As finance transformation initiatives take shape in 2023, not all leaders are hopeful of their organization’s digital trajectories.

Research shows that 55% of CFOs aren’t confident in their current transformation progress, and just 37% have an established, realized digital finance strategy to begin with. While the appetite for process improvement within Finance – inclusive of automation, analytics, and other digital opportunities – is evident, it’s critical that leaders approach change in a unique, tested, and measurable way.

To fully realize Finance efficiencies and positive downstream outcomes, consider the mantra “one approach does not fit all.”

3 Guiding Principles for Finance Process Improvement

Start with the following foundational principles when designing a framework for optimizing Finance processes for the future:

1. Don’t Skip the Basics

- Define and align processes to your strategy: Process definition and improvement opportunities must be informed by your strategic priorities as a future-ready organization.

- Keep it simple: As processes are defined, keep them as simple as possible. If process outcomes and related benefits aren’t clear, do you still need to perform that process?

2. Measure and Analyze Results to Inform Continuous Improvement

The only way to truly know if a process is effective is to measure the results. Define what’s most important about the process in clear KPIs (e.g., time to complete; accuracy of reporting output) and measure against related targets.

Use these results to support transparency, understanding, and accountability. Then decide what to act on and where improvements can continue to be made. Repeat this cycle of measure, analyze, and improve.

3. Be Bold

Go all in with the art of the possible and don’t settle for what’s been done before. When considering automation, do so from the lens of what can’t we automate.

Evaluate Processes Based on 2 Key Criteria

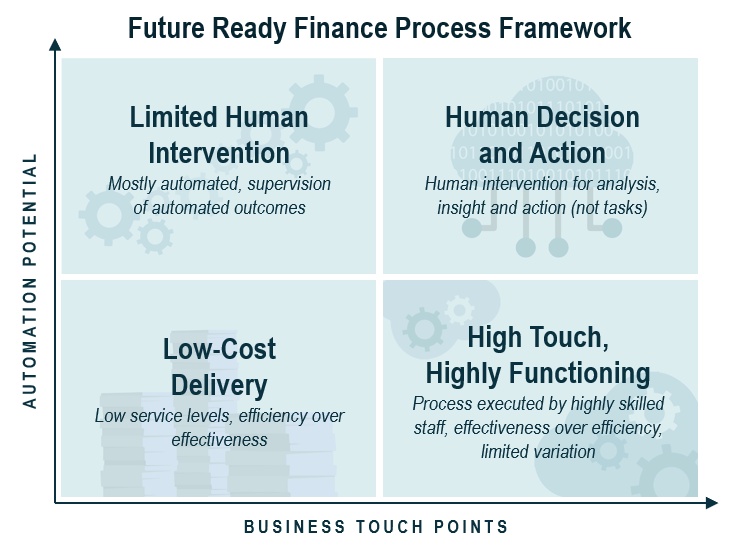

With these three principles in mind, each process should be evaluated based on:

- Automation potential. Automation is when bots or coding perform repetitive tasks, not humans. It can reduce costs, increase speed, and minimize errors. Never automate a bad process or unnecessary task.

- Volume of business touch points. When Finance regularly interacts with staff in other areas of the business, they, by extension, serve customers and suppliers, exchange vital information, and impact the bottom line. Finance processes with the most business touch points should maintain higher levels of human intervention and skilled labor.

To properly identify and optimize Finance processes, they should be filtered through a framework that weighs automation potential against business touch points.

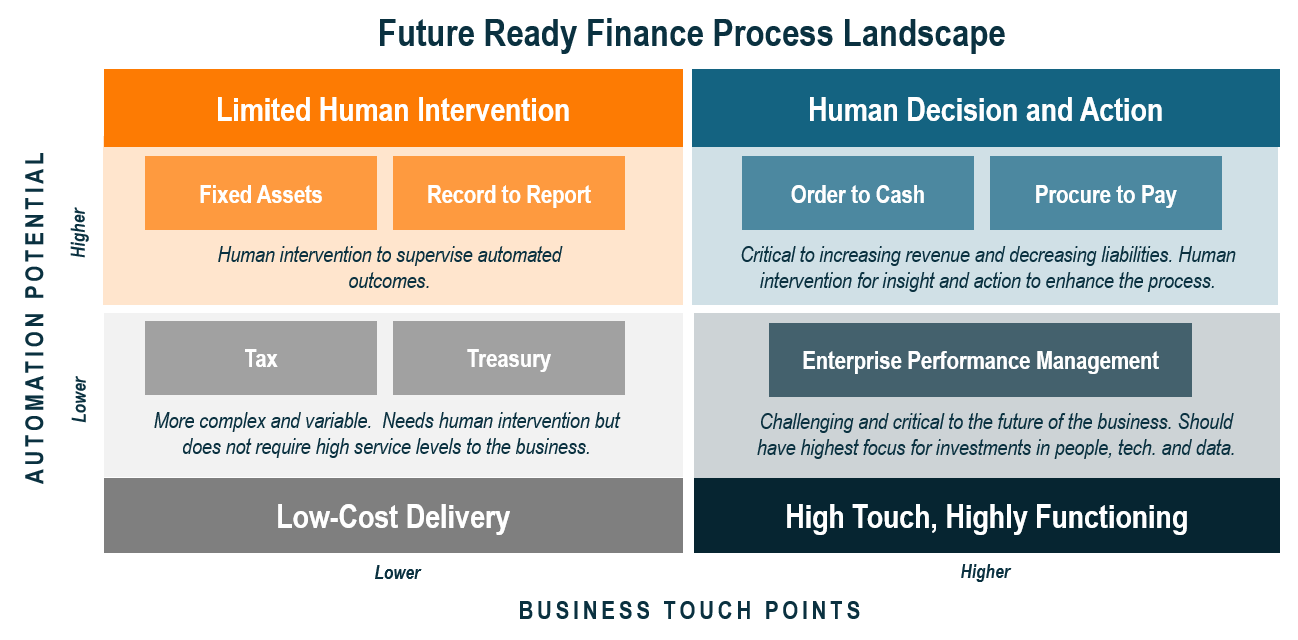

So what might this look like in reality? Where do you start and with which processes?

While each organization’s processes contain nuance, we’ve mapped common Finance processes to where they typically fall in this framework.

Creating Value From a Future-Ready Process Framework

As you review this framework and your own processes, consider:

For processes in the higher quadrants, think about what can’t be automated and why.

Repeatable, transactional processes should be rules-based and lend themselves well to end-to-end automation with any intervention/judgment limited to true exceptions or escalation points. If your evaluation uncovers core process steps that aren’t rules-based, this indicates a likely need for process simplification and standardization.

For higher-touch, higher-functioning processes and capabilities, you must retain human analysis, judgment, and collaboration.

As pictured in the lower right quadrant of the above diagram, Enterprise Performance Management (EPM), along with other high-touch processes like scenario planning, forecasting, and strategic sourcing, are more challenging to directly automate. Yet, with the right investments in people, technology, and data, they can still be materially improved. For example, there are often automation opportunities related to upstream data and processes that can free up time for Finance to engage in and lead with true analytics and insights – core value centers for the benefit of the business as a whole.

As these principles are applied and this framework configured to your organization’s goals and capabilities, continue to challenge the status quo. No process is sacred. And as individual processes are successfully improved, it has a compounding effect on connected processes and stakeholders, empowering even greater optimization throughout the entire Finance process architecture.

It’s never been easier to achieve lower delivery costs, reduced risk, improved process outcomes, and greater uptime for analytical insights.

For expert Finance process improvement support, contact CrossCountry Consulting.