Is zero-based budgeting (ZBB) just a buzzword, or are your competitors really starting their budgets from scratch every year? How do they find the time?

Though interest in ZBB gains traction in times of crisis – as evidenced by the responses to the financial fallout in the 1970s, 2008, and 2020 – it wanes in stronger economic cycles.

Fast forward to today, and organizations are once more unearthing ZBB as a tried-and-true method for identifying and realizing cost savings in anticipation of another economic downturn. Why?

- It works. It’s a quick way to generate material improvements to earnings before interest, taxes, depreciation, and amortization (EBITDA). Over 40% of surveyed companies using ZBB decreased headcount and cost of good sold (COGS) by greater than 40%. And SG&A budgets can be reduced by 10-25% through ZBB alone.

- But it’s time-consuming – or is at least perceived that way – which deters companies from doing it every year.

So how can companies zero-base to realize savings without disrupting operations? Consider “near” zero.

What Is Near Zero-Based Budgeting?

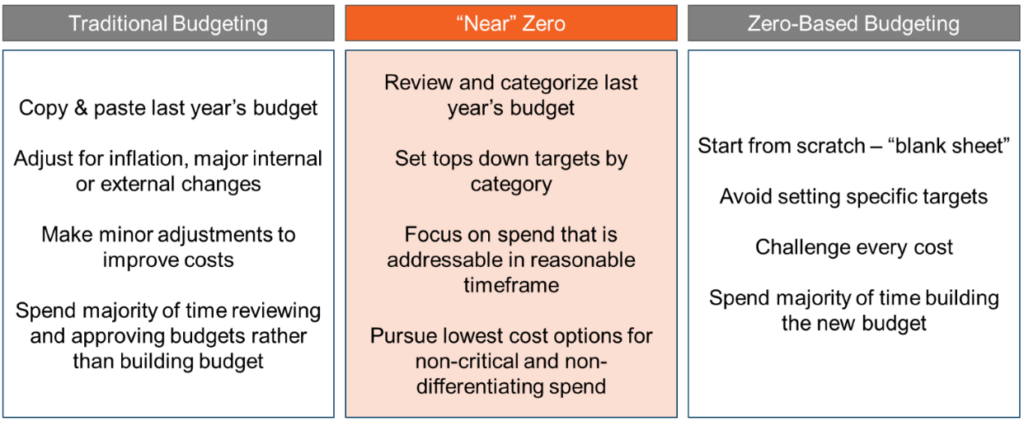

While ZBB challenges finance leads to justify all expenses against a fresh budget starting from zero every period (rather than against last period’s budget), “near” zero-based budgeting (NZBB) can be a more efficient and realistic approach that aims to be less time-intensive, less disruptive, and more flexible than conventional zero-basing.

Ultimately, all costs are designed to contribute to the year’s necessary operations and corporate objectives. ZBB starts from a blank sheet of paper; NZBB safely assumes that some expenses can be carried into a new budget based on the previous year but most rightly require new justification and allocation.

It’s a healthy, productive budgeting methodology that gets companies as close to ZBB as possible without harmful rigidity. Plus, NZBB contains elements of traditional budgeting, which most organizations are comfortable with, serving as a smoother on-ramp to better budgeting practices overall.

As seen in the comparison below, NZBB sits in between traditional and ZBB, making it useful to a wide array of organizations on their journey to healthy planning and budgeting activities.

Near Zero-Based Budgeting in Action

Following a standardized yet configurable approach to NZBB can yield positive results for virtually every business. To reduce spend strategically rather than mechanically, consider the below steps:

First, get clear transparency at the line-item level for spend. Even if you don’t need last year’s budget to start from scratch next year, you’ll never be able to analyze spending if you don’t get data transparency.

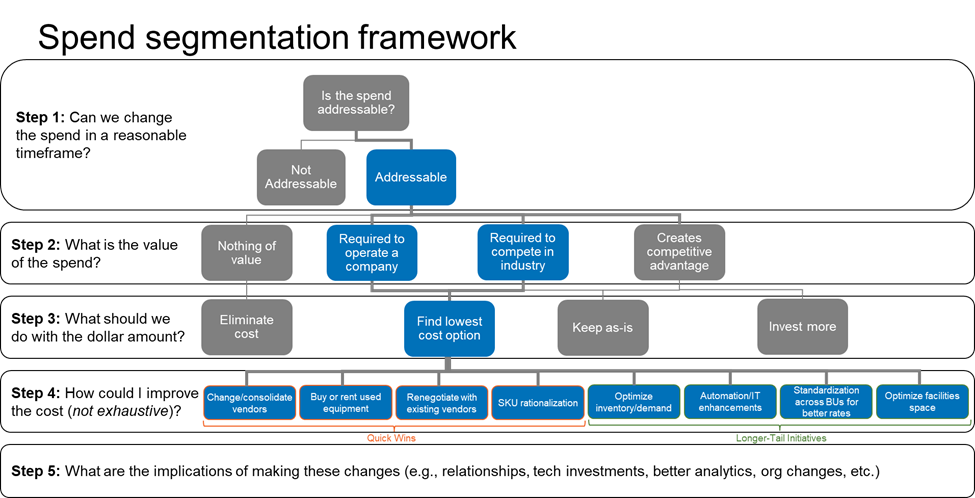

Second, determine what spend is addressable within a reasonable timeframe and focus most of the budgeting time on those items. In the framework below, you can see that it’s important to pursue addressable spend wherever it may exist rather than wasting time on not-addressable spend. And in cases, where the obvious solution is simply to eliminate a given cost, that decision should be made efficiently without undue roadblocks. Ultimately, it’s key to get to a point where the harder more granular cost-improvement decisions can be made strategically before the budget cycle is up.

Third, rigorously pursue the lowest-cost options for addressable items required to operate a company (e.g., Wi-Fi) and the items required to compete in your given industry but that a low-cost alternative won’t destroy value (e.g., logistics company requires trucks but can have more affordable vehicles as long as they are dependable).

Often, there are quick-win solutions to better vendor management. These options can be implemented parallel to longer-tail initiatives that require a heavier lift, like implementing a new automation software or migrating operations to a cheaper facility.

Lastly, don’t mix zero-basing headcount and budgets. Those activities should be separate because they require different approaches. Keep budgeting activities within integrated planning and sales teams, whereas decisions on headcount can sit closer to operations and management teams. The goal of ZBB and NZBB is not to reflexively arrive at layoffs as the sole or most convenient solution every budgeting period. It’s to eliminate wasteful spend primarily in less-essential areas of the business to ensure the budget is always aligned to the strategic vision of the firm.

For expert support improving costs systematically across your business, contact CrossCountry Consulting.