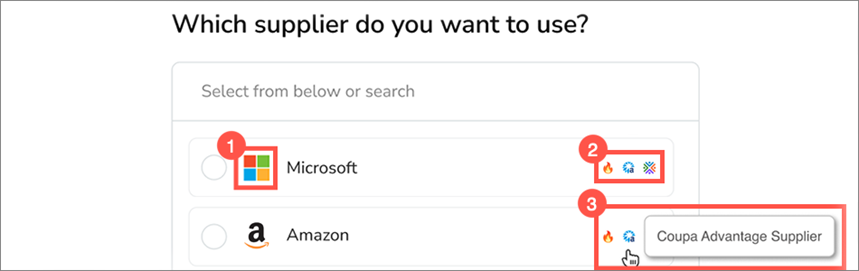

New Visual Cues

Want to guide users with easy-to-recognize visual cues? No problem.

If users submit a purchase request, by using visual cues, admins can create brand recognition and icons to inform them about which supplier and purchase experience they can select. As seen below, the supplier logo is used for brand recognition and icons are now available to indicate supplier popularity within the organization, diversity criteria, and whether the supplier is a Coupa Advantage supplier.

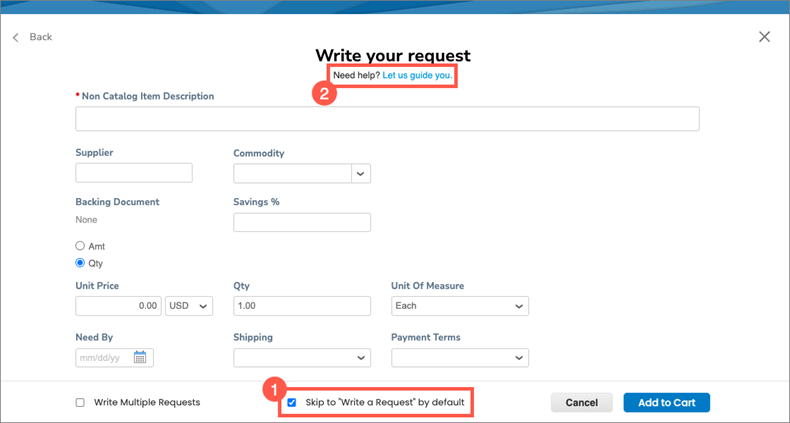

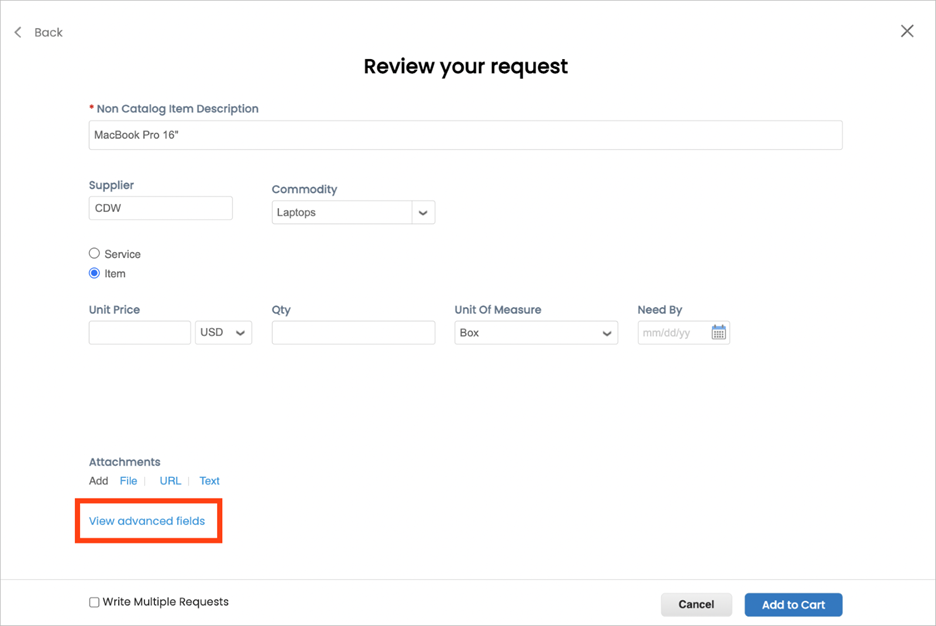

Default to Write a Request

Have users who frequently write a request? They can now default to the “Need help? Let us guide you” button to write a request (#2 below). From the request page, users can check the “Skip to ‘Write a Request’ by default” box at the bottom of the page, before adding the item to their cart (#1 below).

This will then default this page for this user every time they click the “Need help? Let us guide you” button.

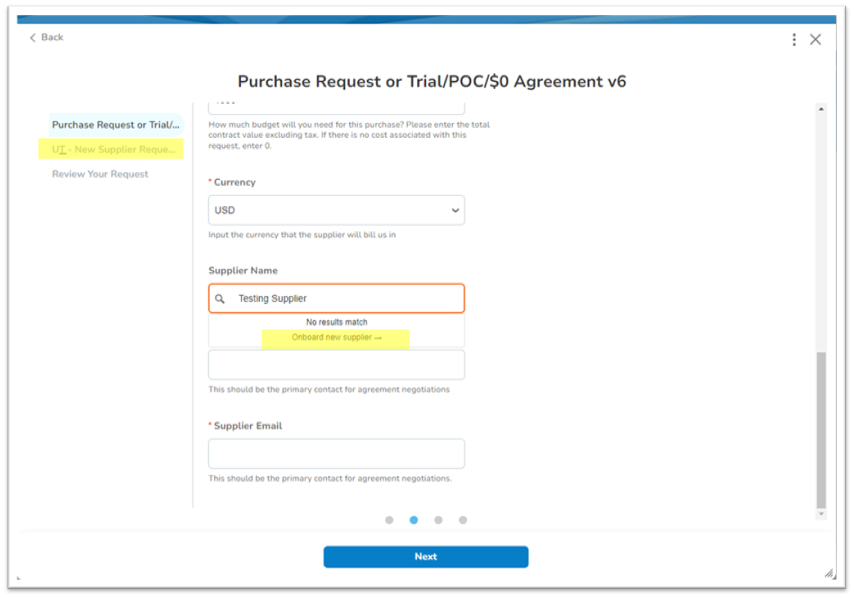

Process Automator and Guided Requests to Streamline the Supplier Request Process

Previously, the New Supplier Request Form and the Requisition Line Form were independent of each other. Now, the process automator can link the two forms (see image below), creating a seamless experience for the end user.

By leveraging this functionality, paired with the “Auto Approve” setting on the New Supplier Request form, requests can flow freely through the approval process while the supplier completes the remaining onboarding tasks.

New Document Types

There are three new custom selection options available when creating a Guided Request page.

- Policies: Allowing the user to view the selected policy.

- Processes: Guiding the user by starting a process.

- Guided Request page: Allowing a parent-child experience for the Guided Request page.

It’s important to note that child pages don’t include content groups, which means they can be reused with different start or parent pages.

New Data Table Experience

Lastly, the streamlined data table views now have a collapsed option and take up less space on the page. This reduces scroll and improves user experience for users quickly navigating through the platform.

Coupa’s Guided Requests and the R38 enhancements are available to all customers right out of the box with R38; however, customization does need to be configured by a Coupa admin.

Are you an existing Coupa customer looking to maximize this valuable new feature? Still deciding which business spend management (BSM) application is right for your organization? Contact our Coupa Release Management team to ensure your application centralizes purchasing requests and generates tangible ROI with every release.

Leaders preparing to launch a significant international growth initiative have a million tasks on their plate. Scalable financial management software that meets present and future needs is but one – yet it has far-reaching implications for ongoing operations, financial health, compliance, and procurement.

Fortunately, Sage Intacct’s robust functionality and platform experience simplifies complicated transnational reporting, currency, data, tax, and language disparities that finance and accounting teams will encounter. SaaS companies in particular will find valuable use cases for billing automation and revenue recognition, enabling faster, more efficient execution in their growth journey.

All this and more was discussed at Sage Transform 2024, with Sage implementation experts from CrossCountry Consulting leading key discussions on the internationalization of SaaS organizations. Here are some of the core highlights:

Financial Management Challenges International Companies Face

SaaS companies entering a global market for the first time will confront numerous and potentially complex obstacles if their accounting and technology systems are not designed to scale or support international needs. Similarly, companies that already have a global footprint may still be dealing with persistent challenges they’d prefer to finally overcome.

The long but non-exhaustive list of expected challenges includes:

| – Multiple currencies lead to reporting and transactional issues | – Multi-language requirements | – Manually creating transactions to force compliance |

| – Systems and data cobbled together manually | – Requirement-gathering is often incomplete | – Consolidations become more complicated due to FX implications |

| – Tax laws, GAAP, and regulatory requirements differ by country | – Stop-gap solutions become permanent solutions | – Training is undervalued and leads to recurring and unique issues every month |

| – Technology solutions are often regional, requiring upgrades to existing tools or migration to more robust ones | – Systems are looked at in a vacuum (e.g. focus on Sage Intacct only without evaluating impact on upstream/downstream solutions like Salesforce or Lockstep) | – A cross-department problem requires a cross-department solution |

So how can leaders navigate these issues within Sage Intacct?

Identify Accounting Requirements for International Expansion

To make the transition to a successful target state as a global organization, there are two key pillars leaders must keep top of mind: 1) what’s legally required from an accounting perspective and 2) how to address differences in GAAP across multiple countries.

Legal Requirements

The legal requirements for operating internationally are fundamentally different than operating domestically. Finance and accounting leaders should ask themselves:

- What did auditors ask last year? This is a useful baseline to spur conversations about what changes might need to be made in advance of a forthcoming audit cycle. And it can also shed light on the types of providers and third parties that will need to be brought in to support.

- What reports must be submitted to tax and regulatory agencies (e.g., Making Tax Digital)? International requirements may require additional internal and external resources to accommodate, and the Sage environment will need to be specifically configured in a way to allow the proper sharing, visibility, and flow of reporting information.

- What are today’s pain points? For instance:

- Some regions and countries require a unique, sequential number, known as the accounting sequence number, for each posted transaction that affects the general ledger or subledgers.

- Some regions and countries don’t allow deletion of any transactions, especially revenue.

- VAT returns must be submitted electronically directly through the ERP.

- Many countries have specific guidelines for how their invoices must be presented (tax information, language, invoice info, etc.).

GAAP Requirements

The reality of going international is that different countries have different GAAP requirements, such as ASC, IFRS, PCG, and more.

The good news is that domestic accounting teams don’t necessarily need to be experts on all these regulations. Regional teams within the global organization will have more hands-on experience and detailed information on what exactly is needed to accommodate potential accounting changes. User-defined books are immensely useful in this capacity, as they can be adapted and layered to facilitate evolving reporting needs.

Understanding the aforementioned requirements sets the stage for a successful, purpose-built Sage implementation.

Execute an International Deployment: 5 Keys to Success

To remove predictable delays, ensure an optimal outcome, and quickly generate value from Sage, there are five primary focus areas to consider:

1. Define Requirements

- What systems will be impacted by the change?

- What new tax regulations must be complied with?

- Are there new regulatory reporting guidelines?

- Which languages need to be supported in the system?

- Are there new audit requirements?

- What entities will be added?

- Which banking partners will be selected?

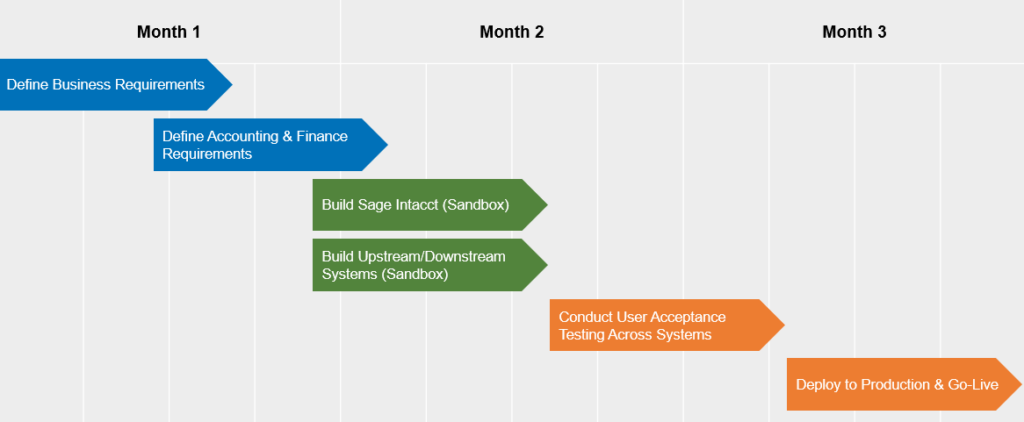

2. Create an Achievable Timeline and Stick to It

While timelines will vary depending on complexity and scope, here’s a rough snapshot of what SaaS leaders can expect:

3. Get Buy-In From the Right People

- International finance teams (tax, audit, operational finance, FP&A, FX).

- Sales operations and Salesforce development.

- Executive leadership.

- CTOs and systems administrators.

4. Engage a Sage Intacct Expert

Clear communication and close partnership with a Sage Intacct implementation expert like CrossCountry Consulting will ensure the internationalization of modules and existing configurations are completed effectively. As part of the project delivery, hands-on go-live and post-production services can add greater value and ROI to the entire technology lifecycle.

5. Support Teams With Thorough Testing and Training

As a reminder, any software is only as successful as its users, so all relevant staff must keep pace with system upgrades, environment changes, and new functionality before, during, and after rollout. Allow ample time for testing and questions, and create a robust list of test scenarios to track against.

To implement Sage for your unique requirements, contact CrossCountry Consulting.

When external auditors discover control deficiencies, especially those that rise to the level of a significant deficiency or material weakness, the remediation process can quickly tie up substantial internal resources public and private companies often lack. Persistent accounting and audit staffing shortages in the last two years have compounded the matter further.

If there’s no one (or no team) on the bench with the required skills and capacity to make remediation their top priority or even full-time job, what’s the next step?

To navigate the maze of remediation efficiently, management should look to strategic audit advisors capable of:

- Filling gaps immediately as a flexible extension of management.

- Leveraging deep technical expertise free of conflict.

- Structuring remediation efforts around proven program management methodologies and frameworks.

- Designing strategies to solve near-term issues while simultaneously establishing proactive best practices and audit-readiness infrastructure for use in every future audit cycle.

- Aligning cultures of all parties engaged in the audit process to promote seamless execution, productive collaboration, and ultimate confidence in the results.

A World of Difference: Audit Support That Frees Up Key Staff for Value-Add Activities

Remediation will stretch internal capacity, prompt the reallocation of resources, and force management to make difficult decisions on whether to delay or abandon core business objectives. In fact, 71% of organizations believe they don’t have the talent or bandwidth to manage emerging risks – when an audit identifies deficiencies that need urgent attention, this gap will widen further.

Plus, the Public Company Accounting Oversight Board (PCAOB) notes that companies typically take 6-18 months to fully address a material weakness. That’s valuable time companies will never get back.

Featured Insight

Will the months or yearslong remediation effort overlap with enterprise digital transformation programs, complex transactions (IPO, M&A, etc.), or expansion into new markets? These high-value initiatives are vital to current/future growth and competitive advantage – and will themselves take years of work and investment to orchestrate.

Balancing these activities with the regulatory and investor demands resulting from an audit report represents a serious fork in the road for even the largest enterprises at a time when PCAOB-identified deficiencies are on the rise.

There’s a real opportunity cost involved with how these concurrent efforts are shepherded – not to mention the total “true” cost on the balance sheet.

Beyond Root Cause Analysis: An Audit Liaison

Material weaknesses rarely stem from a single, isolated issue. They often involve intricate interdependencies between processes, people, and systems. Identifying the root cause of each deficiency is time-consuming and requires a meticulous, well-trained team.

CrossCountry Consulting, a strategic audit advisor with extensive Big 4 audit experience, can manage all aspects of an audit, including remediation of deficiencies, significant deficiencies, and material weaknesses. This work entails:

- Total immersion in the issue, including a full understanding of the root cause of the deficiency.

- Defining a clear path to remediation as urgently and effectively as possible, including preparation of all necessary documentation.

- Training internal staff on what to look for, avoid, and better understand in future remediation efforts.

- Auditor communications, including responding to auditor questions and inquiries.

- Executive reporting of issues, remediation progress, results, and opportunities, including board and audit committee communications.

- Other operational enhancements, including automation, technology systems deployment, or process re-design, within Finance, Accounting, IT, and Risk functions.

Audit support tackles all the issues dropped in the lap of management and impacted stakeholders without sacrificing critical ongoing initiatives outside of the audit process.

That means:

- Devoting full-time focus to the remediation without unnecessarily distracting internal staff with complex requests.

- Propelling forward momentum daily so remediation is wrapped up on time and on budget.

- Reducing staff burnout and low morale during a high-pressure period.

- Removing information silos within the organization, which generates enduring downstream benefits even after remediation.

Audit Impact Where It Counts

As much as companies, auditors, regulators, and investors would appreciate remediation being a one-and-done housecleaning, the truth is that remediating deficiencies is often a multi-year process. A strategic audit advisor can assist management in architecting a control environment that prevents recurring issues and anticipates future risks, in addition to realizing long-term cost savings that avoids increased audit fees, regulatory sanctions, and loss of investor trust.

As a firm built with Big 4 pedigree, CrossCountry Consulting’s audit-readiness specialists speak the language of auditors and take the burden off management teams. We drive value at all points in the process, with the ability to get involved before, during, or after an audit – wherever support is needed, our team plugs in.

To get started on your remediation journey, contact CrossCountry Consulting.

If 70% of change initiatives fail – the commonly accepted industry benchmark – what are the root causes?

It’s easy to point fingers at individual stakeholders, leadership decisions, or technology systems with steep learning curves. But it goes deeper.

Change management must be a cultural bedrock within the organization. When change fails, it makes clear that the organization was never truly invested in seeing the process across the goal line. Corners were cut, obstacles were sidelined, and everyone was left dissatisfied.

So how can organizations avoid the change management pitfalls that plague the vast majority of instances in which change is forthcoming? Where must greater consideration be given?

5 Common Change Management Failures

1. Under-Communication

When embarking on an ambitious change project – or even a relatively minor project – under-communication is the enemy. While top stakeholders involved directly in the change management initiative might be apprised of the goals, progress, and timelines of the project, it can’t be taken for granted that parties outside this group are likely in the dark.

Or, they’ve received general email blasts about upcoming change and have had to fill in the blanks themselves as to what that means and how it affects them.

Under-communicating will sabotage the best of intentions. In the absence of fact, rumor can take over.

Similarly, when the velocity of communication is lacking, it’s common that the volume of mediums used is also subpar.

Townhalls. Intranet announcements. Focus groups. Beta testing groups. Feedback sessions. Emails. It’s not one or the other; it’s all of the above. All communication channels available to the organization must be employed to ensure the change management message appropriately reaches all audiences.

2. Messaging Inconsistencies

Telephone isn’t just a game on the playground. It’s also unintentionally pervasive in the corporate world.

In addition to under-communicating change management, it’s equally destructive to inconsistently communicate.

There are several shapes this often takes.

- The wrong level of detail: Some teams only need the cliffs notes version of the change messaging, while others need the full synopsis, annotations, and methodologies behind the initiative. Saturating staff with the wrong level of detail is ineffective and superfluous. Messaging must be calibrated to each respective stakeholder group.

- Leaders receiving different messages: The OCFO has one lens on a project and the CHRO might have another. They come to the table with different questions, expectations, internal stakeholders, and responsibilities. But while the project might have different outcomes for their respective offices, they should still be reading from the same blueprint and sharing the same messages. The highest levels of leadership should be fully aligned on change and what it means for the organization at large. If ambiguity seeps into executives’ understanding of change, they can’t be expected to fully and faithfully communicate the initiative downward and outward.

3. Inadequate Budgeting and Planning

“It always gets cut and it’s always regretted.”

Truer words were never spoken in reference to change management budgets.

When evaluating a large investment in a software, reorganization, or growth, the devil is in the details. These outcomes must be paired with stellar change management at every juncture.

Change management is not the line item in the scope of work to cut, as once the initiative gets off to a rocky start, it’s difficult to course-correct without having to devote even more dollars, resources, and time. So, change management can be planned for upfront, or it can be retrofitted into the transformation after the fact much more expensively.

It’s not uncommon for a change program like a systems implementation to take five to seven years to put into place due to the absence of an effective change management strategy. At that pace, the system in question may no longer even be best-in-class or useful at all. To go back in and try again would only cause a significant amount of rework and extreme sunk costs. Think $3 million the first time, then $9 million the second time around for a total expenditure of $12 million over nearly a decade.

Inadequate budgeting and planning is the fastest route to a change failure. An implementation partner with expertise in project management, process improvement, and digital transformation efforts will always pay off.

4. Not Reinforcing

Change is a process, not an event.

As such, there isn’t a defined period of time when leaders can let off the gas during a change implementation. Reinforcement must be continuous if the transformation is to have any hope of achieving its stated outcome. Consider the three pillars of change in the table below with their corresponding actions:

| Preparing for change | Managing change | Reinforcing change |

|---|---|---|

| Change management project plan | Project management | Process documentation, job aids, FAQ materials |

| Project team and key stakeholder communication | Ongoing assessment of change | Stakeholder followup and acceptance surveys |

| Communication strategy and timeline | Dashboard and progress reporting | Issue monitoring framework |

| Audience and stakeholder assessment | Communication content | Measuring and reporting impact of change |

| Training strategy | Training schedule and materials | |

| Approach to managing resistors to change |

Managing complex change requires a holistic approach, with a center of excellence, change leader, or process owner orchestrating the effort. Some of the best ways to ensure a successful change management program are:

- Designing a framework, such as agile, for monitoring and responding to issues as they arise. Change management accountability is derived from the clear-cut roles and responsibilities built into the framework.

- Continuously measuring and reporting metrics related to the impact change is having on its intended business units (i.e., human resources, IT, finance).

- Engaging in feedback surveys and sessions to gain a qualitative and quantitative perspective of the change process.

- Creating accessible FAQ materials and process documentation.

5. Misalignment Among Groups

It’s not enough that senior executives and the project team are aligned on transformation. The entirety of the organization must be as well, even those who will be only tangentially impacted.

Every person in the business should have a baseline understanding of the who, what, where, when, why, how. This is instrumental in the larger company culture. If certain staff are left out of communications, totally unaware of change, or perhaps in total disagreement with the impetus for change, this friction must be addressed quickly.

Misalignment from leadership will derail a change initiative almost immediately. But misalignment among the rest of the staff may only become evident much later (or after) the process. At this point, it’s challenging and expensive to undo the friction that was already created.

Fundamentally, if you leave people out, change fails.

For total support in managing change in your organization, contact CrossCountry Consulting.

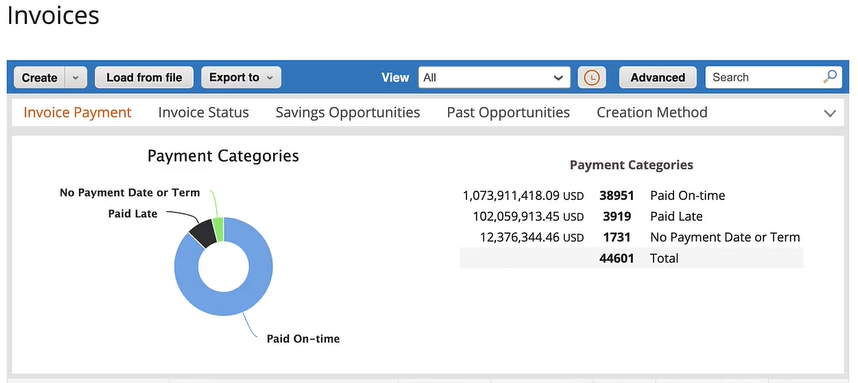

Coupa’s Release 38 (R38) production rollout through the first quarter of 2024 has brought a host of valuable upgrades to Coupa admins and users. Considered one of the biggest updates yet, procurement and spend management teams can expect substantive changes to various modules, interfaces, and applications commonly used in their day-to-day.

For an in-depth exploration of all things R38, watch our recent webinar. To understand some of the key R38 highlights selected by CrossCountry Consulting’s Coupa implementation and transformation experts, here’s a good place to start:

1. InvoiceSmash Scanned Invoice Extraction With AI

Continuous improvements to Coupa’s artificial intelligence (AI) engine have enhanced InvoiceSmash’s ability to extract information from scanned image PDFs. This new capability is in addition to existing extraction capabilities for text PDFs and credit notes. Note: Users must enable this feature and agree to the terms.

For text-based invoice extraction, nothing has changed. For image-based extraction, InvoiceSmash will automatically begin parsing. Coupa states that “If the AI has low confidence in the extraction, it sends the invoice to Ready for manual entry, just like your existing workflows for scanned images.”

2. Multi-Factor Authentication for Supplier Payment Accounts

While multi-factor authentication (MFA) is already a requirement for creating Supplier Payment Accounts (SPA), as of R38, it will now be required during the approval process as well. This update applies to all SPAs, with the only exception being if SPA or Supplier Information Management (SIM) is auto-enabled.

MFA may create additional steps for users, but the update is critical to application security and process integrity.

3. Third-Party Check Printing

Coupa Pay can now facilitate the printing and mailing of checks to beneficiaries. Payments are sent to a trusted third-party provider that generates physical checks and mails them via USPS First Class mail. The provider handles all processing, meaning suppliers who aren’t yet equipped to receive digital payments can still quickly and securely receive payments.

The entire process originates within Coupa Pay.

Explore expert Coupa solutions that solve real-world problems

Execute efficient Coupa deployments, enhance procurement and supply chain ROI, and minimize risk with Integration-as-a-Service offerings.

4. Invoice Entitlement and License

Coupa admins can now more easily grant (or control) invoice licensing to new users ad hoc or in bulk. Users added to Coupa accounts via API or CSV upload can automatically be given invoicing credentials at point-of-setup. Admins should keep this step top of mind when adding new users, as they’ll be prompted to select the appropriate licensing box, which will determine ongoing access control.

The invoicing license is required for anyone who may need to view invoices.

Change Management Is Essential

In some cases, no action is required to access and benefit from R38 upgrades; in others, admins must manually enable a specific feature. It’s important to recognize that each Coupa release provides an opportunity to elevate the value Coupa can bring to the organization, and capitalizing on this value is only possible if users effectively implement and get comfortable with these new features.

Although it may seem like another tedious change effort to leave for another day, it’s best practice to adopt Coupa upgrades as they come online. As an award-winning Coupa implementation partner, CrossCountry Consulting can help organizations maximize Coupa ROI and integrate each new release holistically across the Source-to-Pay lifecycle.

Contact CrossCountry Consulting to get started.

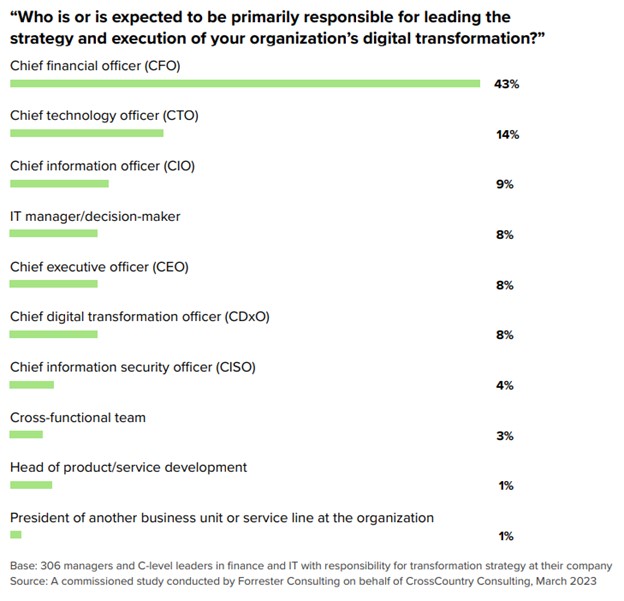

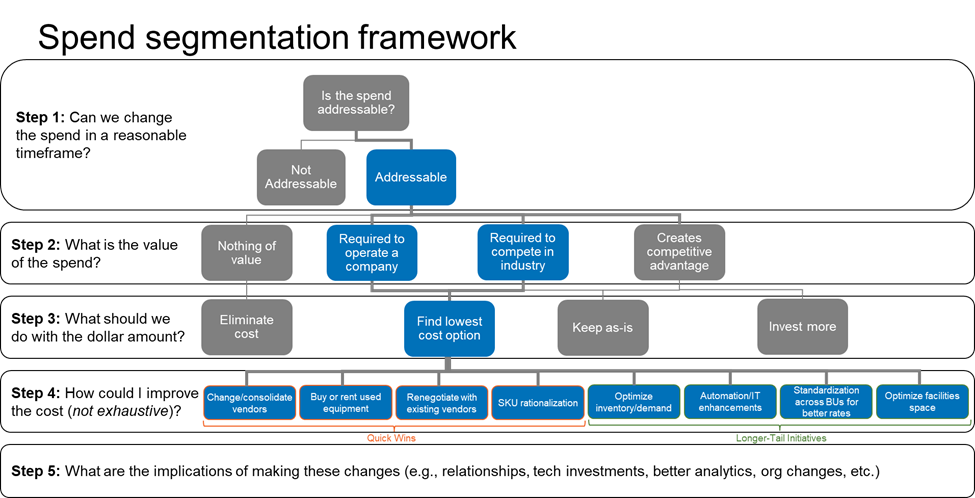

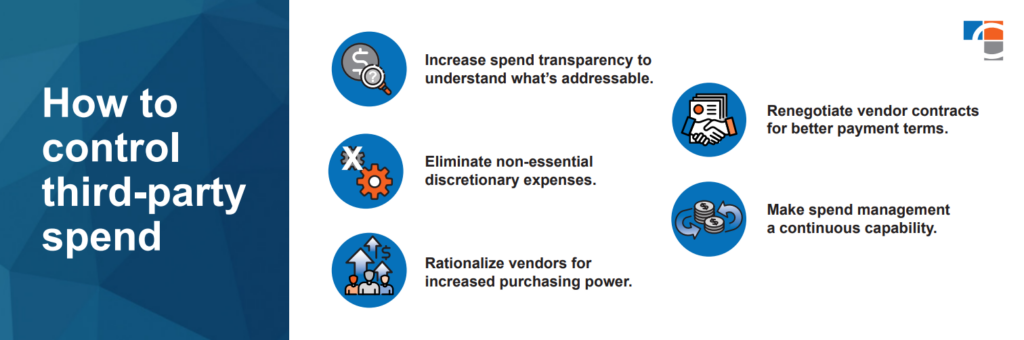

As a CFO, Controller, Procurement leader, or executive with Procurement oversight, you’ve been instrumental in rapid company growth. But that growth comes with a cost: It’s become increasingly difficult to have full visibility into what those costs are today and where they will be in the future. You’ve heard Procurement delivered significant cost savings at other organizations but aren’t sure how or where to start within your own company.

If your company recently stood up a Procurement function or plans to do so soon, below are five steps to building a value-driving team:

1. Use Data to Inform Your Path

Nothing can be actioned until there’s visibility into all vendors and spend. Gathering this information can be expedient if a Procure-to-Pay (P2P) system (like Coupa) or data integration capabilities (like an ETL and Snowflake) already exist. Unfortunately, many companies still have data scattered in numerous spreadsheets.

Aggregating and organizing spend data by categories enables teams to pinpoint immediate opportunities for supplier renegotiation and consolidation, while also identifying the organizational needs required to build the Procurement department (how many buyers vs. strategic sourcing personnel, how to align the team, how to connect Procurement to AP and Finance).

The best organizations have deep connections between Finance and Procurement in which the annual budget feeds Procurement-related decisions (Plan-to-Pay). While this capability will not happen overnight, any new Procurement department should explore how to tie objectives and actions to the annual budgeting and planning activities across the company.

2. Build and Sell Your Strategy

It’s important to immediately prove value to the organization. One of the first keys to this – even if Procurement reports to the CFO – is to step out of the accounts payable (AP) organization and position the new function as a strategic value-driver to the business.

Then, it’s important to broadcast the goals of Procurement in line with overall company goals. For example, if the company is focused on generating cash, Procurement should identify ways to improve the company’s cost structure.

Support from the business will be critical to the success of the new organization. Procurement leads must spend time with the business not just verbally explaining the value of the new function but proving value through hands-on experience.

For instance, in the cost improvement-focused goal above, the Procurement department could help the business with building sourcing strategies, bringing market intelligence, developing RFx documents, and conducting sourcing events on their behalf. The Procurement organization then should have KPIs that showcase its value through data (e.g., savings generated, time saved for the business, etc.).

Lastly, establishing governance from the start is critical. Procurement leads should work with the business to define decision rights across the Procurement lifecycle through a RACI (responsible, accountable, consulted, informed) document. Procurement’s role in sourcing, contract management, supplier management, and purchase order (PO) and invoice processing must be well-defined and understood by the organization as you move from decentralized decision-making to a more structured and controlled way of buying.

Consider what percentage of spend should be directly influenced by Procurement. Which categories of spend (e.g., IT Services, Real Estate, Professional Services) will you lead vs. support? You’ll need coverage from executive leadership to advocate and champion these ways of working to make them stick.

A reminder: Some business functions, such as IT and Marketing, may have built mini-Procurement teams in your absence. Strong alignment with these functions on the vision of Procurement will enable you to add value to existing structures and ultimately gain traction for new changes and objectives you plan to implement.

3. Generate Quick Wins to Stop the Bleeding and Gain Momentum

There are some relatively easy actions – many self-funding – organizations can take to generate immediate value through Procurement.

Some are as simple as tightening policies around spend. For example:

- Putting controls around spending.

- Instituting requirements around the use of POs (No PO, No Pay) for the majority of spend areas.

- Documenting allowable exceptions.

- Leveraging Procurement catalogs for repetitive, low-dollar purchases like IT peripherals, office supplies, and general business admin. Catalogs can make buying faster and easier without disrupting normal operations.

Tightening policies can help reduce maverick buying that’s common with organizations that lack sophisticated Procurement departments.

Sourcing is another opportunity. By examining spend data from step #1 above, RFx events can be conducted for key indirect categories (e.g. computer hardware) in which spend is higher than expected and/or desired.

Explore expert Procurement & Cost Transformation solutions that solve real-world problems

Optimize Source-to-Pay, capitalize on procurement analytics, and drive cost management sustainably across the enterprise.

4. Review Digital Capabilities and Technology Architecture

Technology, data, and automation can be a catalyst to anyone building a new capability or department. You may be the only person in the entire company with “Procurement” in their job title. Or, there may be no dedicated Procurement function at all – just activities that ladder up to the CFO or Controller.

In either case, you’ll need all the help you can get, and the more you can automate activities, integrate data, and simplify reporting, the more time you can spend with business stakeholders and suppliers on strategic, value-add activities. The great news is that there have been significant advancements in Procurement technology over the past 10 years that can provide built-in automation and reporting capabilities. That said, technology should be seen as an enabler to process. So, where do you begin?

Start by examining the current technology architecture and flow of data.

- What sits in the ERP? Think through Sourcing, Contracts, Vendor Master, Requisitions, POs, Receipts, Invoices, and Payments.

- Are there other Procurement support tools in place, such as SharePoint as a contracts repository or Service Now as a routing tool?

- How are contracts, POs, or invoices approved today?

- What sits in offline spreadsheets?

- How do you retrieve data from each system and tool?

- How should it look in the future?

Not sure where to start? Take a blank sheet of paper and draw an unconstrained view of a streamlined end-to-end P2P process that minimizes human touch and has the desired end-state technology architecture. How would live data reporting be automated in this desired end state?

It may take time to achieve the technology target state, so answering these questions early is critical. The value of digitizing Procurement goes beyond efficiency benefits and can improve the experience the business and suppliers have with your Procurement department.

5. Build a Multi-Year Roadmap

Time to put it all together. There will be so many things that you could do, but what should you do, when should you do it, and how?

Some best practices include:

- Build an 18-month roadmap. Anything shorter doesn’t have enough lens into the big picture, and anything longer is too long to plan for.

- Prioritize 3-4 quick wins. These are initiatives (e.g., sourcing events for key categories) that take less than three months but generate noticeable value. They often include wins like defining decision rights throughout the process, updating policies, cleaning up vendor records, updating the approvals process, and installing a scanning tool or invoicing portal.

- Organize initiatives by people. What roles and skills are needed in Procurement to fuel process and technology-related activities?

- Prioritize initiatives that add the most quantifiable value. This is often cash generated, time saved, etc. Don’t boil the ocean and don’t get into initiative overload.

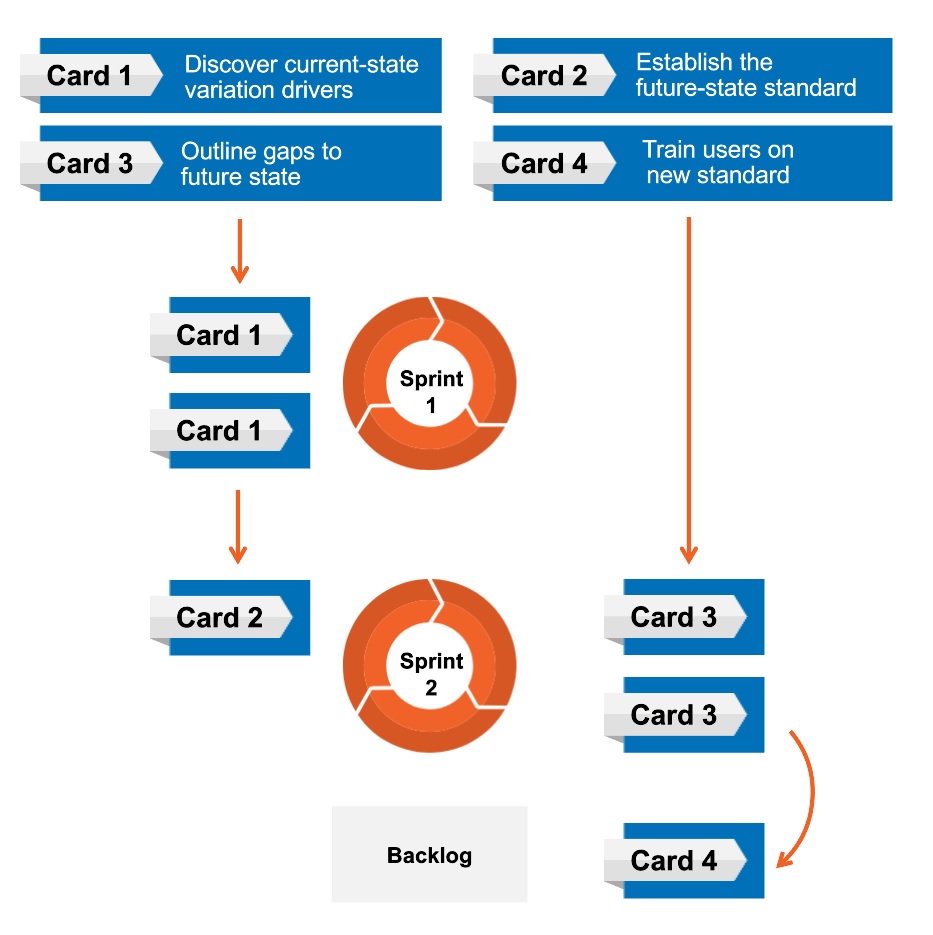

- Work in agile sprints. Instead of conducting sourcing for 10 categories at once, do them in sequenced waves.

With this framework, organizations can build a Procurement department from scratch the right way or optimize their current Procurement activities to fit the needs of the business and reporting structure.

To get started on your Procurement transformation journey, contact CrossCountry Consulting.

The Public Company Accounting Oversight Board’s (PCAOB) “Target Team Inspections” consists of inspectors who focus on emerging audit risks and other topics the PCAOB believes could have important implications as audit teams aim to improve audit quality now and in the future.

Recent PCAOB inspections identified the following three audit risk areas:

- First audits after traditional IPOs or de-SPAC transitions.

- Audit team reliance on shared services centers (SSC).

- Climate-related matters.

Audit teams, already stretched thin, are feeling the pressure of closer scrutiny from the PCAOB due to a noticeable decline in observed audit quality. Overcoming current audit challenges – specific to the above focus areas and beyond – is imperative moving forward, and the work must begin now. Audit teams will increasingly be looking to management to engage in their audit responses to best navigate these challenges.

Audit Quality by the Numbers

The PCAOB estimates 40% of audits they review “will have one or more deficiencies that will be included in Part I.A of the individual audit firm’s inspection report.” Approximately 46% of audits are expected to have one or more deficiencies in Part I.B as well.

This persistent upward trend over the last several years is a troubling sign, with PCAOB chair Erica Y Williams stating, “These findings are absolutely unacceptable, and audit firms must make changes to turn things around and live up to their responsibility to investors.” The Target Team focus areas may provide additional insights into auditors’, and by extension management’s, future areas of focus.

Featured Insight

The inspection report found the following:

- 20% of post-IPO audits contained deficiencies. Instances of deficiencies were in some cases caused by a departure from GAAP “in the presentation of deferred revenue” and the failure to test the accuracy of “labor hours used as an input to record revenue,” among other reasons.

- Positive signs for audit quality when relying on shared services centers (“SSC”), such as SSC personnel continuity between audit cycles, additional layers of review over SSC deliverables, and effective coordination between SSC and the U.S. firm.

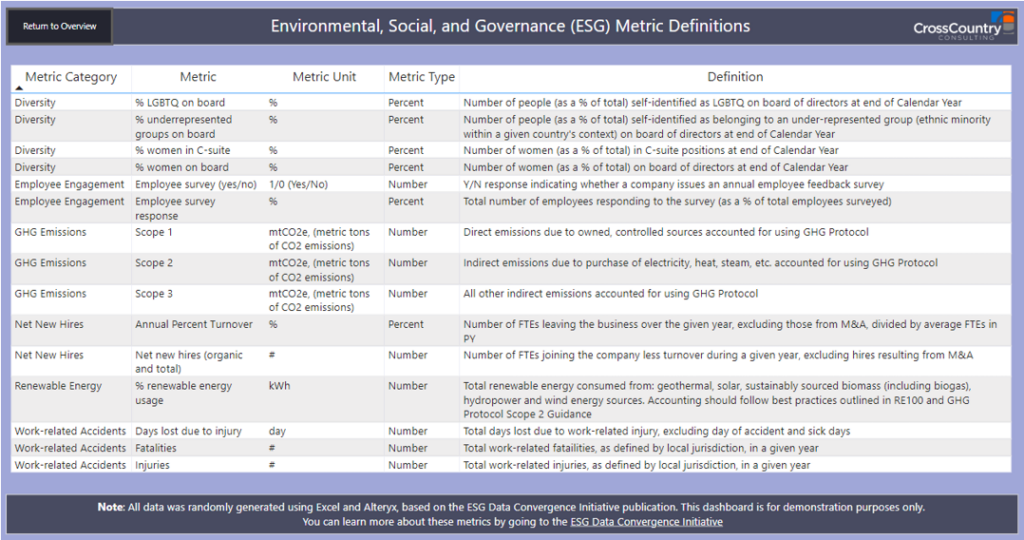

- Registrants’ increased focus, communication, presentation, and disclosure considerations relating to Environmental, Social, and Governance (ESG) issues in anticipation of forthcoming ESG reporting requirements from the SEC.

These targeted reviews will likely influence the areas of the business in which auditors will increase scrutiny. Therefore, companies should expect more questions relating to areas such as revenue recognition and ESG and be prepared with appropriate responses. In addition, audit teams may increase their use of SSC, which may lead to challenges with coordination.

The Path Forward

In the second half of 2023 and into 2024, audit firms have shifted their attention to respond to what’s viewed as a “breaking point in audit quality.” Firms turning the corner successfully are focusing on:

- Standardizing audit procedures and deliverables.

- Getting ahead of new accounting standards and policies by better understanding what regulators are thinking before audit season becomes time- and labor-intensive.

- Increasing audit partner engagement earlier in the audit process.

- Formulating proactive frameworks and responses to expected complex, judgmental areas (e.g., defining emerging risks).

Additionally, new PCAOB Target Team focus areas for audits of 2023 financial information will include risks associated with:

- Distributed ledger technology.

- Interim reviews of certain banks.

- Multi-location audits.

- Significant or unusual events and transactions.

Management, along with their auditors, should be prepared to address these ongoing and forthcoming audit inquiries.

Fortunately, the audit process doesn’t have to be managed alone. CrossCountry Consulting’s audit-readiness experts help companies reduce audit friction and see around audit curves. To navigate the audit challenges of today and tomorrow, contact CrossCountry Consulting.

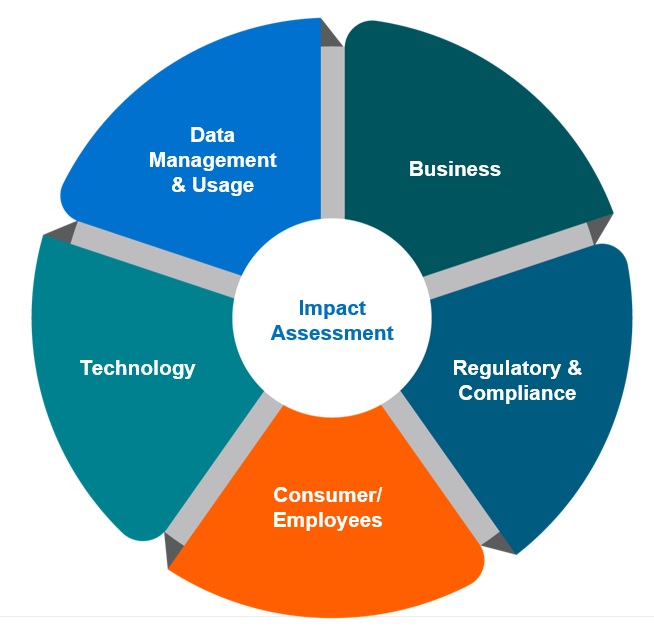

As generative artificial intelligence (GenAI) becomes more accessible and expansive, business leaders need a plan to harness its potential while mitigating risks. This requires strategic planning activities, including exploring use cases, drafting an implementation roadmap, creating ethical usage policies, and elevating organization-wide AI literacy.

There are two parallel paths organizations must take to successfully encourage the safe implementation of AI while proactively mitigating risks:

- Build a strong data-driven foundation.

- Experiment with GenAI to create momentum for adoption.

Current AI trailblazers and innovators are already on this course. It’s beyond time for other organizations to follow suit.

1. Build a Data-Centered Mindset

A data-centered mindset is the precursor of a successful data transformation journey. This consists of having:

- A data strategy.

- Necessary governance mechanisms.

- The required initial infrastructure (people, processes, and technology).

- A capable team.

- Organizational data literacy.

Together, these components enable companies to innovate and embrace GenAI safely and responsibly.

To build a strong data foundation, companies should specifically consider the following actions:

Establish Data Strategy and Governance

An effective data strategy should drive the decision-making process of technology selection, including GenAI technology, as well as the assessment of use cases. Of course, these decisions should align with business needs, pain points, and goals.

Leaders must ask “What tasks or functions could AI assist with?” “How could it improve operations or services?”

Understanding the problems to be solved will help guide implementation and the selection of technology.

Clear data governance allows the company to translate the strategy into an actionable roadmap. This includes:

- Defining data roles.

- Distributing responsibilities between stakeholders.

- Setting GenAI usage guardrails.

- Establishing measurable objectives at all levels of the company.

Additionally, having a clear understanding of the organization’s risk landscape and how the usage of GenAI fits into it will enhance the organization’s ability to respond to new opportunities and risks and the ability to identify key gaps along the way.

Focus on Data Centralization and Tool Selection

With an explosion of technological advancements, companies must control where their data is created, transformed, and stored. It’s estimated the average enterprise uses more than 470 SaaS applications – SMBs rely on roughly 250 as well.

As the data technology space becomes more complex, so does the ability to manage and track multiple data sources. Selecting GenAI tools to kick-start experimentation doesn’t need to be a colossal task.

Develop a short list of current market offerings and their capabilities to efficiently select a Large Language Model (LLM) that employees can start leveraging for everyday tasks. In parallel with this initial experimentation tool, develop a longer-term plan for enterprise-level tools, carefully considering infrastructure needs, including hardware, software, and connectivity required to develop, host, and integrate broader GenAI into your data ecosystem.

Team Building and Increasing Data Literacy

While experimentation can be done with a handful of early adopters within the business, organization-wide adoption requires a data-literate workforce. Gartner’s Annual Chief Data Officer survey indicates that less than a third (29%) of companies are successfully meeting ROI objectives from the rollout of their data and analytics initiatives. Developing a literacy program with curated training materials and capable instructors is key to a successful implementation.

2. Promote GenAI Experimentation

There are several ways to shepherd GenAI adoption within the business, and, often, certain employees or departments will be ahead of the curve while others may be more averse to experimenting with new tools. To encourage responsible experimentation in a way that isn’t too aggressive, intimidating, or disruptive to normal operations, focus on the areas below:

Start With Everyday Tasks

OpenAI’s ChatGPT 3.5, Google’s Bard, and Anthropic’s Claude 2 are a few existing examples of public LLMs that can be accessed for free by all users. Similar to many other data-driven or business intelligence tools, the best way to grasp and understand the capabilities of the LLM is to use it.

Featured Insight

While the free versions of these LLMs do not offer protection of your proprietary business data, employees can still make great use of these tools in ways that don’t involve confidential data.

Some employees may leverage the LLM as a teacher for existing marketplace technologies, while others may use it as an accelerated and more efficient research assistant. The teacher can walk through the steps of building the first workflow in an automation tool, while the research assistant can synthesize an industry article from a 10-minute read into a 1-minute read. As employees prompt the LLM for these low-risk use cases, each employee’s AI literacy increases.

GenAI literacy is imperative to estimate ROI for projects and implementations in this space. Enterprise executives list “unproven ROI” as a key barrier to GenAI adoption. The experimentation phase helps to refine exactly how LLMs can slot into workflows, which can lead to more informed and data-driven assumptions around the true ROI that can be expected.

Leverage Existing Tools

Within the last year an increasing number of technologies, especially those focused within the business intelligence and data analytics industry (e.g. Alteryx, Tableau, PowerBI, Qlik Sense, Snowflake), have seamlessly integrated GenAI capabilities into their offerings.

Some of these tools may offer an API that allows users to interact with an LLM from within the existing technology’s user interface, while others have fully integrated GenAI capabilities into their technology, allowing the auto-completion of code written by the user or the auto-generation of new insights from data. Technology leaders should speak with their third-party technology partners about safely experimenting with GenAI within the bounds of their existing offerings.

Explore expert Data Transformation & Analytics solutions that solve real-world problems

Accelerate strategic adoption of data, analytics, and artificial intelligence platforms within a scalable systems architecture for efficient reporting, cleaner insights, and greater change readiness.

Crowdsource Use Cases

Due to both the novelty of LLM capabilities and the breadth of their use cases, it can be difficult to build a use case list until the organization develops an initial familiarity with the technology. The initial focus on leveraging the LLM in everyday tasks is nearly guaranteed to spur new, more intricate use case ideas by those experimenting. There should be a central repository for the organization’s use case ideas that individuals can add to in real-time as they work and ideate with the LLM.

The Right GenAI Partner

CrossCountry Consulting can build out this initial use case list specific to your business and your industry and provide priorities so your organization maintains its momentum without becoming overburdened by the exponential proliferation of use cases. Proving the effectiveness of the first few use cases is a significant stride toward a culture that values the transformational capabilities of GenAI.

Our Data Transformation & Analytics team believes that a successful GenAI journey starts with a strong data strategy and is accelerated by safe experimentation. It’s critical to get the correct foundations in place, whether that’s refining your data strategy and governance model, selecting the initial LLM to experiment with, exploring your existing tools for add-on GenAI capabilities, or developing and prioritizing your use case list.

Contact CrossCountry Consulting to get started.

You just implemented your SaaS enterprise application you were told needed only minimal support.

Because it’s – allegedly – a light lift (and cheaper), your organization opts to appoint as system administrator a member of staff who has availability to “help.” Unfortunately, they don’t have the proper, ongoing time or skills do the job effectively.

Even if this administrator was heavily involved in the initial implementation and will be a power user, it won’t be long until you recognize that go-live is just the beginning of the application’s journey. Its actual value and impact on your organization start now – but you’re missing the critical infrastructure to realize true ROI.

State of Enterprise SaaS

It’s estimated the average large enterprise has anywhere from 100-500 SaaS applications in use. Then there are also the dozens or hundreds of unsanctioned applications that employees use for individual tasks, creating a so-called “shadow IT” in addition to existing IT.

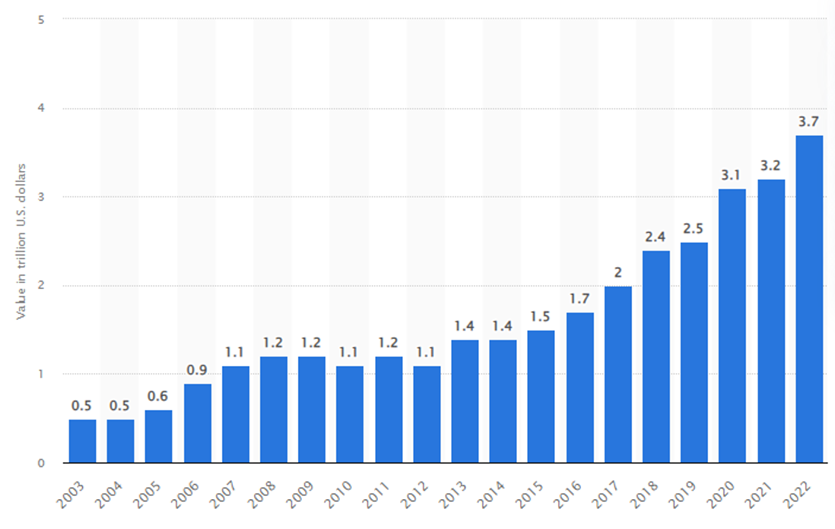

The implementation of more SaaS products will only increase, as evidenced by 500% growth of the SaaS industry at large over the past seven years. In 2024, the industry is projected to grow another 20%.

The explosion of the generative AI (GenAI) market further compounds IT demands. The GenAI Infrastructure-as-a-Service (IaaS) market will be valued at $1.3 trillion by 2032. A full-lifecycle systems architecture strategy is the path forward for IT teams and department heads concerned about adapting to change, adopting new technologies, eliminating IT redundancies, and controlling technical debt.

The appointed systems administrators for all this software can make or break your investment.

Featured Insight

Can You Rely on a Part-Time Systems Administrator?

Applications consistently roll out new features and updates throughout the year, and your organization is most likely evolving with growth or change. Amid this sprawling infrastructure, maintaining alignment between systems, processes, and roles over time is the key to maximizing ROI.

The chief barrier, however, is that your administrator has another day job, which leads to multiple debilitating issues that introduce risk across the rest of the business.

The Downsides of a Part-Time Systems Administrator

- Inflexibility when demand surges: When questions or issues arise during a surge period, it’s incredibly difficult for a single part-time administrator to keep up.

- Continuous training to maintain comprehensive knowledge: SaaS enterprise applications like Coupa or Sage Intacct are constantly evolving and rolling out new features. This requires a level of dedication to continuous learning. Ongoing system training is not going to be a priority when your administrator has competing operational activities they need to complete.

- Overall organizational risk: No one likes the phrase “but let’s think about segregation of duties.” There may be situations in which your accounts payable (AP) manager is also an admin in a system where they can manage suppliers, approve or bypass invoices, and maybe even execute payments.

- High turnover risk: Isolated or limited knowledge of the system within the organization can create significant gaps/risks if those key individuals leave. Additionally, talent with the right experience and skills is scarce, so the time to hire a candidate requires more time and money.

Benefits of a Third-Party Administrator

Rather than settle for an in-house, part-time administrator, your organization may opt to have a full-time administrator dedicated solely to your application ecosystem. This is a considerably necessary and effective evolution in the application journey – if done well.