You’re launching a new product suite, redesigning internal processes, or building innovative operating models and team structures to generate value.

Immediately you run into:

- Change resistance, misunderstanding, and employee strife.

- Unclear or poorly envisioned roles, responsibilities, and communication.

- Delays, false starts, and incomplete stakeholder buy-in.

- Unexpected risks (third-party risk, legal and regulatory implications, technology systems, etc.).

If not managed proactively, even the most well-intentioned transformation can introduce a complex web of potential risks that can erode value creation. The key is to embed practical risk management strategies into operational change management initiatives.

Modern Operational Change Management

Operational change management is a systematic approach to planning, executing, and monitoring new transformations within the business to ensure a smooth transition and successful adoption. For many organizations, this approach is applied to specific operational initiatives, such as re-engineering workflows, integrating technology systems, and bringing to market a new offering.

Each of these transformations represents a significant operational shift designed to enhance efficiency, expand market reach, or improve customer experience. While the benefits are clear, it can be difficult to keep stakeholders aligned and progress on track, which is where risk management comes into play.

Risk Management’s Role in Change Management

For risk professionals, the critical question isn’t if change will happen, but how effectively the associated risks will be identified, assessed, and managed. Bringing risk into the conversation early and often is paramount. The goal is to minimize disruptions to operations and prevent adverse consequences that can impact financial performance, regulatory standing, or reputational integrity.

Consider a new product offering or a significant process update. The inherent risks are multifaceted and demand a comprehensive review. For instance:

- Third-party risk: Does this change necessitate new relationships with vendors, suppliers, or partners? What are the associated due diligence requirements and ongoing monitoring obligations? Read more: Navigating Third-Party Risks: Best Practices and Questions Answered for Today’s Businesses

- Technology risk: Is new technology required? What are the cybersecurity implications, data privacy concerns, and integration challenges?

- Strategic risk: Does this change align with the company’s long-term strategic vision, or could it inadvertently pull resources away from core objectives?

- Legal and regulatory risk: Are there any new legal or regulatory obligations that arise from this change, particularly in highly regulated industries or in public markets. What are the compliance implications?

Failing to address these questions proactively can lead to costly remediation, reputational damage, and even regulatory penalties.

Common Pitfalls in Assessing Change-Related Risk

Implementation of risk-informed change management practices often faces significant hurdles. More often than not, risk is an afterthought, which can lead to several issues:

- Too late: Risk teams are often engaged too late in the product or change lifecycle, leading to a perception that they are “slowing time to market” rather than enabling informed decisions.

- Inconsistent: Risk assessment processes often vary across different business units, leading to a lack of centralized visibility and a fragmented understanding of enterprise-wide risk exposure.

- Repetitive: Stakeholders often find themselves answering the same questions from multiple risk groups, creating frustration and inefficiency. This signals a failure to leverage existing risk management programs effectively.

- Opaque: Unclear accountability and ownership structures for risk management throughout the change process can lead to gaps and unaddressed exposures.

- Point in time: Assessments are often one-off events, failing to provide for ongoing monitoring or visibility into the evolving risk profile throughout the new product or service lifecycle.

Explore expert Risk Management solutions that solve real-world problems

Understand emerging threats, changing regulations, and evolving technologies – then formulate actionable, pragmatic strategies to reduce risk across the enterprise.

Keys to Success: Modernizing Risk Assessment for Change

Overcoming these challenges requires a deliberate and strategic shift in how risks are assessed within the change management process. The path to success involves:

- Early embedding of risk stakeholders: Integrate risk management actions at the earliest possible point in product or change development. This shifts risk from a bottleneck to a strategic partner, enabling proactive management.

- Consolidate risk assessments: Develop a product and process assessment methodology that leverages existing risk program components, covers risks within a company’s taxonomy, and is central for change stakeholders to populate throughout the change management process.

- Tool enablement: Move beyond manual processes to leverage robust Governance, Risk, and Compliance (GRC) platforms or specialized risk assessment tools. This improves efficiency, consistency, and data capture.

- Centralized reporting and visibility: Establish mechanisms for centralized reporting and transparent visibility into risk management decisions across all change initiatives. This fosters a holistic view of organizational risk.

- Ongoing monitoring and key indicators: Design a program that includes continuous monitoring and the establishment of key risk indicators (KRIs) to track the evolving risk profile of new products, services, and processes.

What Good Looks Like: A Structured Approach

A truly effective risk management program for operational change is built on a clear, structured framework.

1. Design the Program:

This phase involves establishing the foundational elements of your risk assessment framework specific to new products and services that are going through the change management process. This program should align with the enterprise risk management framework (ERM) and include:

- Visioning session: Identify the requirements of the program and key stakeholders.

- Pain point identification: Understand current specific pain point and improvement opportunities.

- Initial design: Create initial processes to address pain points

- Feedback and documentation: Solicit feedback from stakeholders to ensure design complements existing process and document details of new process.

2. Build the Program:

Once the design is complete, the focus shifts to building and operationalizing the program. This entails:

- Developing playbooks and tools: Creating standardized templates, questionnaires, assessment processes, and potentially leveraging technology solutions to streamline the assessment process.

- Integration with existing frameworks: Ensuring the new program seamlessly integrates with existing ERM frameworks, compliance programs, and internal audit functions to avoid duplication and leverage existing controls.

- Governance and metrics: Develop the program’s governance documentation (operating model, program standard, etc.) and program success metrics.

- Maturity roadmap: Develop roadmap to continuously mature the program (staffing model to run the program, upgrading tools, etc.) over time.

3. Pilot the Program

- Training and awareness: Educating stakeholders across the organization on the new risk assessment process, their roles, and the importance of early engagement.

- Pilot program: Running a pilot with select change initiatives to test and refine the process before full-scale rollout.

- Lessons Learned: Incorporate lessons learned from the pilot program to feed into the overall program to promote continuous improvement. Add items to the maturity roadmap.

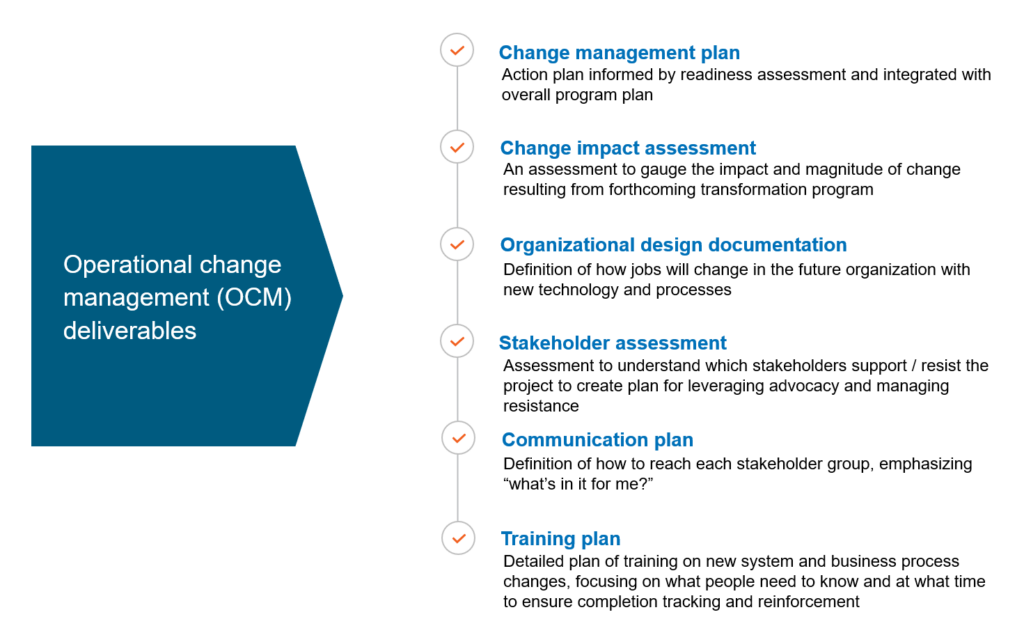

As illustrated below, CrossCountry Consulting provides a comprehensive set of customizable operational change management deliverables, tools, and templates tailored to each organization’s project needs:

Transform Change Management Threats into Opportunities

Navigating complex operational changes while effectively managing risk requires specialized expertise and a pragmatic approach. CrossCountry Consulting’s Integrated Risk Management experts support organizations at every stage of their change journey with programs configured to unique needs and risk appetites. This includes developing frameworks, methodologies, and supporting documentation.

Beyond the technical aspects of risk, successful change hinges on effective people management via a proven 3-step approach:

- Preparing for change: Assessing organizational readiness, identifying potential resistance, and developing communication strategies.

- Managing the change: Implementing detailed action plans, providing training, and ensuring effective stakeholder engagement throughout the transition.

- Reinforcing the change: Establishing mechanisms for ongoing monitoring, feedback, and continuous improvement to ensure the new operational paradigm is sustained and delivers intended benefits.

To proactively integrate risk management into your operational change initiatives, contact CrossCountry Consulting.