Compared to a decade ago, the financial planning & analysis (FP&A) function is getting more expensive. That could be due in part to the added responsibilities put on FP&A’s plate, the expanding role of the OCFO generally, and the convergence of costly software in a tight labor market, to name a few reasons.

What’s known for sure, however, is that FP&A employees are still spending 75% of their time sourcing data and “performing” FP&A. That means just 25% of time is spent on true value-add activities to the business.

Interestingly, while 77% of finance professionals believe their FP&A work is delivering value-added insight, connectivity and collaboration between departments are still limited, which caps the value and height FP&A can reach.

Modern FP&A functions are moving the needle toward several core focus areas, including:

- Close interpersonal collaboration with non-finance teams.

- Technological synergy across departments and platforms.

- Refined, simplified process and policy architecture for the entire organization.

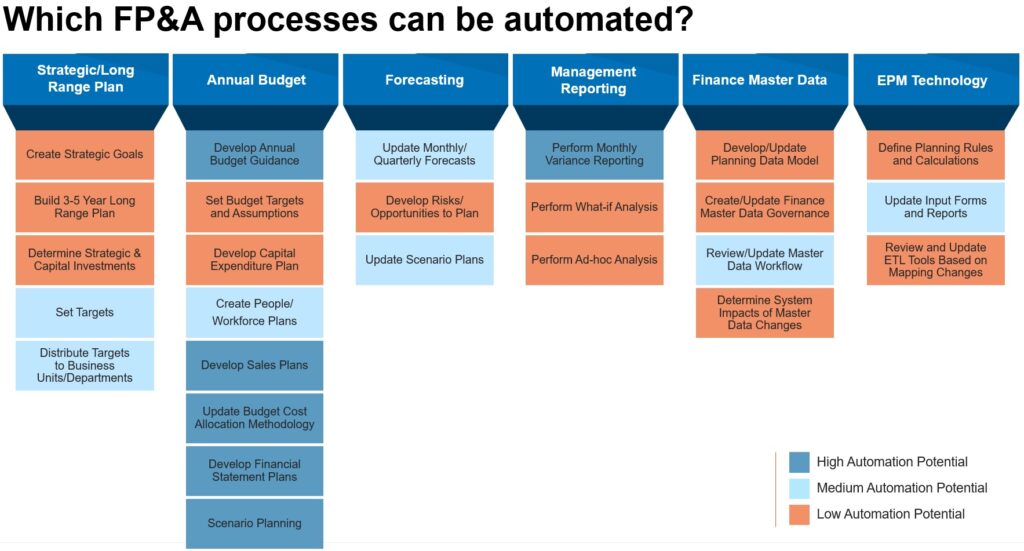

- Automation for low-touch processes.

- Agile scenario management.

The scope of FP&A is changing. Here’s how to get ahead.

1. Integrate Company Strategy Into the Planning Process

The high-level objectives and key results (OKRs) the business pursues must be observed at the departmental and cross-departmental levels as well. The FP&A function interprets and converts these OKRs into their own sub-OKRs primarily through the planning process – ensuring actionable targets are set and that everyone is working toward the same goals.

This integration requires close collaboration between FP&A leaders, other department heads, and senior executives to maintain a sustainable, unified approach to planning that ultimately fuels operational excellence and achievement of OKRs.

It’s FP&A’s job to take this first step and embed company strategy and tone into its wider process transformation initiatives.

Explore expert FP&A Transformation solutions that solve real-world problems

Drive analytical forward progress across the organization with modern process architecture, technology, and data insights.

2. Move to a Driver-Based Approach to Enable Real-Time Planning

Driver-based planning is a more flexible and dynamic approach that orients and aligns the entire planning process toward key business drivers in a way that includes more operational and people data. As business drivers are impacted or adjusted due to economic, regulatory, or industry conditions, FP&A must thus be agile enough to quickly re-calibrate plans.

A driver-based approach is only possible with firmwide alignment and access to more data FP&A may not historically have had access to. But as this shift toward business drivers occurs, FP&A can develop more accurate forecasts and provide more valuable insights to the business – and do so without being disruptive or slow to the chase.

Similar to the point above, an innate understanding and integration of the corporate strategy is mandatory.

3. Design Flexibility for Scenario Planning

Pivoting, adjusting, or otherwise re-planning on the fly is a necessary task for future-ready organizations but one that virtually none have perfected. As market conditions change and the business evolves, FP&A must nimbly adapt to new realities to ensure decision-makers are still receiving the latest, most accurate information. This requires core flexibility built into the planning process from the start so that plans can be adjusted quickly and efficiently without prompting a full teardown and re-build of the plan from the bottom up.

Platforms like OneStream can aid and visualize scenario planning across the organization with built-in intelligent financial signaling. These “signals” – once hidden and locked away in reams of data – can be surfaced midstream and acted upon during normal close or planning periods.

Rapid “what if” scenario planning is critical, and FP&A needs to be at the forefront of this activity to keep the business pointed in the right direction when reacting to new opportunities or threats.

4. Implement Scalable, Repeatable Processes

FP&A functions that contain a solid foundation of financial and operational master data management can enable the scalability of various technology and process innovations that are vital to elevating business performance. For example, automation, performance management, and data analytics software can build upon this foundation to instill common, repeatable processes and controls throughout FP&A and adjacent functions to start – and the entire organization in time.

Think UiPath, Alteryx, and more.

Consistent, self-executing processes – be it budget cost allocations, monthly variance reporting, or financial statement development – reduce errors, inconsistencies, and inefficiencies.

Free from rote, error-prone processes, the FP&A function is also better positioned to provide the most actionable, comprehensive information and recommendations possible to management, further elevating the strategic importance and gravity of FP&A to the business.

5. Leverage Predictive and Prescriptive Analytics

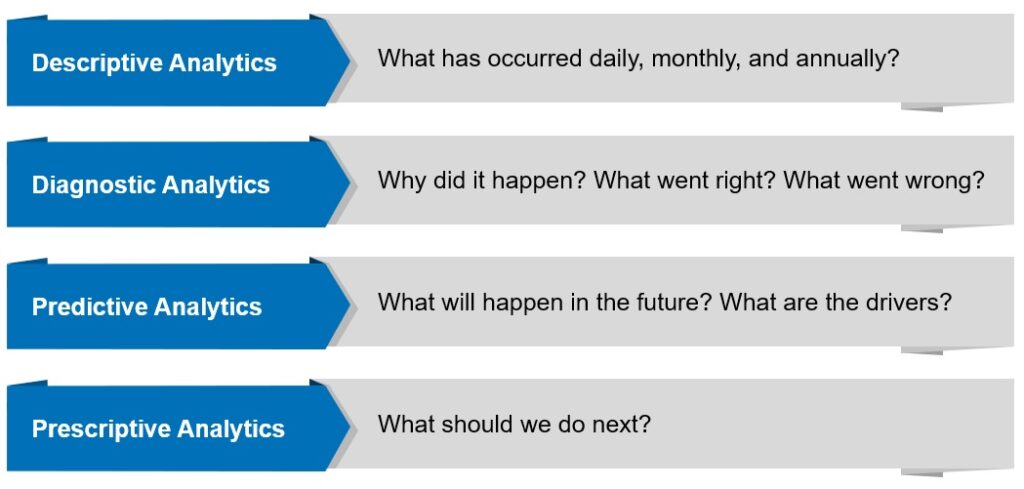

To predict future trends, FP&A must look to the past – past data and historical patterns to be exact.

Embedded in FP&A should be a robust predictive analytics capability that uses prior data points to make future predictions using artificial intelligence (AI), machine learning (ML), modeling, and data mining. As past and future benchmarks are better identified and understood, teams can measure performance more effectively, as well as mitigate risk and capitalize on opportunities effectively.

But predictive analytics only goes so far.

Prescriptive analytics takes a prediction and recommends next steps and actions organizations can take to meet a goal. This means the prediction has been analyzed more thoroughly and decisions can be made based on a “truer” or more real set of facts rather than assumptions. A prescriptive approach puts FP&A fully in the driver’s seat of strategic decision-making, with data-backed intelligence guiding every move.

6. Think Beyond the Ledger

Historically, other departments toss data over the fence to FP&A and hope for the best. Data may be coming from different unstructured sources, it may be incomplete or unverified, or it may be communicated too late in the process to really be useful in a given period’s planning process.

This dynamic has created an environment in which FP&A operated within the confines of the ledger, making do with the data it had. Moving forward, the FP&A function should be ingesting broader data sets from across the business – HR, operations, IT, third parties, etc. – to generate more robust, holistic plans. As more data is routed through FP&A, leaders are able to see clearer pictures of the past, present, and future on metrics that weren’t previously accessible or well-understood.

Consequentially, this produces a mindset shift of the professionals inside and outside FP&A. Now there are more labor hours and headspace available to effectively think beyond the ledger and get out in front of management and boardrooms with new insightful ideas and strategies.

7. Connect the Planning Process to Other Functions

The totality of all of the above FP&A accelerators and innovations adds up to deeper, more collaborative relationships with other departments. In other words, FP&A’s success, value, and impact are extended to other functions (known as xP&A).

See what 300+ Finance and IT executives say about the state of enterprise digital transformation.

New Forrester research commissioned by CrossCountry Consulting

Building integrations and processes with these functions is imperative to high-performance planning. But each team should also play a larger role in their respective planning responsibilities to ensure handoffs to finance are clean, firmwide alignment exists, and technology systems are working in unison.

As other functions like HR, IT, and sales leverage existing FP&A recommendations and toolkits, it will become clear where redundancies lie, where further efficiencies are to be won, and how the entire spectrum of enterprise planning can be continuously optimized for impact.

For expert support in transforming enterprise planning at your organization, contact CrossCountry Consulting.