Overall transaction volumes in the first half of 2025 remained stagnant, consistent with M&A trends since 2023. While continued interest rate pressure, geopolitical conditions, and increased market uncertainty have materially impacted the market for exits, many shareholders and boards are becoming increasingly eager to divest underperforming assets, rationalize their portfolios, or complete corporate restructuring initiatives.

Maintaining an Exit-Ready Posture

Increased uncertainty has led business leaders to adopt a more conservative approach to deals. As the corporate transaction markets turn, companies should start preparing now so they can act decisively when an exit opportunity arises. Executing a successful carve-out sale, a promising deal option in today’s market, requires meticulous planning and execution with the support of experienced internal resources and third-party advisors.

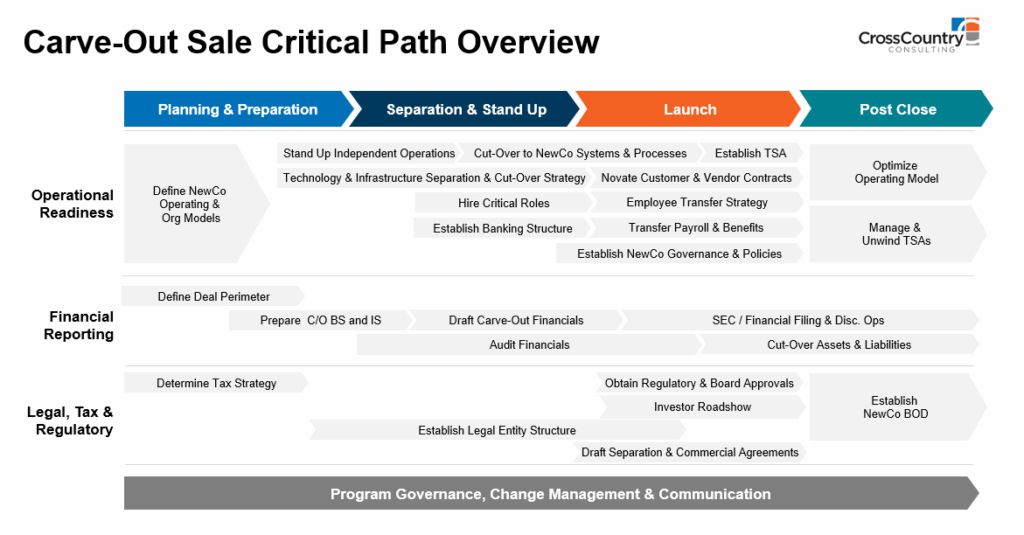

To deliver on an effective and efficient path to separation, meet necessary milestones, and maximize value, the critical steps below merit careful consideration:

Evaluate Tax and Legal Strategy

- A company’s tax function, or outside advisor, should be engaged to evaluate the tax implications of a proposed carve-out sale ahead of any final decision to proceed with the transaction, as tax impacts may influence deal structure and timing.

- The deal perimeter should also be clearly defined at a legal entity level and mapped to the company’s ERP system to ensure the book and tax bases match appropriately. Establishing these connections beforehand can accelerate the carve-out sale process and ensure the right legal and tax infrastructure is in place before proceeding.

Establish the Separation Management Office (SMO)

- Establishing an SMO ensures effective cross-functional coordination during a critical initiative for the company. Carve-out sale execution is an all-hands-on-deck effort requiring significant expertise in project and change management, stakeholder management, and structured transformation governance.

- An effective SMO also augments the ability of key stakeholders to navigate the deal timeline and assess the impact of cross-functional dependencies. By tackling the day-to-day details of the carve-out sale – proactively removing roadblocks and maintaining change momentum – the SMO allows senior leaders to maintain focus on the underlying business, condensing their involvement to only critical path issues.

- The SMO can empower functional leaders to quickly de-risk roadblocks and deliver value in real time. A strong SMO equips leaders with the tools and information to be agile while they meet the needs and realities of the transaction process.

An SMO manages execution against a structured roadmap, which is a path of matrixed activities across the company and key third parties, both internally and externally, as illustrated below:

Prepare Deal-Basis Financials

- In addition to carve-out financials, deal-basis financials may be required to facilitate due diligence procedures by prospective buyers. Deal-basis financials should be prepared in collaboration with management along with corporate development teams to ensure all due diligence and pro-forma adjustments are identified.

- In addition to quantifying and planning for any stranded costs, organizations should prepare working capital analysis, quality of earnings, and stand-alone costs to reflect the future state of the for-sale business.

Begin Preparation of Carve-Out Financials

- Engage advisors and align with auditors on the approach to carve-out financials and periods required. Note, divestitures can take many forms, with corresponding impacts on financial statements and audit readiness.

- Align on an approach for allocating commingled accounts and entities to the carve-out income statement and balance sheet, and determine if the transaction qualifies as “Significant” for a potential buyer (e.g., requires SEC 3-05 financials).

- Ensure the carve-out results bridge to historical financial information as well as any deal-basis financials for a sale.

- Support basis of presentation with appropriate technical documentation to facilitate an efficient audit of carve-out information.

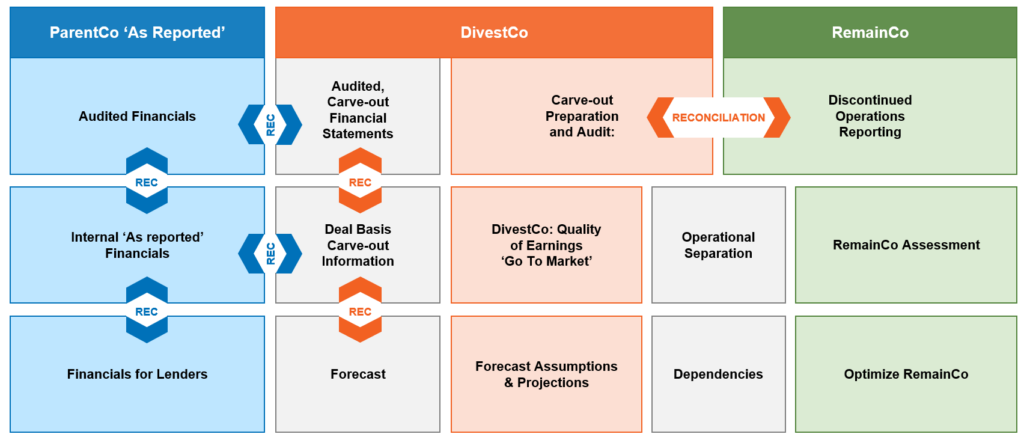

The base system and management reporting information are the same for all types of carve-out financial information. It’s critical to be able to explain, reconcile, and bridge the various pieces of carve-out information as laid out in the graphic below:

Prepare Operations for Separation

The structure of the sale for the carve-out entity will determine the timeline and complexity of pre-transaction readiness activities. In addition to the expected disentanglement of operations, separating a business intended to operate independently requires a robust systems architecture roadmap, clear process transition strategies, well-defined stand-up activities, and a draft of potential organizational hiring needs.

Alternatively, selling a business intended to be integrated into a buyer’s existing business will require planning and analysis around the RemainCo’s ability and willingness to support Transition Services Agreements (TSAs). Critical activities of focus, regardless of sale type, include:

- Reviewing inter-company entangled services/processes, employee matters, contracts, and systems, and developing separation strategies to limit the impact of the transaction on continuing operations.

- Understanding required novation/disposition and communication requirements related to vendor, customer, and commercial contracts impacted by the transaction.

- Considering employee transfer requirements and communication strategies for both impacted and remaining employees.

- Determining which core business processes require independent operations and which may require a TSA. Additionally, prepare the business to support TSAs and determine scope, cost, service level, duration preferences, and exit criteria.

- Define any stranded costs associated with remaining operations. Companies should review and plan for stranded costs, likely stemming from contracts, technologies, and other shared services like IT infrastructure, marketing, or human resources that are not fully allocated (100%) to the divested or remaining business.

Go to Market

- Engaging the right banking and legal counsel partners is a critical decision for management to facilitate the sales process, prepare the offering memorandum, and support the negotiation of the sales terms and conditions, including TSAs.

- Diligent preparation of roadshow materials, talking points for fireside chats, and seamless management of the data room will further support the due diligence process, allowing the company to support its equity story and increase value in the eyes of potential buyers.

- As part of the Go to Market playbook, many buyers today expect visibility into KPIs, operating trends, and margin drivers of the business. Preparing to tell the exit story will accelerate the diligence process and expand potential

Explore expert Divestiture & Carve-Out solutions that solve real-world problems

Maximize shareholder value, ensure a profitable path forward, and proactively manage complex accounting, risk, and systems implications for RemainCos and NewCos.

Taking the Next Step

CrossCountry Consulting provides a suite of accounting, risk, compliance, systems, and deal expertise that empowers sellers to confidently and profitably navigate divestitures and carve-outs. To establish and execute a divestiture roadmap at your organization, contact CrossCountry Consulting.

This information is for general knowledge and informational purposes only and does not constitute legal or professional advice. A comprehensive spin-off strategy requires careful planning and consideration of various factors, which is why consulting with legal, financial, tax, and other relevant experts is crucial.