For decades, private equity has used financial engineering and cost reduction as primary levers of value creation. More recently, operational transformation and digital enablement became the new playbook. Today, AI represents the next frontier, offering efficiency, growth, and competitive advantage – but also complexity and risk.

For sponsors and their portfolio companies, the question is no longer if AI should be part of the value-creation strategy but how to adopt it responsibly and at scale.

From Deal to Exit: A Picture of AI-Enabled Value Creation

Consider the trajectory of a successful AI-enabled PE deal:

- Deal sourcing and diligence: AI-driven market scans and sentiment analytics reveal a target overlooked by competitors. AI-enabled diligence surfaces revenue drivers, operational risks, and synergies, enabling sharper pricing and accelerated underwriting.

- Post-close transformation: The portfolio company invests in a holistic AI capability model, building data infrastructure, embedding AI into core functions, and cultivating a workforce confident in AI-enabled tools.

- Key transformations include AI-powered forecasting, dynamic pricing, supply chain optimization, and automated finance processes, all governed by a consistent risk and compliance framework.

- Exit and value realization: Over the hold period, revenue accelerates, margins expand, and AI maturity itself becomes a differentiator, with data and AI-enabled processes boosting buyer confidence and valuation multiples.

The result is not just a successful deal, but a repeatable playbook for portfolio-wide advantage.

Laying the Groundwork for Sustainable AI Value Creation

Portfolio companies have different levels of AI maturity. Some are still building basic digital and data capabilities, while others are piloting advanced models. Sponsors must meet each company where it is, while keeping an eye on a future where AI is a core capability.

Holistic AI adoption cannot be solved purely from the top down. Leadership sets the vision and governance, but real value often comes from engaging those closest to the work: line-level staff who know the daily bottlenecks and friction points. Their input ensures AI solutions address real problems, generate practical efficiency gains, and are embraced by those who use them.

Without a roadmap, companies risk “pilot purgatory” – where projects never scale – or creating vendor sprawl that increases cost without impact. Poorly governed AI can also expose companies to reputational, ethical, and regulatory risk.

The lesson: AI adoption is about building capability, with governance, risk awareness, and alignment to value-creation goals driven by insights from leadership and frontline staff.

A Framework for Responsible AI Implementation

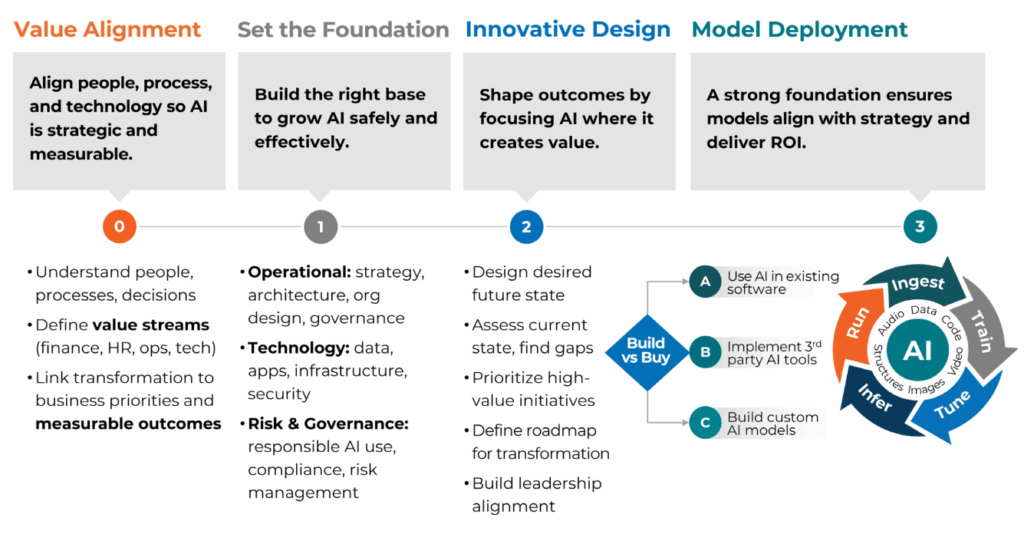

CrossCountry Consulting evaluates companies using a simple framework to determine where they are on their AI journey and how they can most effectively execute on an implementation roadmap:

A clear roadmap is critical to ensuring the right foundation is in place and that investment is focused on high-value, scalable initiatives.

A human-centered approach ensures AI solutions are shaped by the actual people who will use them every day. By engaging CFOs, functional leaders, and frontline staff, technology investment aligns with real-world business problems, improving adoption and accelerating impact. This holistic model promotes four key AI capabilities for PE:

- Strategic transformation toward an AI-powered organization: New operating models, innovation hubs, process design, cross-functional command centers, and digital workers.

- AI solutions that solve business challenges: AI use case development, system selection, intelligent AI agent orchestration, and embedded AI for greater organizational insights, predictive modeling, and ROI quantification.

- AI enablement that ensures successful employee adoption: Playbooks, starter packs, templates, training toolkits, and hands-on enablement programs tailored to organizational maturity. This can also include upskilling, certifications, and end-to-end change management.

- Governance, security, and risk for enterprise AI: AI governance frameworks, risk monitoring, cybersecurity assessments, continuous agentic oversight, and compliance with ethical and regulatory standards.

The Next Lever for PE Value Creation

AI is not a plug-and-play solution; it’s a strategic capability that requires intentional investment, governance, and cultural alignment. For PE sponsors, holistic AI deployment is poised to become the next big lever for value creation, much like lean operations or shared services in past decades.

The opportunity is clear: Sponsors who adopt responsible AI practices today will enjoy sustainable competitive advantage, stronger portfolio performance, and potentially higher exit multiples.

Ready to take the next step? Contact CrossCountry Consulting today.