The monthly close process is a significant strain for financial professionals, with 52% citing it as their top stressor. Surprisingly, though, 74% of organizations have not implemented process automation improvements to streamline the close.

Technological advancements, such as cloud-based applications, application integrations, automation, and artificial intelligence (AI), collectively offer opportunities to enhance the finance and accounting function and specifically address commonly cited close challenges. When adopted in a unified systems architecture, these innovations enable what’s now referred to as “autonomous financial close” – a high-speed, high-accuracy close process achieved with limited human intervention, which will be explored in greater detail below.

While few organizations have reached the top of the maturity curve in adopting these technologies, significant advantages can be won by those that do. They can access key business insights faster and make decisions more quickly, giving them a competitive edge over organizations lower on the maturity curve. Additionally, once a firm has successfully leveraged technologies of these kinds, it becomes much easier to organically outpace lower-maturity competitors over time, creating a flywheel effect.

Reaching peak digital maturity begins with a core understanding of an organization’s current position on the maturity curve and then implementing a strategic plan to achieve incremental and continuous progress on the path toward autonomous financial close. Learn how below.

What Is Autonomous Financial Close, Exactly?

Autonomous financial close, also known as continuous financial close, is the pinnacle of financial close maturity. This approach to the close process involves automating transaction entries, system integrations, account reconciliations, data consolidation, and financial reporting through the month.

It is not “continuous” in the sense that the close process is never-ending or that it entails constant human action. It’s the opposite. It leverages the latest technology to operate autonomously in the background, evolving the users’ job to more of a reviewer than a data enterer, resulting in an accelerated and perpetually accurate financial close. Regardless of the level of automation, accounts, of course, are still necessary for close and scrutiny is still required, especially for public companies.

Companies that embrace an autonomous close aim to achieve a state where a “soft close” can be performed at any time, providing timely financial insights. While a “hard close” is still conducted at the end of each period, it becomes a streamlined, predictable process, due to the continuous processing and aggregation of financial information. By spreading out the task of closing the books over the entire month, technology can enable the team to address items promptly, greatly reducing the accumulation of journal entries.

More specifically, an autonomous close enables instantaneous reporting by eliminating the need for different modules to be closed before reporting balances to the nominal ledger. For example, technology stakeholders can implement tools to automatically process invoices for accounts payable, reducing the need for manual intervention and providing quicker access to key reports. Another application of close automation is the automation of reversing journal entries.

Automation of manual tasks is just one of the ways technology can contribute to achieving an autonomous financial close.

Explore expert close optimization solutions that solve real-world problems

Accelerate strategic adoption of advanced technologies like AI, automation, analytics, and business intelligence platforms that support rapid close execution and smarter insights to the business.

Benefits of Making Progress on the Maturity Curve

Moving up the maturity curve brings numerous benefits to an organization, including:

- Better executive decision-making by providing faster access to critical data and deeper insights.

- Accurate information on-demand that’s accessible by management, with financial data updated in real-time for improved accuracy and reliability.

- A comprehensive review of the organization with cleaner and more accessible data.

- Optimized compliance and auditing processes enabling auditors to see source files linked to financial records.

- Greater staff uptime as workers are freed-up to focus on strategic collaboration, financial planning, and organizational performance.

- Reduced burnout, improved morale, and empowered employees, enabling staff to play a more integral role in the firm’s success.

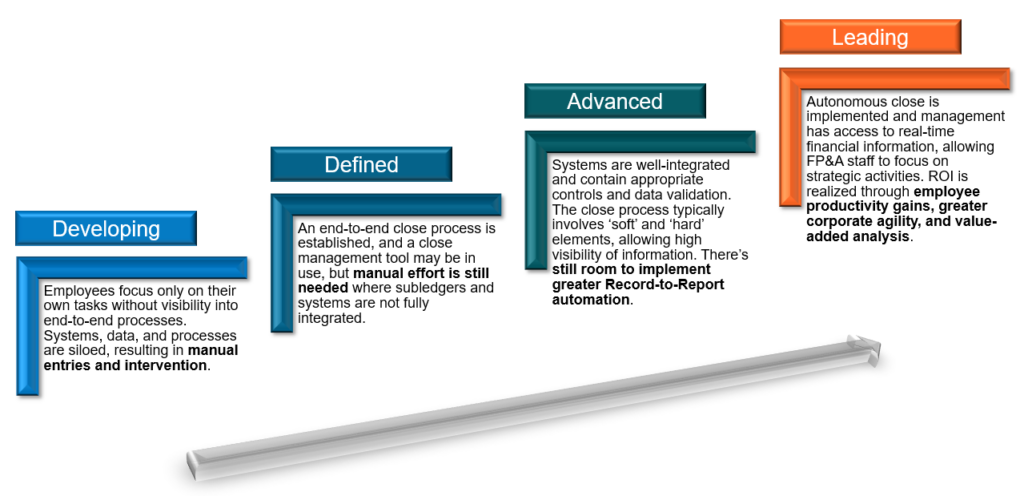

Diagrammed below is a sample close maturity curve with key distinctions and opportunities to be realized by steadily progressing along the curve toward a truly market-leading close function. The average organization can spend years stuck in one stage with no clear action plan to advance further.

Challenges to Achieving an Autonomous Financial Close

Autonomous financial close is not without its challenges. Organizations must overcome resistance to change and spearhead a cultural shift toward forward-thinking problem-solving. Not all companies are equipped to easily communicate a clear vision, align leaders, and generate buy-in.

Common challenges to be on the lookout for include:

- Unclear and undocumented current close processes.

- Over-reliance on tenured employees’ institutional knowledge.

- High costs and complexity associated with implementing new technologies.

- Incompatible legacy systems.

- Unreliable data, lack of data governance, and difficulty disseminating data.

- Lack of training and unclear roles and responsibilities.

- Little knowledge of the tools and technologies that can automate transactions.

Well-defined plans for handling these obstacles should be discussed and established prior to any major change event.

Moving Up the Financial Close Maturity Curve

Moving up the financial close maturity curve offers significant benefits, regardless of an organization’s starting point. The goal is to gain more accurate and timely insights into an organization’s performance while optimizing the usage of its people and technology. Incremental changes, driven by a continuous improvement mindset, are key to reaching the top.

Examples of incremental improvements that can generate substantive gains include:

- Utilizing a close checklist.

- Maximizing the use of existing technology to increase automation.

- Implementing a new tool that improves workflows.

Each organization should assess its current state, evaluate personnel, processes, and technology, and develop a vision for improvement. No matter where an organization is on its close journey, incremental improvements add up to significant benefits and eventually a competitive advantage. Autonomous financial close doesn’t happen overnight – it can take months or years to truly achieve peak maturity. However, there are myriad optimizations to make along the way that deliver tangible value, making the climb worth it.

For expert support with understanding where your organization is on the financial close maturity curve, identifying areas for improvement, creating process optimization plans, and bringing those goals to reality, contact CrossCountry Consulting today.