2021 was an outlier year for FinTech companies, which saw financing deals exceed $140 billion – a truly historic number. To put that in perspective, that was more than triple the level of financing that occurred in 2020.

Also occurring in 2021, 39 FinTechs went public on U.S. exchanges, with countless more entering the markets via a SPAC transaction.

Hundreds if not thousands of other earlier-stage FinTechs are thinking about following a similar path to the public markets in the coming years. With these trends in mind, our FinTech team has highlighted several key challenges that must be overcome to ensure companies are ready to operate as public entities.

1. Acquiring and Investing in the Right IPO Talent

Newly hired CFOs at FinTechs are finding they inherit accounting teams with limited technical IPO and SEC knowledge. Trying to find the right talent remains one of the most important tasks for any company; however, it is increasingly difficult for FinTechs given that the industry is a relatively new field. As such, finding people with the necessary experience or skillsets continues to be a challenge.

This is a pain point exemplified by a 2021 survey from CrossCountry Consulting which found that acquiring and retaining the right IPO talent is the biggest challenge facing companies in their pursuit of going public.

Limited resources, insufficient public company experience, and an inability to retain key staff during a talent war considerably impede the IPO process. These factors also make it impossible for FinTechs to satisfy subsequent reporting obligations.

It’s imperative that companies on the pre-IPO journey have the necessary expertise in technical accounting and SEC reporting. Therefore, your company will want an internal team and third-party advisors that bring a diverse set of skills along with the necessary knowledge to enable your team to hit critical timelines and milestones.

Some of these functions include:

- CFO.

- Controller and Assistant Controller.

- Project Manager.

- Accounting Policy & SEC Reporting.

- FP&A.

- Internal Audit.

- Compliance.

- Tax.

- Investor Relations.

- SEC Counsel.

- Accounting Advisors.

- Underwriters.

- Underwriters Counsel.

- External Auditor.

- Financial Printer.

2. Integrating the Tech Stack to Fuel Scalable Growth

Most, if not all, FinTech companies have proprietary technology at the core of their business. But in most cases, these systems haven’t been fully integrated with backend systems such as an ERP, FP&A tool, or even a reporting tool.

A FinTech company’s focus is on developing the market-facing elements of their product to drive client adoption and revenue. While this makes perfect sense, it leaves the backend accounting and finance processes neglected, which translates to Excel-intensive manual processes that do not scale. Although this may be sustainable early on in a company’s life, it soon becomes untenable when transactions, headcount, and new obligations balloon. It also adds significant risk and control issues for a company approaching an IPO.

To overcome these challenges, consider:

- Dedicating development team resources to focus on backend integration.

- Investing in automation tools to alleviate manual effort.

- Implementing an ERP system that provides the data necessary for any new financial reporting requirements.

Pre-IPO, your company should begin to conduct a detailed assessment of all business requirements for the new environment and identify key areas for improvement. Incorporating a tech stack within your organization enables more optimization, discussed further below.

3. Creating a Clean Data Infrastructure to Power Impactful Insights

Investors rely on several key metrics, such as revenue growth, customer growth rates, and customer acquisition rates, when evaluating a firm’s valuation. For a firm to attain a fair valuation during IPO, its business leaders should define and monitor these metrics closely throughout the various phases from funding to pre-IPO.

To achieve this, firms should embrace a well-designed data lifecycle by turning data silos into meaningful information to provide an edge over competitors.

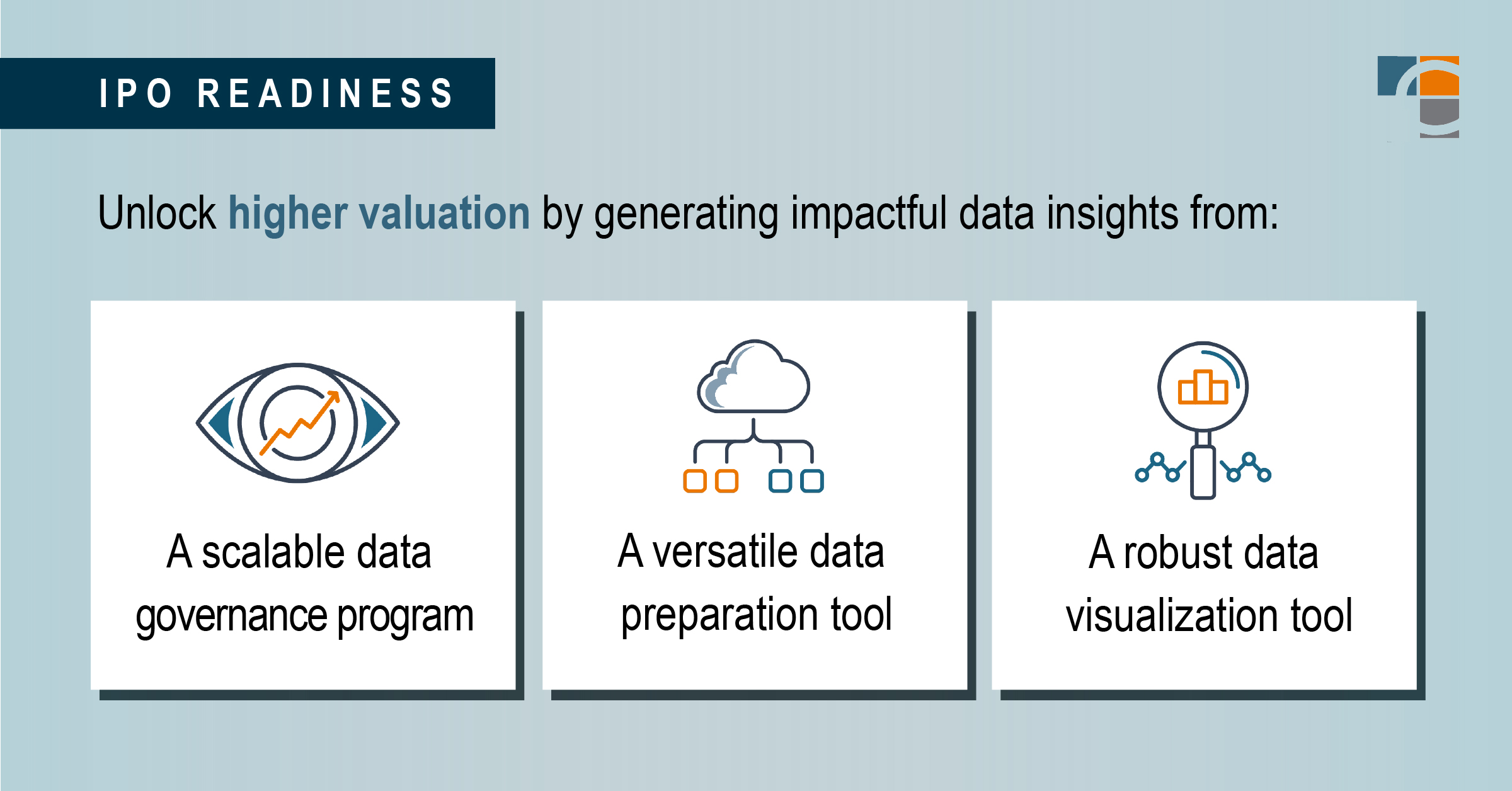

Below is a summary of the steps to help your firm unlock a higher valuation through impactful data insights:

Data Governance

Data integrity is critical for business leaders to trust the data insights received and to make critical business decisions. A lack of controls around a company’s data infrastructure will eventually harm your company’s valuation.

By ensuring good data quality, a scalable data governance program should be a key component of a company’s long-term growth strategy. Using a data catalogs platform (e.g., Collibra) to build out a data governance structure will help a firm track and investigate all aspects of data (e.g., data lineage and data quality) that is generated by the company’s systems.

Data Preparation

A FinTech’s technology stack could generate terabytes of data per day with the company’s proprietary technology working in cohesion with several other data platforms. One can view the data flow from each of these sources as analogous to the flow of oil through a pipeline. Your company’s data pipeline must optimize the ETL (Extract, Transform, and Load) or ETL process, which prepares data for reporting.

A versatile data preparation tool (e.g., Alteryx) will not only allow data loading and data extraction from several different data sources, but it will also build a robust data cleansing and transformation functionality. In addition to traditional ETL, these platforms offer excellent forecasting capabilities which can be used by FP&A teams to forecast growth and revenue.

Data Visualization

A timely insight into your firm’s financial performance and customer interactions will be key to outpacing competitors.

Market-leading data visualization tools (e.g., Tableau and Power BI) enable users to customize reports or dashboards to suit business needs, and they can be updated within seconds. Users across the firm can further use filters and drill-downs to perform deep dives into the information and tweak their marketing strategy, product line investments, and customer retention strategy accordingly.

Strong data governance and infrastructure coupled with an automated close process can greatly reduce dependence on manual, human-led processes, thereby reducing downtime, cost, and errors. Human capital can then spend time analyzing the rich data insights and setting up the company for success.

Lastly, the byproduct of architecting this robust structure will also generate accurate, complete data for regulatory reporting, which helps to avert costly remediations, fines, and/or reputation risks.

4. Defining a Transition Plan to Convert Current-State Accounting and Financial Reporting to Required Future State

As required by regulatory/SEC guidelines, the accounting and finance function must be transformed in the pursuit of IPO readiness and ongoing compliance. This change may not come naturally to all FinTechs and can require significant resources due to several reasons mentioned above (scarcity of talent, inexpertise, and beginning too late).

Key areas that your company can start to think about pre-IPO include:

Compiling SEC- and US GAAP-Compliant Historical Financial Statements and Disclosures

A new audit or re-audit may be necessary, which can be both resource- and time-consuming.

Enhanced disclosure requirements such as MD&A, fair value of investments, and segment reporting will become a new reality when public, so you should become accustomed to these requirements and commit resources to collecting the necessary data that will be needed.

Implementing Complex Accounting Standards

Implementing accounting standards for the first time can drastically alter the presentation of your company’s financial position and results of operations. Examples of this include consolidation, derivatives and hedging, fair value of investments, and share-based compensation.

Accounting considerations could also require changes to business practices and contracts (i.e., adoption of ASC 606/ASC 842). One other area that is expected to be addressed by the SEC in the near future is the accounting rules for digital assets.

It’s critical that you have an accounting team who can devote the appropriate level of time and resources, as it will minimize comment letters or restatements from the SEC.

Complying With Ongoing Public Company Financial Reporting Obligations (e.g., 10-Q and 10-K filings)

As mentioned before, limited staff or external support is a serious obstacle to the IPO process. FinTechs will likely need a strategic partner with significant expertise in satisfying reporting obligations post-IPO.

Complying With Sarbanes-Oxley (SOX)

A system around disclosure controls and procedures to ensure information is accurately reported and disclosed within the SEC reports you file is imperative.

Under SEC rules, a newly public company must comply with certification requirements under SOX 404 when it files its second annual report. While the rules provide a brief “grace period,” your underwriters and investors may expect controls to be substantially in place prior to the IPO.

SOX implementation will span your entire company, meaning dedicated resources who possess the relevant expertise are required.

Establishment of an Internal Audit Function

An internal audit function provides management and the audit committee with ongoing assessments of the company’s risk management processes and systems of internal control. Most FinTech compliance audits will include BSA/AML/OFAC, fraud, consumer regulatory compliance, and privacy.

A Strategic IPO Partner for FinTechs

At CrossCountry Consulting, we understand that an IPO is a transformation, and we stand ready to provide you with the full unbiased benefit of our capital markets experience, technical accounting knowledge, tools, and methodologies with cross-functional expertise in the areas of IPOs, financial reporting, investor relations, corporate governance, risk, compliance and internal controls, and project management.

For expert support on your IPO journey, contact CrossCountry Consulting.