You might be surprised to learn that your organization has implemented AI in more ways than is often recognized. Think about Optical Character Recognition (OCR) for document processing or even basic chatbots for customer service. However, the true power of AI lies in its ability to integrate with your core financial systems and unlock a new era of intelligent automation and predictive capabilities.

For organizations making incremental progress on their AI journey, accelerating AI maturity is a matter of digging a little deeper into existing finance workflows and fully utilizing the tools in your tech stack.

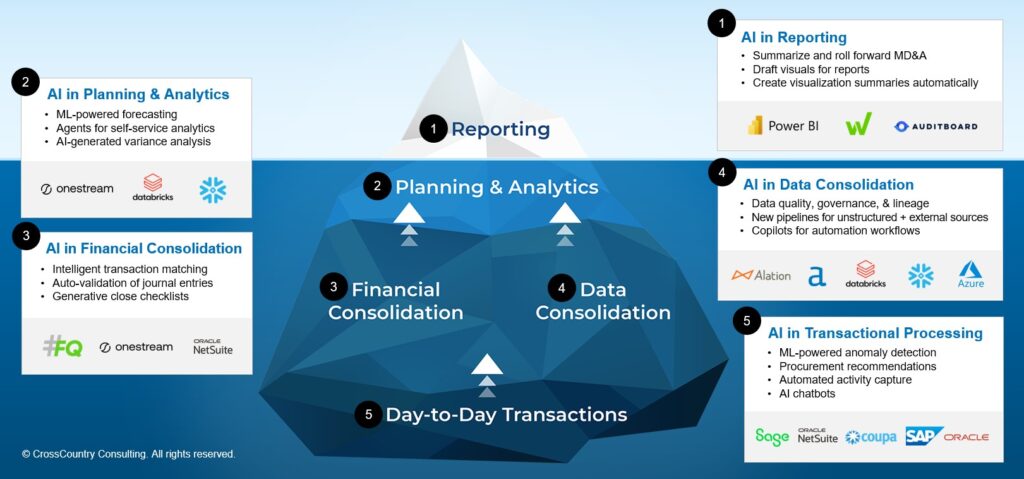

As visualized in our proprietary AI-driven reporting and analytics framework, let’s explore five areas of finance with the most opportunity for AI and how leading organizations are maximizing operational efficiencies in the process.

1. AI in Financial, Risk, and ESG Reporting

It’s estimated that nearly 20% of organizations are using GenAI in financial reporting – but that number is expected to climb to 95% in the next three years, underscoring the speed of adoption and universal use cases of AI in finance. These trends extend into other areas of the business for which finance now commonly has oversight, including risk, audit, cyber, and ESG.

- Summarize and roll forward Management Discussion & Analysis (MD&A) for subsequent period through comparative analysis, automating the population of recurring sections, and drafting initial forward-looking statements.

- Draft narratives, policies, procedures, disclosures, risk statements, and other key documents and descriptions.

- Identify key factors that influence a chosen metric, highlight trends, isolate outliers, and enable further drill-down and root cause analysis.

- Generate quick data-driven visuals and points of emphasis for reports.

- Create visualization summaries automatically that align to executive/board business drivers.

- Ask questions in plain English with natural language processing (NLP) and receive instant, visual answers.

Real-world example: In what previously took days to complete, KFC Australia now generates and delivers reports in just 20 seconds while at the same time cutting database operation costs by 70% through AI data analytics.

Expert recommendation: AI is not a standalone initiative. It must be embedded into existing frameworks and ideally through integrated reporting tools that offer cross-enterprise value rather than siloed benefits to an individual business function.

Helpful tools: Power BI, Workiva, AuditBoard

2. AI in Financial Planning & Analysis (FP&A) and Corporate Performance Management (CPM)

Today’s AI-forward teams are connecting enterprise data and integrating planning processes for serious efficiencies and savings. This includes 86% faster planning processes and 30% higher forecast accuracy.

- Machine learning (ML) to analyze vast datasets, identify complex patterns, and generate more accurate and granular forecasts compared to traditional methods. This may include techniques such as driver-based analysis, variance analysis, time series analysis, scenario planning and simulation, demand forecasting, and anomaly detection.

- Agents for self-service analytics to empower business users without deep technical skills to perform bespoke analysis of respective data.

- Guided analysis and data exploration that helpfully navigates users through analytical workflows with easy-to-use prompts, actions, and visualizations, which can surface relationships between data points and insights they may have been otherwise unable to achieve.

- Rapid insights and impacts on COGS, EBITDA, liquidity, and other key financial performance metrics. Built-in AI-enabled CPM workflows and insights often come out of the box versus legacy systems that may only have AI bolted on or that require another integration or implementation. OneStream’s Sensible AI, for instance, is a suite of purpose-built AI solutions that includes ML/AI models built directly on top of OneStream’s unified data model and proprietary financial intelligence.

Real-world example: Utility locating service Stake Center leveraged AI to generate 20% greater forecast accuracy and 50% faster close time, saving millions annually.

Expert recommendation: Prioritize ROI-friendly solutions and avoid over-complication. Too often, organizations swing for the fences and start too big too soon with expensive vendors and tools. Successful AI adoption is best accomplished through targeted pilot programs – the lessons learned and value gained from this experience can then inform subsequent, larger initiatives to ensure ROI is achievable and the organization is capable of handling the disruption caused by a transformation of this kind.

Helpful tools: OneStream, Databricks, Snowflake, Trullion, Klarity

3. AI in Financial Consolidation

Gathering, mapping, and preparing repetitive financial statements is ground zero for AI value. Recent reports suggest that close cycles in particular can be completed 15–100X faster with the use of AI-powered automation tools.

- Intelligent transaction matching that learns from historical matching patterns and user-defined rules to automatically match transactions from various sources (e.g., intercompany invoices, bank statements, sub-ledgers). AI can also identify minor variations and risks that would be difficult to spot manually.

- Auto-validation of journal entries, including auto-compliance with company policies, reasonableness tests, and flags on entries that deviate from norms.

- Generative close checklists that are dynamically created based on the entities being consolidated, their complexity, regulatory requirements, and historical close performance. This process can help maintain forward progress, remediate issues proactively, and provide automated updates to key stakeholders along the way.

- Enhanced audit traceability to meticulously track all data changes, eliminations, adjustments, and approvals within the consolidation process, creating a more robust and transparent audit trail. It can also automatically map financial data to regulatory requirements (GAAP, IFRS) to ensure compliance.

Real-world example: Costco deployed AI to unify financial results, P&Ls, forecasts, and variance commentary, which enabled the company to reallocate 25% of FTE time to higher-value work and eliminate more than 90 Excel spreadsheets.

Expert recommendation: Use what you already have. AI is now embedded into virtually all major SaaS products in some form, especially for workflow automation and faster analytics. It’s likely the case that common cloud-based ERP, finance, and accounting software solutions already implemented in the Office of the CFO (OCFO) are being underutilized with respect to newer AI functionality. Exploring the latest AI upgrades to existing software with internal teams and vendor reps is a great way to make continued incremental AI progress without requiring a lot of time, cost, or disruption.

Helpful tools: FloQast, OneStream

4. AI in Data Consolidation

In the next three years, it’s projected that the fragmented data management software market will collapse into a single unified market enabled by GenAI and augmented data management architectures. This underscores the transition toward AI enablement and the future CFOs and CIOs can expect when formulating their data consolidation strategies.

- With AI data observability capabilities, the AI automatically detects anomalies, identifies root causes of data quality issues, and even suggests remediation steps, which drives policy enforcement and compliance.

- AI, especially NLP and computer vision, is being used to build intelligent pipelines that extract valuable information from unstructured data sources (e.g., documents, emails, social media) and external sources (e.g., market data, news feeds) for consolidation.

- Copilots for automating complex tasks within ETL/ELT pipelines, executing desired workflows, and providing context-aware recommendations.

- ML that facilitates the automatic mapping of data fields and the alignment of schemas from disparate systems, significantly reducing manual effort.

- Automated cleaning and preparation in which AI algorithms identify and rectify inconsistencies, errors, and duplicate entries across diverse data sources.

Real-world example: Entertainment data provider Luminate achieved 334% faster daily data processing through a scalable data lake architecture and AI/ML that extracts richer insights.

Expert recommendation: If you can’t produce BI, don’t focus on AI. As much as 70% of developing a usable AI solution is spent wrangling and harnessing data. By already having a well-designed infrastructure and high-quality data structure, it makes generating and scaling AI outcomes significantly more achievable.

Helpful tools: Alation, Alteryx, Databricks, Snowflake, Azure

Explore strategic Finance solutions that solve real-world problems

Harness the power of data-based analytics, discover hidden AI insights, and drive enterprise value creation from the OCFO.

5. AI in Transactional Processing

AI’s ability to analyze transactional data in real time to establish baseline behavior and identify deviations is helping flag fraud, errors, or other suspicious activities. That’s why 71% of banks now turn to AI to prevent and recover from payments fraud.

- AI-powered anomaly detection across thousands of data points per transaction, which can then adapt to normal user behavior and catch anomalies as they occur. Over time, this process helps reduce false positives and can proactively identify high-risk accounts.

- Procurement recommendations, including finding the most suitable supplier based on select criteria, analyzing internal/external news to predict supply chain disruptions, and identifying cost optimizations such as bulk discounts or better contract terms.

- Automated activity capture through a combination of OCR and intelligent document processing (IDP) for contract analysis, invoice processing, receipt management, and transaction monitoring.

- AI chatbots to guide users and customers through simple transactions, communicate FAQ answers, update account information, and augment customer-facing employees.

Real-world example: Coupa reduced time spent on manual data extraction and contract reviews 85% by leveraging an NLP revenue recognition tool.

Expert recommendation: Automated, connected data brings the entire enterprise together and unlocks faster, more informed decision-making. The sheer volume of transactions across departments and the number of systems and data sources in play require effective controls and process efficiencies that AI is perfectly suited to assist with. Invoice and expense report processing, data entry, fraud checks, payment verification, and other traditionally manual, repetitive tasks are the tip of the spear for AI in finance.

Helpful tools: Sage, NetSuite, Coupa, SAP, Oracle

Ready to deliver on the promise of AI within your finance function? Contact CrossCountry Consulting today.