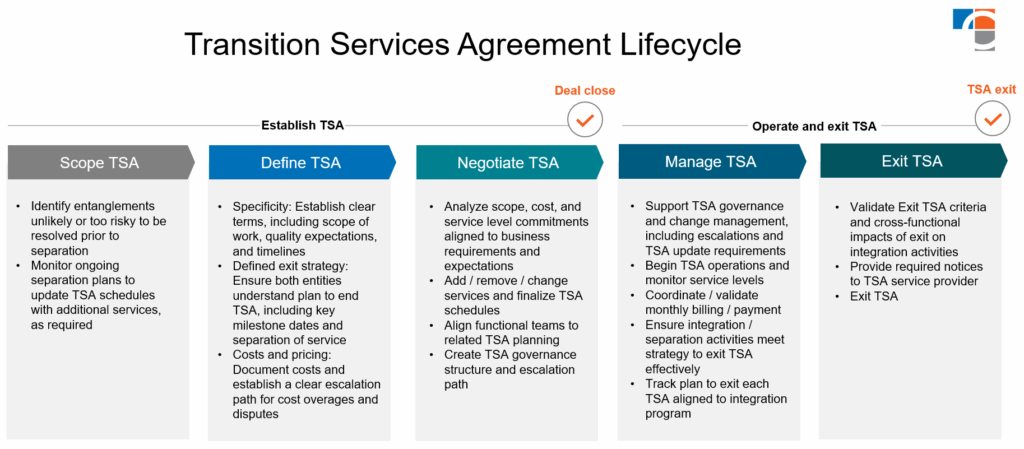

An integral component of the divestiture process is the Transition Services Agreement (TSA). A well-crafted TSA can make the difference between a seamless transition and a chaotic handover. Explore how to minimize operational risks and business disruptions during the transition while maximizing deal value.

Understanding the TSA

A Transition Services Agreement is a contract between the buyer and the seller (or divesting parent, RemainCo, and the new organization, NewCo, in the case of a spin-off), where RemainCo agrees to provide certain services to NewCo for a specified period post-divestiture. In some cases, although less common, NewCo will agree to provide services back to RemainCo for a period of time, called a Reverse TSA.

Common services in TSAs include IT infrastructure and systems support, access to historical data, system cutover assistance, HR and people services, and finance and accounting assistance. Whether due to accelerated deal timelines or strategic priorities while executing the separation, an effective TSA ensures business continuity while NewCo establishes its own capabilities and/or successfully integrates into a buyer’s operations.

Key Elements of a TSA

- Scope of services: Clearly define the services to be provided. This includes detailed descriptions of the service, expected outcomes, and any specific service requirements. Ambiguity in service descriptions can lead to misunderstandings and disputes, so precision is crucial.

- Duration: Specify the duration for which services will be provided. This period should be realistic, giving NewCo enough time to set up its own processes and systems while being reasonable and minimizing undue pressure on RemainCo’s ongoing business operations. A process for service extensions and/or early terminations should also be addressed in the TSA. It’s critically important to consider divestiture tax goals when contemplating service durations, as the IRS considers TSA services in its tax treatment rulings.

- Service levels: Establish clear service level agreements (SLAs) to set expectations for performance. This includes reasonable response and resolution timelines as well as quality standards. Well-documented SLAs ensure the services provided meet the service recipient’s needs and minimize potential conflicts.

- Exit criteria: Include language on what “completes” the required service and an understanding of the service recipient’s plan to exit. A clear understanding of how the TSA is ultimately satisfied will ensure both parties are aligned on expectations post-close. Termination clauses may also be relevant to define conditions of early termination of the service, contemplating scenarios such as breach of contract, changes in business circumstances, or mutual agreement.

- Pricing and payment terms: Outline the cost of services and the expected invoice and payment schedules. Consider the costs associated with providing the service, the headcount required to deliver on the service, and any recurring or ongoing charges associated with technology or other infrastructure required to support the service. Companies should also contemplate whether penalties for late payments or escalating pricing are appropriate; transparency in pricing helps avoid financial disputes.

- Confidentiality and data security: Address how confidential information and data will be handled. This includes data protection measures, access controls, and protocols for data transfer. Ensuring data security is paramount, especially when dealing with sensitive business information.

- Governance and management: Define the governance structure for managing the TSA. This includes appointing key contacts, determining individual service owners from both parties, and establishing a schedule to review the execution of the TSA and resolve issues after launch. An effective governance model ensures that both parties remain aligned and conflicts are resolved promptly.

Best Practices for Crafting a TSA

- Define TSA strategy early: An upfront expectation of a company’s approach to TSAs will aid in decisions around operational readiness and set the stage for day 1. Does the organization wish to minimize continuing commitments and services and avoid TSAs? Then additional work pre-deal is required to accelerate stand-alone operations and/or immediate day 1 integration plans. Alternatively, will the organizations accept more services provided through the TSAs, allowing for a quicker deal timeline but likely creating a longer timeline to separation and/or integration?

- Conduct thorough due diligence: Understand NewCo’s needs and RemainCo’s capabilities to align on a TSA that’s realistic and achievable. Involving key stakeholders across functions early and leveraging their expertise is invaluable in identifying critical services. Subject matter experts can help simplify potential complexities and challenges that, with proper planning, can be solved.

- Consider impact of Bi-Lateral or Reverse TSAs: While most TSA services are typically provided by RemainCo, there may be situations in which key personnel or technologies are part of, or go with, the divested business. RemainCo must plan and schedule the definition of its service needs to avoid disruption to existing business processes.

- Remember atypical or irregular services: Some TSAs will be required to deal with activities that occur on irregular or infrequent schedules. Examples like rebates, benefits or expense reimbursements, and tax or audit services fees are important to capture, although they may not occur as frequently as recurring processes.

- Coordinate with the pro forma financials process: Arrangements under the TSA are often a component of NewCo’s autonomous entity adjustments in the pro forma financial statements. To ensure the accuracy of amounts disclosed in pro formas, close collaboration is required by finance, accounting, and investor relations during the TSA process.

- TSA processing and management: A TSA will require a new process to manage execution and billing related to the defined services. Evaluate both organizations’ ability to perform the services and meet the SLAs. How will you measure expectations, collect costs, establish a process to bill for the services rendered, and assess service winddown progression?

Delivering Value in the Deal and Beyond

Alignment of all impacted parties during a divestiture creates the conditions for a smooth transition, faster time-to-value, and reduced risk. TSAs lay an important foundation for post-divestiture success and should be supported with strategic planning, clear communication, and ongoing collaboration.

CrossCountry Consulting aids organizations across the deal lifecycle and helps drive toward maximize exit value. Contact us today for expert support in your next transactions.