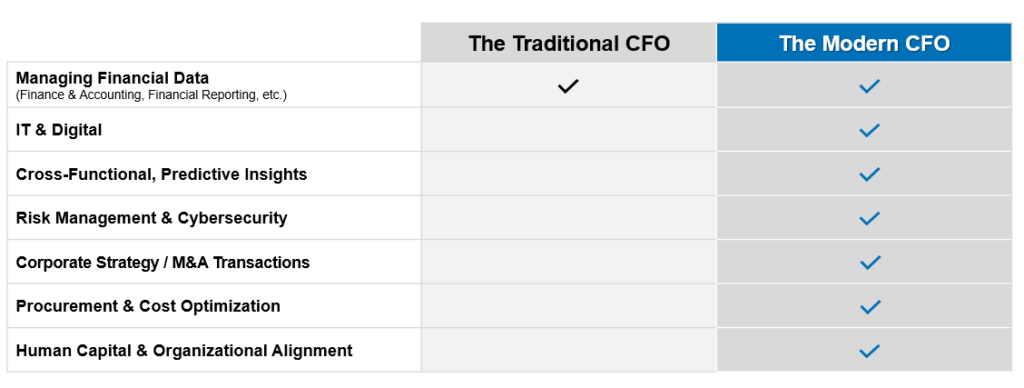

The game has changed for CFOs. The traditional way of running a Finance organization is not going to work in 2025. In fact, 66% of CFOs say they need to rewrite the organizational playbook to remain competitive. Why?

The role of the CFO is expanding beyond FP&A and Accounting into a cross-enterprise role. 43% of CFOs are leading enterprise strategy and transformation initiatives. And the CFO is often leading Procurement and IT/Data teams – or at least has oversight of the key decision-maker for respective departments. This all comes in parallel to the traditional CFO roles of managing the company’s investments, balancing risk, and leading M&A activity. Doing all of this in an uncertain economic climate, and it’s a lot for the CFO and his/her leadership team.

At the same time, most CFOs (59%) say that cost reduction is currently their top strategic priority. But CFOs must balance cost improvement with investments in value creation given board and competitive pressure to adopt generative AI and ESG and avoid putting the company at risk. So how can today’s CFOs thread the needle?

Consider zero-basing the structure of the company.

What Is a Zero-Based Organizational Structure?

The term “zero-base” traditionally applies to budgeting and managing third-party spend – often abbreviated as “ZBB.” It’s a great tactic to generate material EBITDA improvement. However, CFOs can extrapolate on this concept and leverage it across the enterprise to achieve similar, compounding results.

To apply ZBB to building a zero-based organization structure, you simply take a blank sheet of paper and start from scratch. Forget about what roles and key personnel you have today; draw the structure that you need to win based on company strategy and priorities, how transactional tasks could best be completed, and where technology could make efficiency gains. You’ll be amazed how different the new drawing will look versus your current structure.

Benefits of Zero-Based Organizational Design

- Lower cost: Companies adopting ZBB report up to 25% SG&A improvement. CrossCountry Consulting’s teams have seen similar, and sometimes greater, results by applying ZBB to organizational design. Median Finance organizations are 1% of revenue today – tomorrow they could be even leaner, or work can be more balanced in favor of value-driving FP&A and BI.

- Faster output: Blank-sheet organizations usually have fewer management layers, allowing teams to move with higher velocity.

- Higher integration: Newer structures blur the lines between different departments. Instead, workflows and responsibilities are tailored around end-to-end processes, not traditional job specs and hierarchical structures, which enables greater cross-functional collaboration and communication.

Approach to Building a Zero-Based Finance Organization Structure

- Start with strategy: Be clear about the company’s enterprise strategy and what type of structure will best support that vision. For example, if the company is in high-growth mode and may be acquisitive, invest in FP&A to proactively identify and evaluate growth targets.

- Know what core vs non-core is: Talk to key leaders about what their employees are doing day-to-day. Understand what you really need to do versus tasks that are nice to have. Design a structure that focuses on core activities, automates transactional activities, and eliminates wasteful activity.

- Let data inform but not become your path: Benchmark your costs and headcount against industry peers and assess the number of management spans and layers. Use these data points to inform your new organization size and structure, but don’t let those numbers become the answer. Every company is different.

- Take a blank sheet and draw your new organization: It’s time to take a pencil and draw your new value-focused structure (boxes and wires) bottom-up. Start unconstrained with what could be (art of the possible) then seek cross-functional input from IT, Procurement, Businesses/Operations, etc. and iterate until you get it right.

- Don’t forget about process: Your new structure only works if you optimize the processes, people, technology, and data around the structure – otherwise you’re just doing the same work with different or fewer people in different roles.

What Types of Finance Organizations Are Going to Win in 2025?

Be bold. Go big with your new structure. To join the modern CFO community with leading practices, here are the attributes to fuel progress:

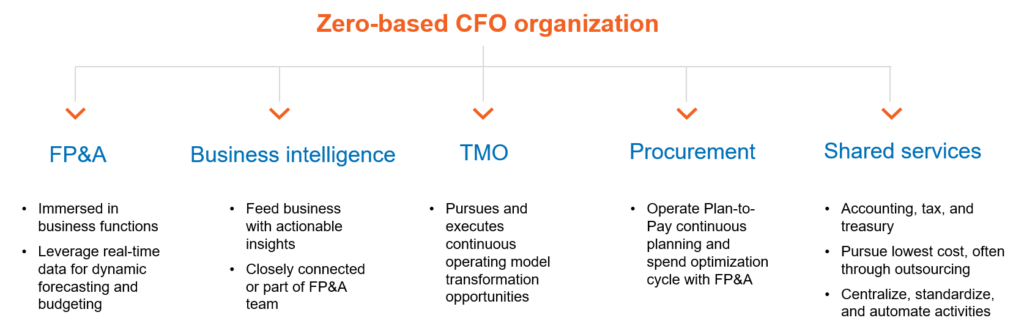

- Speedy, data-driven FP&A: Separate strategic from corporate FP&A activities. Strategic FP&A contains embedded data and analytics personnel and capabilities and is immersed in the business units or functions it serves. The team is powered by a modern reporting and analytics framework.

- Plan-to-Pay FP&A-Procurement integration: Closely integrate Procurement with FP&A to build a coordinated financial plan and budget that drive spending decisions throughout the year. Sourcing-related savings should tie back to the financial budget to enable immediate cash flow savings and allow dynamic budgeting.

- Transformation Management Office: CFOs increasingly are responsible for enterprise transformation and should have a business transformation arm in their organization. This team is responsible for continuously prioritizing and executing operating model improvements, operating in an agile way to maximize velocity. Done right, this function is a weapon that can be applied across function and process, allowing Finance to serve as the steward for change across SG&A.

- Low-cost automation-powered shared services: Functions like Accounts Payable, General Accounting, Payroll, Tax, and Treasury can be highly automated if companies invest in data integration tools. Remaining tasks that require human touch should be pooled in low-cost centralized service locations. It’s important to incentivize management of these functions to find the gains and dive roadmap to efficiency.

As the company’s zero-based transformation lead, the CFO must architect change starting with Finance and then carry those practices and designs outward to other functions. To get started on a strategy zero-based org structure roadmap, contact CrossCountry Consulting.