While institutional investors have long dominated the alternatives landscape, a fundamental shift is underway as leading asset management firms recognize the untapped potential of high-net-worth individuals and family offices.

Alternative investments currently account for less than 3% of high-net-worth individual portfolios, yet industry projections suggest this allocation could expand dramatically over the next decade. This presents a compelling opportunity for asset managers willing to adapt their infrastructure, products, and go-to-market strategies for the private wealth sector.

The transformation extends beyond simply creating new products – it requires a comprehensive reimagining of operations, technology, compliance frameworks, and client service models.

The Strategic Imperative for Private Wealth Expansion

Several market forces are converging to make this expansion necessary for long-term competitiveness:

- Massive market opportunity: The global high-net-worth individual population holds combined assets of approximately $90.5 trillion. Meanwhile, the mass-affluent segment represents roughly $21 trillion in assets, with 80% having never worked with a financial planner, creating a significant greenfield opportunity for scalable wealth management services.

- Structural market changes: Recent regulatory developments are opening 401(k) and retirement plans to private market strategies, potentially unlocking a $10 trillion defined contribution market. The traditional 60/40 portfolio model faces increasing challenges as public markets become more concentrated and correlation increases during market stress. Owning competitive advantages in both institutional and individual markets enhances market positioning.

- Revenue model advantages: Private wealth offers asset managers the opportunity for more predictable, fee-based revenue streams compared to traditional carry structures. This recurring revenue model provides stability and can boost firm valuations. Additionally, with 84% of wealth managers expecting alternative allocations to rise over the next 12 months, the demand-side momentum is clearly building.

By capitalizing on these opportunities, asset managers can devote more resources toward individualized relationships that can lead to higher client lifetime value and increased referral opportunities.

Industry Leaders Setting the Standard

The top alternative asset managers have moved aggressively into private wealth, each taking distinct approaches based on their strengths and target markets.

- Top-tier firms (>$100B AUM) have established dedicated private wealth platforms designed to serve individual investors directly while maintaining institutional-grade investment quality.

- Mid-tier managers ($50-$100B AUM) are pursuing acquisition strategies, creating business development companies (BDCs), and offering private credit products for high-net-worth individuals.

- Smaller managers (<$50B AUM) are forming strategic partnerships to access established distribution networks without building comprehensive in-house capabilities.

Infrastructure Requirements

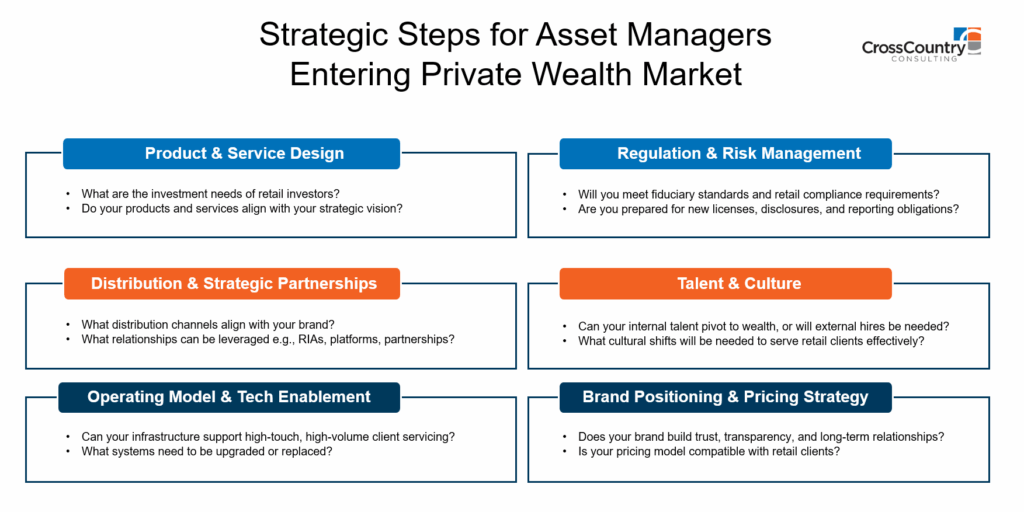

Successfully entering private wealth requires addressing six critical areas, each presenting both obvious needs and potential blind spots.

1. Product and Service Design

While product adaptation seems straightforward, the real challenge lies in understanding the distinct needs of individual investors versus institutions. Entrepreneurs seek liquidity and growth opportunities, family offices prioritize legacy and governance structures, and retirees focus on income generation and capital preservation.

The key is developing tailored offerings that address these distinct client personas while maintaining operational efficiency. This might include concepts such as hybrid portfolios for diversification, BDCs for high dividend yields, trust structures for estate planning optimization, and product wrappers like interval, evergreen, and tender offer funds.

2. Distribution and Strategic Partnerships

Selecting optimal distribution channels requires balancing control with reach. Direct-to-client models offer brand consistency but require significant investment in marketing and client acquisition. Partnerships with RIAs, independent broker-dealers, and wirehouses provide access to established client bases but may dilute brand control.

Strategic alliances with custodians, fintechs, and white-label solution providers can accelerate market entry while reducing operational complexity. The most successful firms often pursue a multi-channel approach, tailoring their strategy to different market segments.

3. Operating Model and Technology Enablement

The shift from institutional to retail clients demands fundamental operational changes. Institutional clients typically require quarterly reporting and can tolerate complex onboarding processes. Individual investors expect more real-time access to information, intuitive digital interfaces, and responsive customer service.

Technology infrastructure must support digital onboarding with e-signatures and automated KYC processes, provide secure client portals for reporting and account management, and integrate CRM systems for relationship tracking and segmentation. Many firms underestimate the complexity of building scalable, client-centric operations.

4. Regulatory Compliance and Risk Management

Private wealth introduces new regulatory and licensing requirements, including FINRA and SEC oversight, enhanced AML and KYC procedures, and jurisdiction-specific compliance for cross-border investments. Risk frameworks must be adapted for retail clients, incorporating stress testing and scenario analysis tailored to individual portfolios rather than institutional mandates.

Governance structures become critical, with oversight committees and escalation protocols ensuring appropriate suitability assessments and ongoing client monitoring. Many firms find that their institutional risk management frameworks require significant modification for individual investor protection.

5. Talent and Cultural Transformation

Success in private wealth requires different skill sets than institutional asset management. Teams need professionals with CFP, CFA, and CPA credentials who understand financial planning, estate strategy, and behavioral finance. Equally important is developing soft skills for client interaction and building the high-touch service culture that individual investors expect.

Performance metrics must shift from purely quantitative measures to include client satisfaction and retention indicators, which impact compensation plans. Collaboration becomes essential as clients often require coordinated solutions across investment management, tax planning, and estate strategy.

6. Brand Positioning and Pricing Strategy

Messaging must resonate with individual aspirations while maintaining professional credibility. Pricing strategies should balance perceived value with client preferences, often requiring tiered service models that provide flexibility and scalability (e.g., flat fee, basis points, or subscription). Many firms find that their institutional pricing models don’t translate directly to individual clients, necessitating comprehensive pricing strategy overhauls.

Proactively Addressing Transformation Challenges

Entry into private wealth can be streamlined with the support of an advisor who can help navigate several key workstreams.

- Regulatory compliance represents perhaps the greatest challenge, requiring new licenses, disclosure procedures, and reporting obligations.

- Client education becomes essential as individual investors often need significant guidance to understand alternative investments and their role in portfolio construction.

- Operational complexity increases dramatically when serving individual clients rather than institutional investors. Cost management becomes critical as serving high-net-worth clients requires higher per-client service levels while fees face downward pressure, particularly at higher AUM tiers.

- Technology integration issues are common, as firms must connect institutional-grade investment platforms with retail-oriented client service systems.

Successfully entering private wealth requires a phased approach that builds capabilities while managing risk and complexity.

- Phase 1: Focus on market assessment and product development, understanding target client segments, and adapting existing investment strategies for individual investors. Strategic partnerships with established wealth management platforms can provide valuable market insights while building initial distribution capabilities.

- Phase 2: Develop infrastructure, including technology platform integration, regulatory compliance framework establishment, and initial team hiring. Many firms benefit from pilot programs with select client segments to test operational capabilities and refine service models.

- Phase 3: Execute full market launch with comprehensive marketing strategies, expanded distribution partnerships, and ongoing optimization based on client feedback and market response.

Positioning for Future Growth

The expansion into private wealth is a fundamental transformation that positions asset managers for long-term success in an evolving market landscape. However, success requires commitment to comprehensive infrastructure development, cultural transformation, and ongoing innovation in client service delivery.

The window for competitive advantage in private wealth is narrowing as more firms enter the market. Asset managers who begin their transformation now, with careful planning and phased implementation, will be best positioned to capitalize on this significant growth opportunity.

To execute on a structured transformation roadmap in service of institutional and individual investors, contact CrossCountry Consulting.