As firms strive to grow Assets Under Management (AUM) without a proportional increase in headcount, the relationship and value received from their third-party administrator (TPA) becomes a key consideration for future growth.

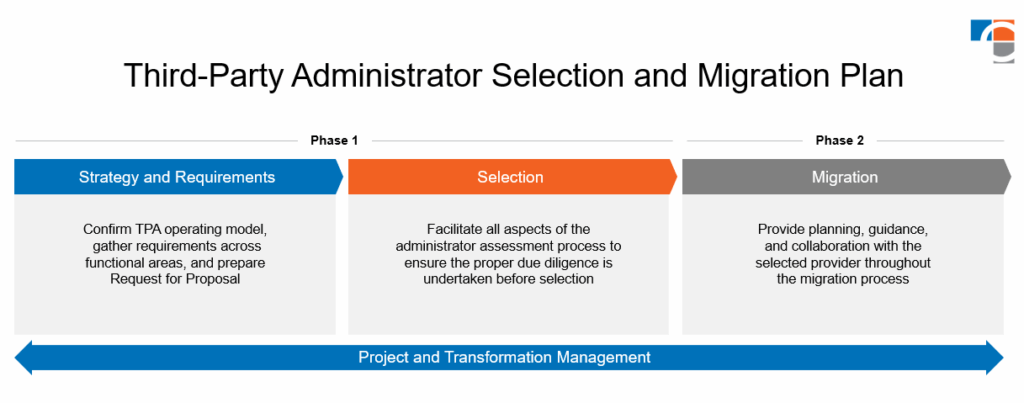

Many firms are reassessing their current TPA relationships against potential alternate providers. It’s imperative that firms approach this assessment strategically, considering a selection and migration process. Key considerations to keep top of mind are included below.

Key Trends and Challenges with TPAs

The TPA technology landscape is undergoing significant evolution, driven by several key trends:

- Focus on integration and interoperability: Seamless integration between the TPA’s systems and the asset manager’s internal technology infrastructure is make or break, as everyone wants access to their data. This ensures efficient data flow, reduces reconciliation efforts that can slow financial reporting cycles, and provides a holistic view of operations.

- Focus on data and analytics: Asset managers require TPAs that can provide robust data analytics capabilities, offering deeper, context-aware insights into fund performance, investor behavior, and operational efficiency. This includes completing or assisting managers with standard compliance reporting, such as Form ADV or Form PF, through automated reporting engines.

- Increased demand for automation: Asset managers expect greater automation in core operational processes handled by TPAs to enhance efficiency, reduce manual errors, and lower costs. In addition to core fund accounting, asset managers are seeking automated and AI-enabled solutions to streamline issuing quarterly Partner Capital Statements (PCAP) and the processing and dissemination of Capital Calls and Distributions.

- AI innovation: To maximize the cost benefit of the relationship, many firms are looking for partners who are using automation and GenAI to increase accuracy and reduce manual reconciliation efforts. Intelligent document processing (IDP) – through the combined power of optical character recognition (OCR), natural language processing (NLP), and computer vision – enhances data extraction, source linking, and auditability. AI can also support anomaly detection, report generation, and more.

- Cybersecurity and data privacy: With increasing cyber threats and stringent data privacy regulations, asset managers are prioritizing TPAs with robust security protocols and data protection measures.

These trends present both opportunities and challenges. While TPAs have scaled with automation and intelligence tools, selecting the right provider requires a formal and deliberate evaluation approach.

TPAs in the Market

There’s a rich market of TPAs, each with its own strengths and focus areas. These providers can broadly be categorized as:

- End-to-end providers: These comprehensive providers offer a wide array of functionalities, covering core administration tasks, investor relations, accounting, reporting, treasury, and compliance. They aim to provide a unified platform for managing fund operations across all strategies.

- Specialized providers: Some providers choose to focus on specific fund strategies (e.g., PE, Credit) or client size based on AUM (e.g., <$10B). Asset managers might benefit from a more specialized approach these providers offer and consider their solutions to complement existing TPA arrangements or address specific pain points.

To recoup the investment, asset managers must thoroughly research the market and identify providers that align with their specific needs and operational model.

Selecting the Right TPA

TPA selection involves assessing the overall service model, operational capabilities, and the underlying technology platforms. For a systematic evaluation of potential providers and alignment with the asset manager’s long-term goals, consider the following:

- Defining business and technology requirements: Clearly articulate the firm’s strategic objectives, operational needs, service needs, and specific technology requirements. This includes identifying critical capabilities the TPA must deliver, such as data accessibility, timely reporting, and integrations through their technology platform.

- Developing a Request for Proposal (RFP): Create a tailored RFP that captures both functional and service-level requirements. The RFP template is a vital tool for ensuring potential providers submit their proposals in a way that allows for efficient evaluation of capabilities and alignment with the organization’s requirements. This ensures vendors present their offerings, including platform capabilities, service model, and support structure, in a standardized approach that facilitates a fair and meaningful comparison.

- Evaluating potential providers: Utilize a consistent scoring matrix to evaluate, assess, and compare the capabilities and performance of TPAs. This tool transparently evaluates TPAs, their operational model, platform scalability, client service approach, fees, and ability to support future growth and regulatory change to ensure the selected provider aligns with the company’s operational needs.

- Conducting comprehensive due diligence: Thoroughly assess the shortlisted providers’ technological infrastructure, security protocols, service-level performance, and client references. This step ensures the vendor’s platform is not only technically sound but also operationally resilient.

- Onboarding and transition planning: Ensure the selected provider has a proven transition roadmap and project management approach that includes onboarding milestones, platform configuration, integration planning, and finalization of contract details. Early collaboration with the fund administrator ensures a smooth path to go-live and long-term partnership success.

The selection process flows into the migration phase to ensure the complete alignment of people, process, technology, and data within the TPA environment.

Transitioning to a New TPA

A comprehensive migration plan outlining key milestones, delivery workstreams, activities, tasks, and roles for the TPA selection and implementation is essential for a successful transition. Key considerations include:

- Data migration strategy: Develop a comprehensive data migration plan for securely and accurately transferring data from the incumbent provider or internal systems to the new TPA technology platform. This includes data mapping, cleansing, validation, and governance to ensure integrity throughout the migration process.

- Integration planning: Coordinate closely with the incoming TPA to align on integration points with the asset manager’s internal systems, ensuring seamless data flow and operational continuity.

- Testing and validation: Conduct thorough testing of the new system and migrated data to ensure accuracy and functionality.

- Training and change management: Equip internal teams with the knowledge and tools to work effectively with the new TPA, their systems, and processes. Effective and proactive change management strategies are essential to drive adoption and minimize disruption.

- Project management: Establish a project governance structure with clearly defined roles and responsibilities across internal teams and the incoming administrator. Strong program and change management practices are critical to enable teams to navigate the complexities of the implementation.

Migration timelines and activities may vary based on the asset manager’s operating model and the complexity of services being transitioned.

TPA Next Steps

Selecting and onboarding the right TPA is a strategic imperative for asset management firms seeking to enhance operational efficiency, improve data insights, and navigate the evolving regulatory landscape. CrossCountry Consulting stands ready to guide asset management firms through this transition, ensuring a smooth selection process and successful migration of a TPA that aligns with unique needs and long-term business goals.

To get started, contact CrossCountry Consulting today.