Will 2025 and 2026 be banner years for IPOs? The answer to this question seems to vary one week to the next due to factors driving the IPO market, including interest rate stabilization, inflationary pressures, new tariffs, and recurring DOGE actions. In the private equity space, hold periods are now closer to seven years versus the historic average of five years, which could indicate PE firms may be prepared to unwind some of their longer held investments.

One thing is true in many IPO markets – you often can’t predict with certainty many of these factors, but you can get your company ready for when that moment comes.

Building IPO Momentum?

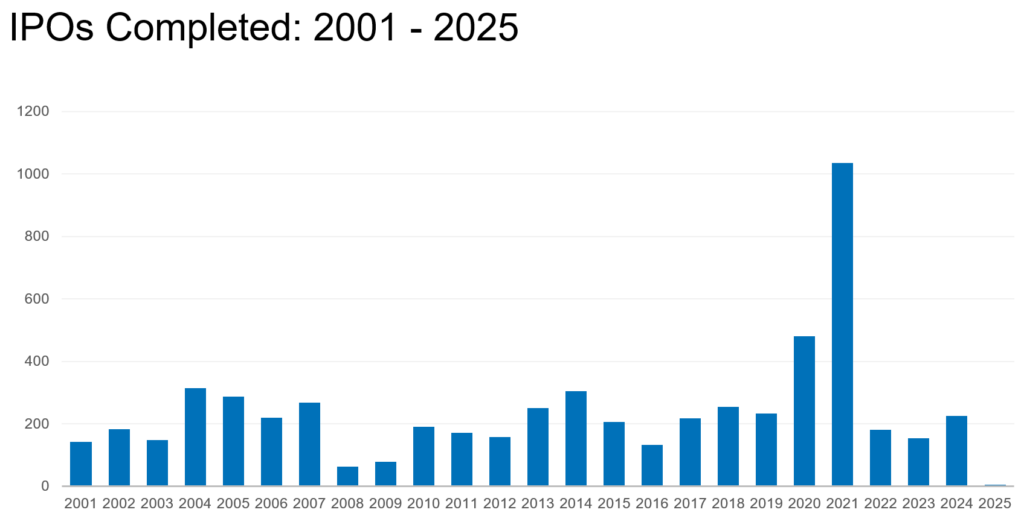

In the last 25 years of IPO activity, most hot IPO markets occur when positive reactions to economic factors have existed for a period of time.

We may never see an IPO market as we did in 2020 and 2021 when there were over 1,500 IPOs. But given the IPO market has been below the historical average for the last 3 years, 2025 and 2026 could turn out to be a period of increased IPO activity.

Another indicator of increased IPO activity can be seen by comparing companies on file with the SEC. As of December 31, 2024, there were 394 companies on file to complete an IPO. In comparison, there were 225 companies on file as of December 31, 2023. This indicates a significant increase in the number of companies preparing to go public.

So, what should your company be doing now to get ready for a successful IPO?

Capitalizing on a Potential IPO Rebound

Companies that give themselves 12-18 months to prepare for an IPO have the highest likelihood of not only completing the IPO process but also creating a successful publicly traded company that can last for generations to come. Even if you decide to forego the IPO path, your company will be in an even better position for alternative options such as a sale, merger, or consideration of a private equity Investment.

There are 10 core areas of focus for companies planning to take the IPO path once market conditions are favorable:

Build Your Team

- Evaluate your current team for skills and resource gaps (e.g., SEC reporting or SOX compliance), as the next year+ will be a monumental labor- and time-intensive period for the company.

- Plan for a hiring process that could take 6-12 months and for pulling in partial internal resources as needed.

- Many private companies often need to fill key positions such as Chief Financial Officer, Chief Legal Officer/GC, CISO, and CTO, among others. These roles can take time to fill, in addition to the time it takes the person to become acclimated to the business and its people.

- Consider the need for an internal audit leader, a requirement if you plan to be listed on the NYSE.

- Consider the right compensation package and how it compares to your peer group.

Enhance Efficiency and Effectiveness of the Close Process

- How quickly do your peers release earnings, and how can you emulate speed-to-release?

- Consider what financial close best practices and accelerators can be implemented, including checklists, calendars, and automation.

- How many days will you need to cut from the close process to be able to effectively close the books monthly, quarterly, and semi-annually?

- Prepare for quarterly reporting to align with new public-company requirements.

Employ Automation and AI to Streamline Processes

- Consider the need to make investments in ERP and other back-office applications to ensure timely and accurate reporting.

- Focus on integration between core financial systems; key customer-facing business systems (e.g., systems that generate accounting events such as revenue and billings); and reporting systems that support forecasting, consolidations, eliminations, and financial reporting.

- Move from manual processes recorded on paper and spreadsheets to automated and AI-powered solutions.

- Evaluate your accounting system.

- Take advantage of this opportunity to transform your business and operational oversight to set the stage for a faster, more agile enterprise in the future. A move toward more automation should also focus on controls (especially ICFR) to maintain an appropriate control environment.

Strengthen Corporate Governance

- A public company’s board composition and structure are often very different from those of a private company.

- U.S. public companies must comply with governance requirements imposed by stock exchanges and SEC rules, as well as related disclosure requirements.

- Both the NYSE and Nasdaq require that the Board be comprised of a majority of independent directors.

- Identify Board and Audit committee members who align to the company’s vision and have deep experience in the space.

- Create an Audit Committee charter to codify audit responsibilities, scope, reporting relationships, and more.

Develop KPIs

- Key performance indicators are the top metrics management uses to evaluate the performance of the business. It’s imperative that companies can align on the definitions of each KPI, pull this information quickly, and sustain data governance practices in the process.

- Start by determining the right KPIs for your business. Common non-GAAP measures include ARR, EBITDA, Adjusted EBITDA, and Free Cash Flow.

- Once chosen, benchmark these KPIs against your peers.

- Companies often disclose KPIs and certain financial measures that do not directly comply with GAAP (i.e., non-GAAP measures). Be prepared to reconcile any non-GAAP measures to the closest GAAP metric to ensure compliance with SEC non-GAAP disclosure rules.

This structured approach turns traditional reporting and finance activities into new opportunities for value creation pre- and post-IPO.

Establish and Optimize Financial Forecasting and Guidance

- Build out your FP&A team to support cross-functional predictive insights and corporate decision-making.

- Long-term predictability of forecasting results impacts valuation and is key to the success of a public company. Predict…Achieve…Predict…Achieve. Poor forecasting can lead to missed guidance, and the beginning of a tailspin for a new public company.

- Decide upon what type of financial guidance will be released by the company annually or quarterly. By communicating guidance in a strategic way, companies can educate analysts and investors and mitigate the risk of swings in stock price.

Enhance Financial and SEC Reporting Capabilities

- Complete accounting policies/technical analysis and finalize new disclosures in accordance with SEC Regulation S-X.

- Draft a Management Discussion & Analysis (MD&A).

- Implement a more robust financial reporting tool for unified data and reporting capabilities.

- Review your operating segments and assess how they should be structured?

- Update financial statements and disclosures to include SEC required items such as EPS and segment reporting.

Prepare for PCAOB-Level Audits and Quarterly Reviews

- Depending on the JOBS Act elections, financial statements (F-pages) filed in a registration statement on Form S-1 commonly include 2-3 years of audited financial information and must be compliant with Regulation S-X.

- The F-pages may also include comparative quarterly financial statements (similar to a Form 10-Q) if the filing includes an interim period, which must also be compliant with Regulation S-X.

- Annual financial statements included in the Form S-1 must be audited in accordance with PCAOB standards. PCAOB audits are performed at a lower level of materiality and within more rigid guidelines and may result in unexpected challenges and delays.

- Certain complex accounting and reporting topics are typically challenged and often require explanation and support as to the basis for a company’s conclusions and related disclosures.

- Partner with a strategic audit advisor to efficiently manage audit resources and best practices.

Optimize Risk and Controls Framework

- In the transition from private to public, internal control standards become much more robust. As public registrants, companies are subject to compliance with Sarbanes-Oxley Act of 2002 (SOX), which among other things requires management to report on the adequacy of internal controls over financial reporting (ICFR) and disclosure control procedures (DCP). Three critical aspects of compliance with SOX include:

- “Section 302 / 906 requires management to certify they have designed and evaluated their DCP in all 1934 Act Filings commencing with its first 1934 Act filing (i.e., its first Form 10-Q or Form 10-K) and periodic report containing the financial statements fully complies with SEC requirements and are materially accurate;

- Section 404(a) requires that company management certify to the effectiveness of the company’s ICFR and provide evidential matter of its evaluation in the second annual Form 10-K; and

- Section 404(b) requires auditor attestation on the operating effectiveness of ICFR. EGCs, in accordance with the JOBS Act, receive up to a five-year reprieve from section 404(b) – auditor attestation of the operating effectiveness of internal controls over financial reporting.

- Evaluate the effectiveness of your IT general controls (ITGCs), the basic controls that can be applied to IT systems such as applications, operating systems, databases, and supporting IT infrastructure. Determine whether an internal audit function is needed.

- Maximize the post-audit debrief and create a project plan to remediate any material weaknesses or control deficiencies. Companies will routinely run into a complicated series of audit issues they must be able to quickly address. But they also need a proactive audit approach and strategic partnership with an audit advisor to ensure their risk and controls framework is optimized with automated controls.

- Create a cyber risk framework and reporting process to support recent SEC requirements and cybersecurity framework for reporting to the Board.

- An effective internal control environment in a public company is much more involved than in a private company. Areas to improve upon or rely upon external advisors for support often include:

- Creating effective Entity Level controls.

- Adopting IT General Controls and standards for reviewing the quality and integrity of your IT setup and supporting effective reporting and financial statement audits.

- System and Organization Controls (SOC) reporting to your customers to support their financial audits.

Build out a Transaction Working Group

- Companies require expert direction and assistance from external advisors to guide and complete a successful IPO. The following is a summary of different parties a company will need to hire:

- SEC counsel.

- Independent auditors.

- Accounting, financial, and reporting advisors.

- Investor relations firm.

- Underwriters.

- Underwriters counsel.

- Financial printer.

- Tax advisor.

- Internal controls and process optimization specialists.

- Cybersecurity specialists.

- The company will need to identify a leader of the project management office (PMO) to coordinate and drive this group to completion.

Maximizing Deal Value with an IPO Readiness Assessment

To better understand your position and timeline on the IPO journey, start with an IPO readiness assessment. The assessment identifies a list of items (along with prioritization and timeline) that will require your company to hire additional people and external advisors and invest in system and process improvements.

Not all improvements are created equally, however. Some can be sequenced later or can even be fine-tuned after going public, while others are mission-critical to begin during the pre-IPO filing process.

If an IPO is in your future, now’s the time to get ready.

For expert IPO readiness support, contact CrossCountry Consulting today.