As the ESG metrics revolution ushers in new reporting frameworks, industry-specific benchmarks, and technology solutions, private equity firms face critical challenges, such as:

- A dearth of agreed-upon, comparable ESG data sets within private markets (emerging SEC regulations apply to public organizations).

- Collecting and interpreting ESG metrics, such as board diversity or renewable energy usage, is tedious and inconsistent at best.

- Aggregating ESG metrics across a large group of portfolio companies is challenging as these organizations often have no dedicated ESG resource(s) and/or are still deciding which stakeholders own the ESG function (CFOs, General Counsels, CAOs, ESG Controllers, etc.).

Fortunately, momentum is building to address these pervasive issues, including the adoption of standardized ESG metrics for private equity from which dashboarding tools that ingest, aggregate, and report portfolio-level data insights to limited and general partners (LPs and GPs) can be constructed.

Transparency for ESG Progress

A very worthwhile effort toward standardizing private company ESG data has been organized by the ESG Data Convergence Initiative (EDCI). This group has defined a set of ESG data elements to be collected across portfolio companies, enabling private equity to report and act upon meaningful ESG metrics.

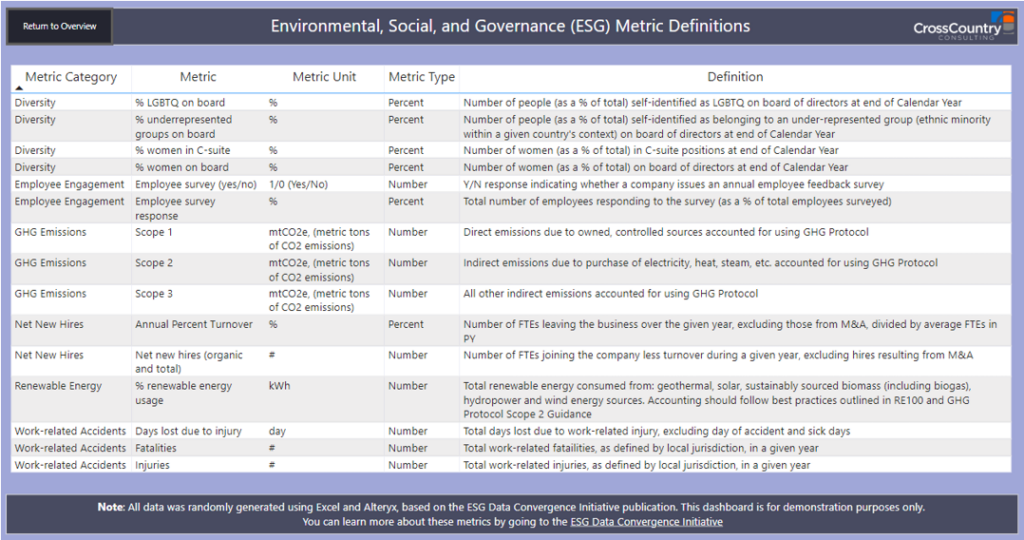

The EDCI is a consortium of more than 260 GPs and LPs holding $25 trillion in assets under management (AUM) across 2,000+ portfolio companies. Data sourced from these members is useful for individual sponsors and is also aggregated across sponsors to create a set of comparison benchmarks. Metrics included in the EDCI initiative include:

- Work-related accidents.

- Employee engagement.

- Renewable energy.

- Greenhouse gas emissions.

- Demographics (age, gender, sex, and racial representation).

Below is an example of CrossCountry Consulting’s ESG experts generating sample datasets based on EDCI principles. Metric categories are customized to the unique needs of individual sponsors.

Private Equity ESG Data Comes to Life

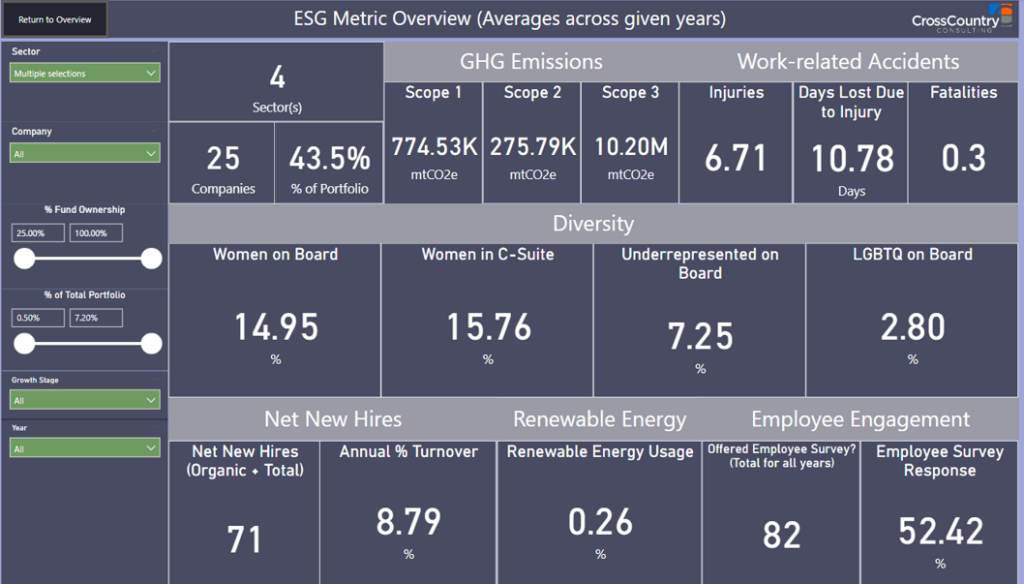

As raw data is converted and compiled into visual insights, sponsors gain access to real-time, scalable analytics across their entire portfolios, including key metrics shown below:

Depending on the audience or sponsor, viewers can further slice the data to take a more nuanced view of a specific metric. With this level of data on hand, sponsors can fulfill their ESG goals and meet the growing demand for greater private equity reporting and visibility into ESG.

Why now?

Harvard Business Review cited three motivating factors responsible for private equity’s swing toward ESG in recent years:

- Large asset owners, like pension and sovereign wealth funds, are placing increasing emphasis on ESG, specifically climate change.

- ESG-influenced investment decisions can enable LPs and GPs to outperform public markets and continue delivering adequate returns to investors.

- The inevitable interconnectivity of private equity to consumer opinion, public markets, and regulation. If investors and regulators are valuing ESG over a long time horizon, private equity must appropriately move in concert with these forces. Those faster to act can define value in new terms beyond just returns.

Private equity’s ESG vision is already prompting new markets for dedicated ESG software or expanded applications of existing risk management or financial reporting tools. LPs and GPs don’t need to wait for new technology solutions to emerge; clean, accessible, automated ESG portfolio insights based on portfolio company-level disclosed data are already here.

For expert technical and strategic ESG support, contact CrossCountry Consulting today.