If you watched the documentary “The Last Dance” about the Chicago Bulls’ sixth championship ring, you may have found yourself in awe of the challenging recruiting and coaching decisions made by the management. There are parallels between sports franchises managing their rosters and successful companies managing their supplier base.

These can be summarized by:

- Determining what drives value for the organization;

- Strategically considering the mix of players and the value each brings;

- Building trust through transparent negotiation of terms;

- Managing risk level and tolerance against inevitable bumps in the road; and

- Quickly on-boarding partners to start to coalesce and perform.

Much like a sports team, your suppliers are teammates that can highly influence the perception and performance of your organization. One of the drivers to scalable growth is optimizing your supplier base to function efficiently and effectively towards your organization’s targets.

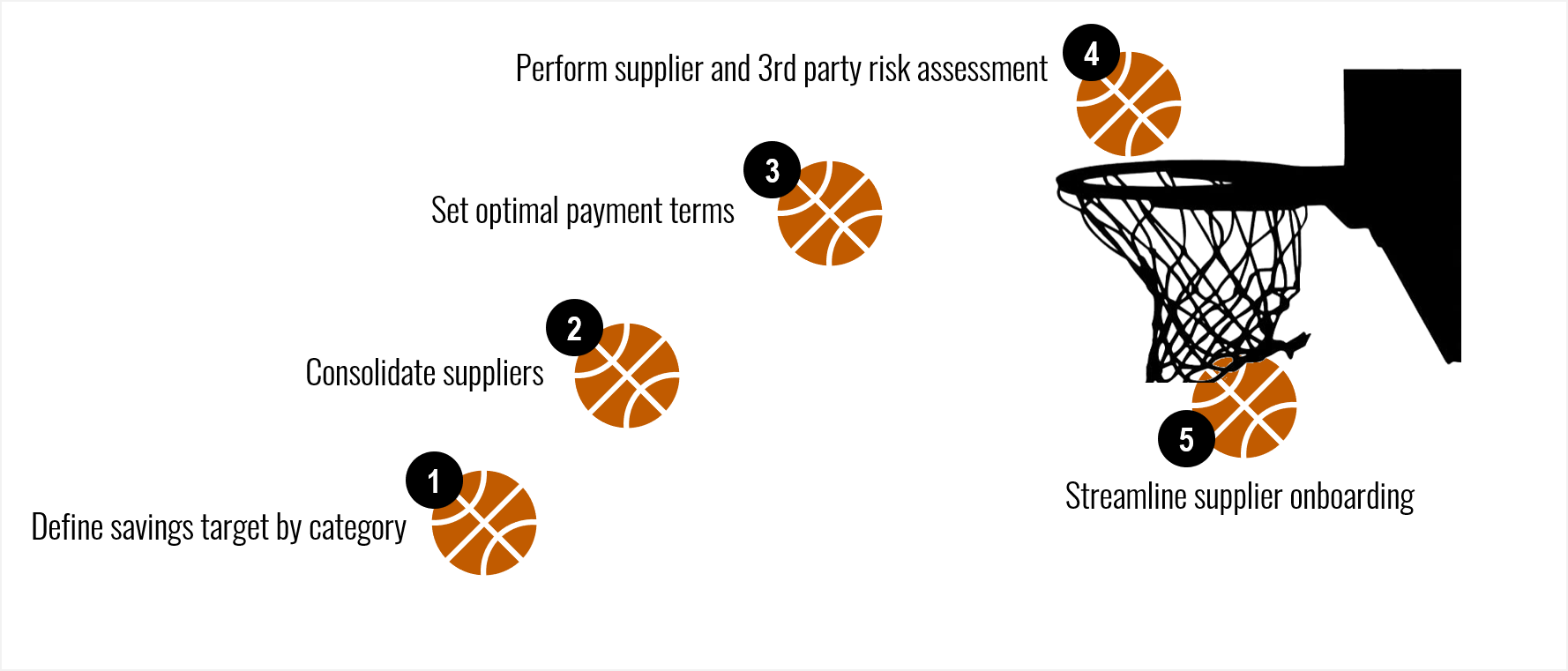

Here, we outline five strategies that companies can use to optimize their indirect supplier base as compared to a sports franchise operating model.

1. What Drives Value for the Team? → Define Savings Targets by Category

For every Phil Jackson (former professional basketball player, coach, and strategic genius), there is a Jerry Reinsdorf (money-oriented businessman and owner of the NBA’s Chicago Bulls and the MLB’s Chicago White Sox). When they engage with senior leadership, one of the key questions will always be, “But how much money is that going to make us?”

Whatever the type of business, estimating your company’s sourcing savings targets can seem anywhere between incalculable or highly arbitrary. Analyze your data with the perspective of whether the spend is addressable (i.e., can it be strategically sourced?); it can then be segmented into waves or teams and given a target savings range per category. This range will depend on factors unique to your business model, current situation, and goals, or external forces such as macroeconomic factors or regulations.

Ultimately, applying a target savings range per category within each sourcing wave should provide an achievable estimated total savings value. Though this may answer Jerry Reinsdorf’s question, ultimately it is the results on the court that really matter.

2. Too Many Players in a Position → Consolidate Suppliers

One of the first tasks a coach performs when inheriting a roster is to assess how many players there are per position. Similarly, a category-based analysis should be performed for your company’s indirect supplier base to identify the number per category. If your data does not yet contain categorized suppliers, they will need to be assigned with the aim of highlighting those who generally supply the same goods and/ or services.

With this data in hand, next is the challenging step of trimming the excess! Approach consolidation with a clear strategy by asking yourself these questions:

- What is the preferred number of suppliers per category?

- Are there critical business needs for using a certain supplier?

- When assessing each supplier’s contract, which have favorable terms and expiration dates?

Essentially, you will want to ensure that your squad has an appropriate number of players for each position, taking into consideration the potential for injuries and driving competition for places in the team.

3. It’s About Balance → Set Payment Terms Both Parties Can Work With

One of the top players in the Chicago Bulls-dominated NBA era, Scotty Pippen, was ranked #122 in terms of salary in the league. Some may feel Pippen was drastically underpaid for the value he brought; others would argue that was merely great negotiation by the franchise. Whether or not your company needs to be as ruthless as the Bulls management, negotiating the most favorable contract possible with your suppliers is essential. Although there are many financial areas within contracting, invoice payment terms remain an important area of focus. Some important considerations here are:

- Review payment terms used on transactions and the original contractual payment terms.

- Set overall strategic net terms that work well from a cash flow perspective (e.g., net 30, net 45, net 60, etc.).

- Consolidate the number of varied and complex net terms which should reduce their risk of being applied incorrectly at the time of invoicing.

- Using an electronic procurement tool will help to enforce the supplier default net terms at the time of invoice processing.

4. Manage Player Risk → Perform Supplier and Third-Party Risk Assessment

Before recruiting a new player to the team, most sporting organizations conduct a mandatory medical assessment and background check. When drafting Dennis Rodman, the Chicago Bulls knew they were hiring a maverick and eccentric genius. In order to bring out his best, they had to strategically manage the risk.

Similarly, companies should incorporate supplier and third-party risk assessments to reduce regulatory, financial, reputational, and/ or dependency risks.

Your company should:

- Define what risk domains are critical to business operations;

- Assess the net impact of failing to manage these specific risks;

- Incorporate a supplier risk assessment as part of the overall management process; and

- Reduce over dependency on key suppliers to manage operational or continuity risk.

5. Assemble the Team & Get Playing → Streamline Supplier Onboarding

Repeatable enforcement of these strategies, methodologies and plans is best executed using a leading Source2Pay solution, and should have the capability of enforcing all of them. Moving to electronic supplier onboarding is similar to creating a singular gate for your “herd” to funnel through. By enabling this, your company can:

- Push requesters towards preferred suppliers/ contracts

- Reduce supplier proliferation.

- Perform third- or fourth-party, etc. risk assessment(s)

- Assign primary categorization to aid in category-based supplier analysis

- Assign default terms as per contract

- Reduce in-house manual supplier management effort

- Reduce late payment issues due to outdated supplier information

- Reduce fraud risk by securely collecting electronic banking information