The two most important Central Counterparty (CCP) Clearing houses in the world, the Chicago Mercantile Exchange (CME) and the London Clearinghouse (LCH), have laid out preliminary proposals for the valuation and risk transition of the discounting switch to the Secured Overnight Financing Rate (SOFR) for a variety of cleared USD-denominated interest rate products. Because organizations will need to hedge balance sheet interest rate risk, causing an anticipated boost in SOFR-linked liquidity, this event has become known as the CCP “Big Bang” within the London Interbank Offered Rate (LIBOR) transition community.

Targeting an October 2020 date, both CCP’s have similar mechanisms for the transition: Both proposals are high-level plans, and market participants can expect further details and modifications in the first half of 2020 once additional feedback requested by the CCP’s have been taken into account.

The mechanics of both proposals involve a cash compensation component, the booking of a basis swap to achieve risk neutrality for the CCP’s, and the CCP’s conducting a standard end-of-day valuation cycle, moving variation margin and cash payments that are currently calculated with the Effective Federal Funds Rate (EFFR) yield curve discounting. After this standard cycle is completed, the CCP’s will conduct a special cycle in which the same positions will be valued off of a SOFR-based yield curve. This adjustment will be comprised of two components:

- (1) A cash adjustment that is equal and opposite to the change in each cleared swap’s Net Present Value (NPV); and

- (2) An EFFR / SOFR basis swap which would be booked by the CCP’s to participants’ accounts at closing market curve levels. This would have the effect of restoring participants to their respective original risk profiles, which is intended to leave the CCP’s with no residual risk.

Thereafter, the CCP’s would utilize SOFR discounting on all USD-denominated swap trades. Both CME and LCH currently intend to provide their clients with the option to opt out of being a counterparty to the EFFR / SOFR basis swap by involving the use of third-party market markers to facilitate risk transfer.

This important and necessary change will present risks for organizations that transact in cleared interest rate products. Unlike many other regulatory and market structure style changes, this is the first time that this type of event has occurred, which presents a heightened level of uncertainty. Here are a number of considerations that an organization preparing for this change should consider.

Prepare for an appropriate range of scenarios.

What are the implications of investors electing to forgo the basis swap and opting for only the cash adjustment? What if there are not enough market markers to provide a deep enough market to absorb institutional size parcels in EFFR / SOFR basis risk? How will movements in the direction and shape of the EFFR / SOFR basis curve impact an organization during the CCP switch? In order to identify various scenarios that will enable a thorough and holistic risk identification process to occur, organizations should hold brainstorming sessions with representation from across the enterprise.

Identify key risks and implement mitigating controls.

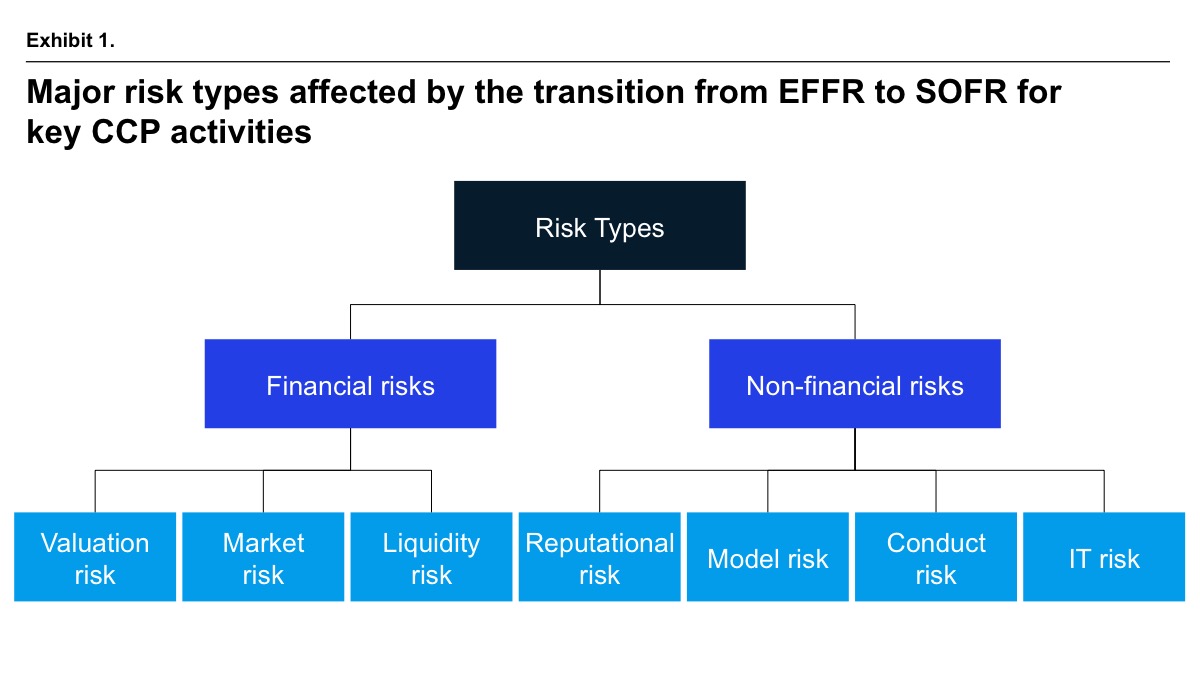

Organizations should prepare for the CCP switch by identifying a range of potential financial and non-financial risks and implementing mitigating controls. Even slight variations in the approach and methodology of the switch by the CME and LCH will add complexity for organizations. A recent meeting of the Market Risk Advisory Committee’s Interest Rate Benchmark Reform Subcommittee at the Commodity Futures Trading Commission called for maximum synchronization between the two CCPs during the switch. Firms with more strategic LIBOR transition programs should consider conducting a CCP switch-specific internal audit of the associated control environment prior to the October 2020 change.

Execute an ad-hoc interest rate swap compression exercise.

Execute an ad-hoc interest rate swap compression exercise.

As a risk reduction practice that compresses portfolios and frees up capital, many multinational investment bank broker dealers run regular swap compression exercises. In order to help facilitate this, third party intermediaries offer automated services. The advantage is that controlled two-way (pay and receive) swap activity can occur to terminate substantial amounts of contracts before they expire by their terms. A swap compression activity prior to the CCP switch would reduce CCP credit exposure and operational risk and cost, as well as lower any potential legal and administrative expenses.

Engage with and provide feedback to the CCP’s.

Both the CME and the LCH have published their respective SOFR switch proposals and associated guidance for market participants. Organizations must study these proposals and use the CCP’s request for feedback as an opportunity to raise any concerns and propose modifications that minimize risk for the broader market.Educational webinars and contact details of relevant individuals at the CCPs are publicly available. Firms with representation of the Alternative Reference Rates Committee could consider raising concerns in that forum.

Create an enterprise-wide CCP “Big Bang” playbook.

Once an organization has identified key risks across a range of scenarios, a playbook should be produced that documents these risks and mitigating controls. A basis swap during the normal course of business would be booked in an organization’s front-end trade capture system. However, the EFFR / SOFR basis swap being proposed by the CCPs will be booked by the CCPs so that the risk will not flow to market participants in the usual way.

An understanding of the practical and operational challenges associated with this type of entry across the trade lifecycle should be gained and documented in the CCP “Big Bang” playbook. The comprehensiveness and complexity of the playbook should be commensurate with the risk size and business mix of the organization’s cleared products exposure.

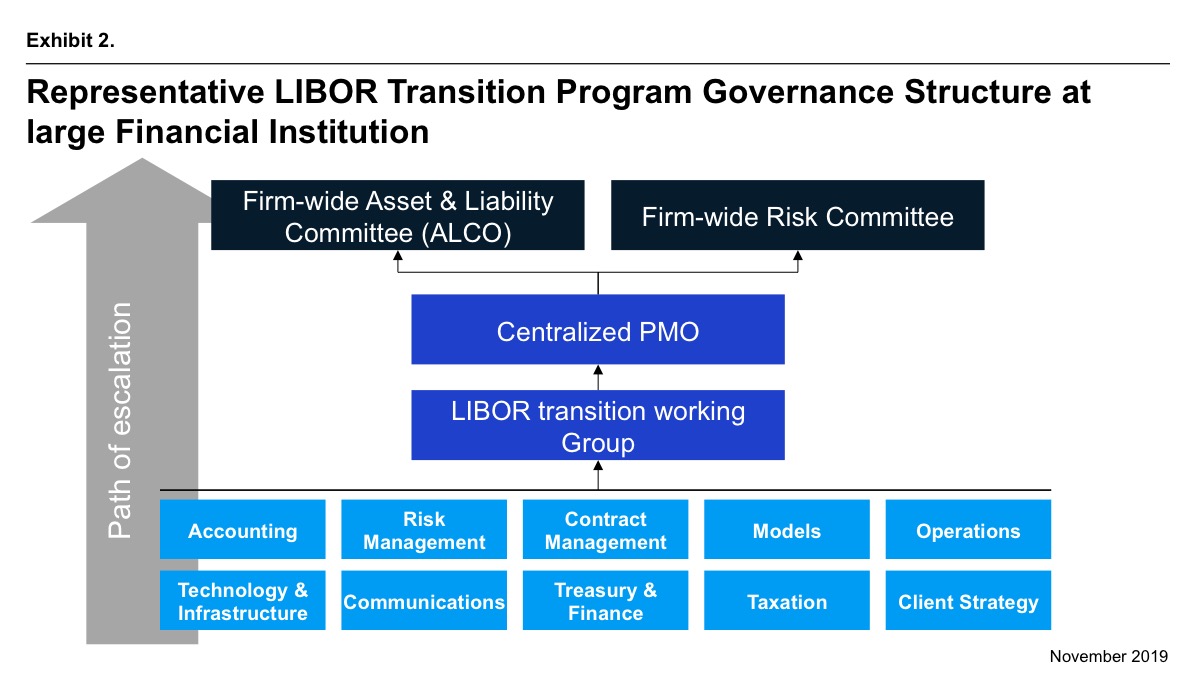

Leverage your organization’s LIBOR transition program governance structure.

Organizations should utilize the governance structure and associated roles and responsibilities that have been set out as part of the Board approved LIBOR transition program plans. A firm’s preparedness, risks and mitigating controls associated with the CCP switch should be included as an agenda item in management team updates and in key committees such as asset-liability, risk, and the board.

Although global LIBOR transition is evolving at varying speeds across geographic financial jurisdictions, this event will occur by in large synchronously, requiring multinational organizations to ensure coordination across international office locations. The risks to an organization and to the broader market in failing to be fully prepared for this change should not be underestimated.