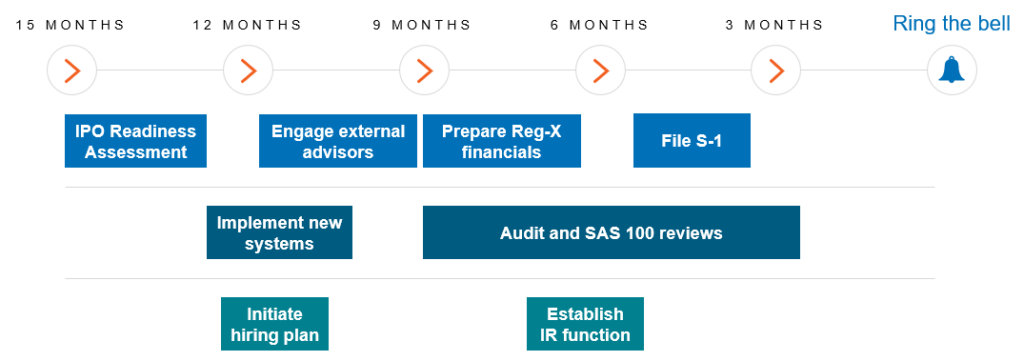

As current market conditions present volatility and uncertainty, companies are increasingly viewing now as the time to prepare for entry into the public markets in 2025 and beyond. While an IPO may be more than a year away, various workstreams and activities can be started in the short term to help successfully execute a public offering and establish good corporate hygiene.

What are these activities? When should companies begin? How can they get started?

Below we discuss a selection of the more time-intensive activities, which can enable companies to evaluate where they currently are on the IPO readiness timeline and begin their journey to operating as a public company.

IPO Timeline and Activities

1. IPO Planning

- IPO readiness assessment: A comprehensive readiness assessment provides a tailored roadmap that bridges a company’s current state of operations to an operating model that will enable the company to perform effectively as a public company. The assessment also can facilitate internal discussion with the Board of Directors, Audit Committee, and executive team with the goal of aligning the company’s priorities ahead of a public company listing.

- Engage third-party advisors: A company pursuing an IPO will need to engage a variety of new advisors and third parties to successfully execute the transaction. These can include accounting advisors, SEC counsel, investor relations firms, underwriters, HR and compensation consultants, and valuation and tax specialists. Determining suitable advisors for your company prior to kicking off the IPO process can enable a more efficient transaction and provide time for the company to do an appropriate level of due diligence.

2. Preparing to Operate as a Public Registrant

- Mature finance and accounting functionality: Front and center in the IPO journey is the capability and functionality of the accounting and finance departments. The right teams and technologies provide a strong foundation for launching as a public company. The ability to adhere to GAAP/IFRS standards and ensure accurate and transparent financial reporting is only the tip of the iceberg. Companies should have an understanding of capital markets and experience structuring capital through equity and debt financing. Additionally, ensure finance and accounting teams can effectively communicate financial performance and deliver during quarterly earnings calls and investor presentations. Critical considerations include teams’ ability to:

- Close the books on time.

- Leverage controlled processes, systems, and automation.

- Optimize tax strategies.

- Establish robust treasury and cash management procedures.

- Modernize and future-proof IT: IT is the IPO backbone. Focusing on strategic upgrades to your infrastructure ensures that it’s scalable, secure, and ready for the spotlight of public company life. Prioritizing projects crucial for IPO compliance and future growth is key, such as the implementation of a scalable ERP system that grows with your company and supports your global ambitions. Other critical systems to prioritize are platforms that accelerate FP&A capabilities, revenue recognition, CRM, and efficient financial management. Lastly, fortify defenses against heightened threats and public scrutiny with a cybersecurity platform that can help prevent negative impacts on shareholder value. By shedding legacy tech and embracing data, analytics, and automation, companies can more realistically meet regulatory rigor and enhance value.

- Evaluate SOX preparedness: While smaller reporting companies and emerging-growth organizations have some accommodations with regard to SOX compliance, it’s still essential that internal control standards be made more robust, particularly as they relate to compliance requirements for Internal Controls Over Financial Reporting (ICFR). As a first step, conducting a SOX risk assessment and scoping exercise can ensure key processes and systems are identified and documented. This strategic planning exercise focuses the company on the most significant and critical processes supporting financial reporting. Once key processes are identified, assess the state of internal controls and remediate control gaps where necessary. Starting with common high-risk processes, such as Revenue, Financial Reporting, and IT General Controls, is a good place to start. Delaying improvements to a company’s internal control environment can increase the risk of a material control weakness.

Deliver value in the deal and beyond with expert IPO filing and advisory solutions

Generate and protect a profitable public company state with a methodology focused on your organization’s critical financial, operational, and technology-related functions.

- Elevate human capital capabilities: Often overlooked is the pivotal role HR plays in an IPO and the criticality of aligning human capital strategies with the company’s overall goals for sustained success post-IPO. Increased compliance requirements, such as compensation disclosures and pay transparency, and the demand for diversity metrics necessitate a proactive approach during the IPO planning phase. Companies may need to design and develop the administrative muscle around executive, equity, and broad-based employee compensation plans, ensuring a harmonized approach that meets diverse compliance requirements while maintaining global consistency. Having a holistic view of the human capital lifecycle will ensure the company is set up for the increased scrutiny of shareholders and analysts in the public market.

3. Successfully Launch as a Public Company

- Prepare Regulation S-X financial statements: Upgraded financial statements that meet the Regulation S-X disclosure requirements will be needed for any prospective S-1 filing. CFOs and Controllers may want to consider whether upgraded statements should be prepared in conjunction with their current-year audit to facilitate inclusion in a future S-1 filing. This approach limits the “uplift” and additional audit work that may be required on the financial statements when the S-1 registration statement is being prepared.

- Hire critical talent: A private company will typically need to build out teams and functions to meet its strategic growth plan along with the demands and governance requirements of a public company. Additionally, identifying and recruiting the right BOD will be a critical component to how the company is viewed by the public. By assessing current staff and competency levels versus a public company environment, leaders can provide sufficient runway to complete their hiring plan and onboard employees ahead of the IPO.

Featured Insight

- Complete audit and SAS 100 reviews: Private companies under an AICPA audit opinion should liaise with their external auditors to determine when a PCAOB audit is appropriate for their current circumstances and future IPO plans. Additionally, companies should discuss with their external auditor the timing of interim SAS 100 procedures over their quarterly financial information. The periods to be included in a prospective S-1 filing will inform the company on which quarters may be subject to SAS 100 procedures.

- Establish strong internal communications channels: IPOs can be a period of immense change in which a proactive communications strategy is key to engaging internal and external talent. Reassuring cultural tenets and explaining how the IPO will impact jobs, benefits, and the opportunities implicit in stock ownership will be top of mind. Having a communications staff, plan, and training program will enable the company to best engage with its people.

On the IPO journey, at no point should you be standing on the sidelines waiting for markets to play out. Due to the variety of organizational and regulatory activities required over the course of more than a year, starting the journey now can ensure optimal IPO readiness when the day does finally come.

For expert IPO readiness support, contact CrossCountry Consulting today.