For non-financial services organizations in particular, CECL for private companies has been another surprise compliance requirement that may have slipped by their auditors. There’s still time for private companies to adopt CECL, but the work must begin now.

Didn’t know you were on the hook for CECL compliance? Unsure where to begin and how to apply the standard?

Read on for key insights to understand and adopt CECL.

1. What Is CECL, and Does It Apply to Me?

Current expected credit loss (CECL) is the Financial Accounting Standard Board’s (FASB) new credit loss accounting standard (ASC 326) that’s required for non-public entities. For most private companies, it will represent some material change from legacy GAAP (ASC 310, ASC 450, ASC 310, and ASC 320) both in policy and application. Although the banking industry is most heavily impacted, all private entities with financial assets like trade receivables, lease receivables, held-to-maturity securities, and contract assets are subject.

For comparison, public entities on average experienced a 37% approximate increase in their allowance balances post-adoption. Private companies will face similar experiences, in addition to increased auditor focus on this heavily judgment-based standard.

2. What Is the New Standard Replacing?

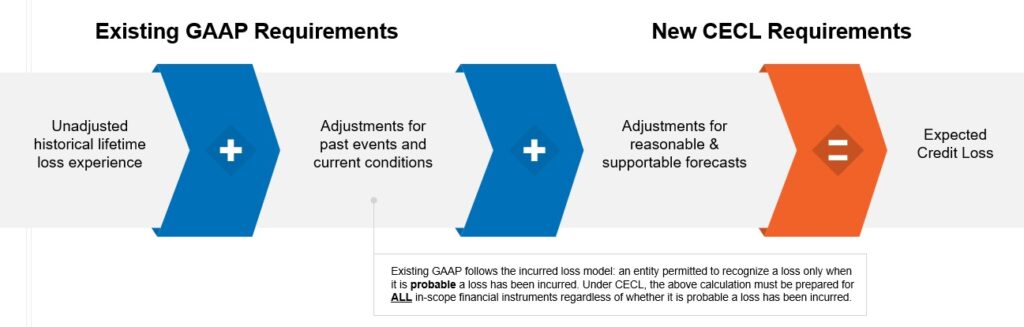

ASC 326 – Financial Instruments – Credit Losses, or CECL (Current Expected Credit Loss), replaces the previous guidance for calculating allowances for doubtful debts, previously accounted for under the “incurred loss” method. Legacy methodology accounted for a loss only when it was probable to occur. Under CECL, private companies must now estimate an expected credit loss for all financial instruments in scope.

Key Differences to Legacy GAAP

| Consideration | Legacy GAAP | CECL |

|---|---|---|

| Recognition Threshold | When a loss is probable to have been incurred. | If any loss is expected, no matter how remote, on a financial asset in scope. |

| Aggregation Requirements | No requirements to pool or segment similar assets. | Explicit requirement to pool or segment assets with similar risk profiles. |

| Period to Evaluate | No requirement to assess for a specific period. | The expected life of the asset. |

| Loss Data to Evaluate | Historical loss data and current conditions. | Must consider historical loss data, current conditions, and reasonable and supportable forecasts about future economic conditions. |

3. What Are the Effective Dates?

CECL was effective for Securities and Exchange Commission (SEC) filers and Public Business Private companies (PBEs) for periods beginning after Dec. 15, 2019.

CECL is effective for all other private companies for annual periods beginning after Dec. 15, 2022. In practice, this means that private companies will need to have documented and adopted the CECL standard for their year-end 2023 annual report.

| Entity Type | Effective Date |

|---|---|

| SEC Filers | Dec. 15, 2019 |

| PBEs | Dec. 15, 2019 |

| Private Companies | Dec. 15, 2022 |

Companies should start planning for adoption now, in addition to planning how to incorporate the new requirements into existing processes and how to identify incremental processes that may need to be added.

4. What Are the Key Changes With CECL?

As summarized above, CECL introduces material changes to prior guidance on calculating credit losses on in-scope receivables. Below are some key details on those changes:

Scoping

- Financing receivables measured at amortized cost are now in-scope of the CECL standard. In practice, this means that an entity will have to assess each receivable for expected credit losses on an ongoing basis. Some of the most common instruments are assessed below:

| In Scope | Out of Scope |

|---|---|

| Financing Receivables including Trade Receivables | Financial assets measured at Fair Value |

| HTM Debt Securities | AFS Debt Securities |

| Contract Assets | Loans and receivables between private companies under common control |

| Net investments in Leases recognized by a lessor in accordance with ASC 842 | Receivables arising from Operating Leases accounted for under ASC 842 |

| Off-Balance Sheet credit exposures not accounted for as insurance | Loans made to participants by defined contribution employee benefit plans |

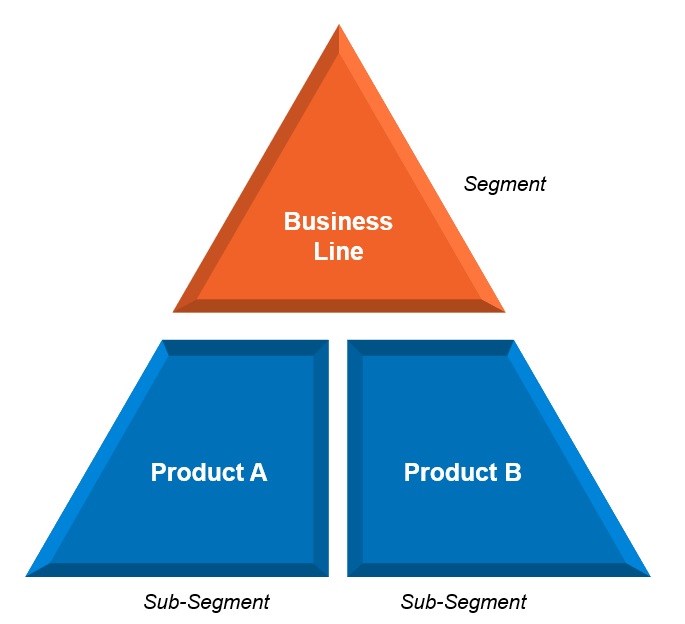

Segmentation

- Private companies are now required to pool assets that share similar risk characteristics. Some examples of aggregating assets with similar risk characteristics would be: (i) credit rating, (ii) financial asset type, (iii) geographical location, (iv) product type, (v) industry of the borrower. Existing segmentation decisions, if any, should be reviewed for CECL compliance.

Life of the Asset

- Private companies must forecast expected credit losses for the life of the asset. Typically, trade receivables are shorter duration (<12 months) financial assets; however, longer duration financial assets such as an HTM debt security will need to be evaluated over the life of the asset.

Adjustment for Current Conditions and Reasonable and Supportable Forecasts

- Private companies must now consider reasonable and supportable forecasts of economic conditions that may have an impact on the expected credit loss calculation. For example, adopters have used the unemployment rate as a metric to evaluate its interaction with write-offs the company has experienced and aligning that experience with readily available forecasted unemployment data to adjust their expected credit losses.

5. Do I Need to Change My Methodology?

CECL does not prescribe a method for calculating expected credit losses. Existing methods may remain a valid approach if adjusted to take account of the key changes noted above. Common methods used by non-financial institutions in calculating an allowance on in-scope receivables include loss-rate methods and provision matrix methods.

6. What Are the Disclosure Requirements With the New Standard?

CECL is a principles-based standard, which requires disclosures to reflect the credit risk inherent in the company’s financial assets and how it’s measured, along with details of the estimate of expected credit losses and the movements within this balance period over period. Generally, adopters are required to separately present on the Statement of Financial Position, the allowance for credit losses that is deducted from the asset’s amortized cost basis.

Upon Day 1 adoption of CECL, entities should capture any changes in the balance from legacy GAAP to CECL through a cumulative-effect adjustment to retained earnings. Subsequent changes in the balance should be captured as an adjustment to credit loss expense in the Statement of Operations and a corresponding adjustment to the allowance for credit losses in the Statement of Financial Position.

Notably, an exception exists from having to provide vintage disclosures for receivables that fall due in one year or less – as most trade receivables would.

7. What Should I Do Now?

Asking and answering the following questions gives an idea of the level of effort required for a successful implementation:

- Are there financial assets that are now in-scope that had not previously been considered from a credit loss perspective?

- Does detailed and granular loss data exist over a sufficient historical period to enable a meaningful calculation to be made for expected credit losses for financial assets identified as being in scope?

- Are the controls over the historical loss data reliable and permit tie out to prior period amounts disclosed in the financial statements?

- If receivable aging buckets have been used to calculate a percentage allowance per aging bucket, does quantitative and qualitative support exist to support these percentages?

- Are there areas of the business that currently use a form of economic forecasting, and can this be leveraged for the CECL calculation, or will it be necessary to perform this evaluation from scratch?

- Does the capability and bandwidth exist in your entity to perform the implementation, update legacy documentation and policy, and adapt existing processes for the new requirements?

8. How Can CrossCountry Consulting Help?

CrossCountry Consulting helps SEC filers, PBEs, and private companies navigate the challenges of adoption and provides ongoing support in adapting methodology to changes in the business and auditor feedback.

With an audit-ready CECL playbook that accelerates compliant adoption and provides robust documentation and assessment, our methodology includes:

- Completion of a comprehensive CECL scoping exercise evaluating each FSLI and sub-ledger account for CECL applicability.

- Provision of an Accounting Judgment Matrix reviewing the requirements of the standard, assessing current practice, and identifying gaps and how to bridge those gaps to compliance.

- Drafting of documentation supporting implementation decisions in addition to providing a thorough up-to-date CECL accounting policy.

- Development of a CECL-compliant methodology, including consideration of reasonable and supportable forecasts, with an accompanying model to generate an expected credit loss calculation.

- Preparation of draft disclosures that are right-sized to the company while remaining in compliance with CECL guidance.

For expert CECL adoption and compliance support, contact CrossCountry Consulting.