An effective strategy to generate shareholder value, streamline operations, and focus on core competencies can be accomplished through a corporate spin-off. Recent headlines included planned spin-offs at Honeywell, Medtronic, and Warner Bros. Discovery as these companies look to create agile businesses focused on revenue growth and earnings leverage.

A spin-off is a type of corporate restructuring in which a company creates a new, independent company by separating part of its operations, assets, or divisions. The new entity, often referred to as a “SpinCo,” builds its own management team and operates independently from the parent company, known as a “RemainCo.” Spin-offs can be executed in a tax-free manner if structured and executed properly.

Spin-offs are often used to enhance shareholder value and provide greater strategic flexibility, including capital allocation, for both the parent company and the new entity.

A Closer Look at the Market for Spins

Historically, the “sum of the parts” value pre-spin often exceeds the parent’s consolidated value over an 18-24 month period. Companies facing activist investor pressure or regulatory scrutiny may find spin-offs an attractive option. Similarly, companies hoping to unlock new value creation by separating under-performing assets from value-creating assets may be able to achieve faster growth and return to the types of activities they do best.

In recent months, industry experts and market participants have signaled 2025 as the “year of the spinoff,” reflecting the increasing value of U.S. corporate spin-offs and the size of established corporations that have displayed interest in undertaking a spin this year.

- Key characteristics of a spin-off: The new company operates independently with its own management and decision-making processes.

- Ownership: Shareholders of the parent company receive shares in the new company, maintaining their investment in both entities.

- Strategic flexibility: The spin-off allows both the parent company and the new entity to focus on their core businesses and strategic goals.

- Market value: Spin-offs can unlock value by allowing the market to better assess and value the separated entities individually.

Benefits of a Spin-Off

- Enhanced focus: Both companies can concentrate on their specific business areas without the distractions and capital allocation competition of non-core operations.

- Improved performance: Independent management teams, with specific industry skillsets, can drive performance improvements tailored to their entity’s business needs.

- Increased transparency: Investors gain clearer insights into the financial health and performance of each entity.

Navigating the Spin-Off Process

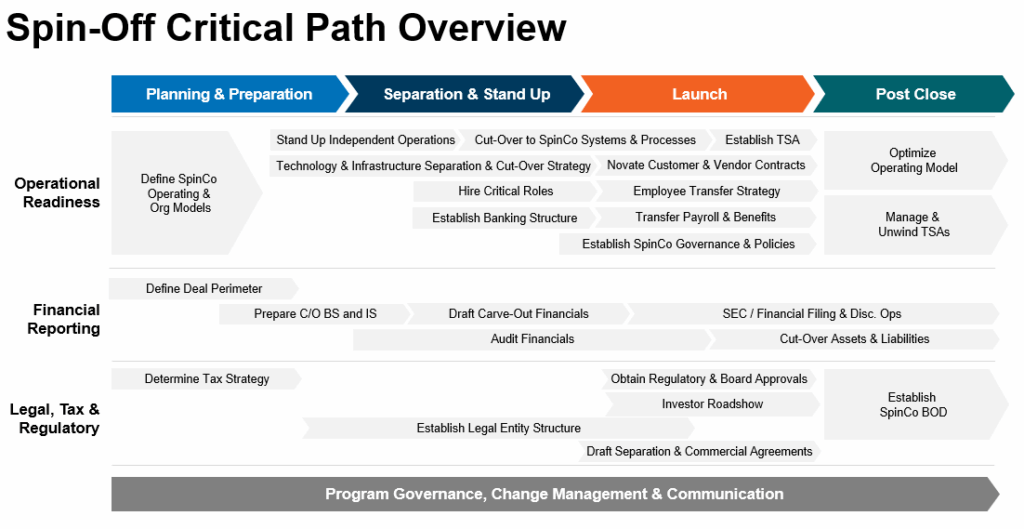

To gain clarity on an effective and efficient path to separation, achieve key milestones throughout the process, and prepare to operate successfully post-close, explore the critical steps below:

Taking the Next Step

A successful spin-off requires meticulous planning and execution, with the support of experienced RemainCo and SpinCo stakeholders and third-party providers.

CrossCountry Consulting provides a suite of accounting, risk, compliance, systems, and deal expertise that empowers RemainCos and SpinCos to confidently and profitably navigate a spin-off. To establish and execute a divestiture roadmap at your organization, contact CrossCountry Consulting.

This information is for general knowledge and informational purposes only and does not constitute legal or professional advice.